- On Tuesday, BTC exchange-traded funds noticed a optimistic internet circulation of over $631 million.

- On the day before today, ETF inflows hovered round $493 million.

- The optimistic influx coincided with Bitcoin’s reclaiming of the $50k threshold.

The analysis staff on the BitMEX trade has known as consideration to the appreciable quantity of funds that flowed into Bitcoin exchange-traded funds (ETFs) yesterday as Bitcoin reclaimed the $50k threshold.

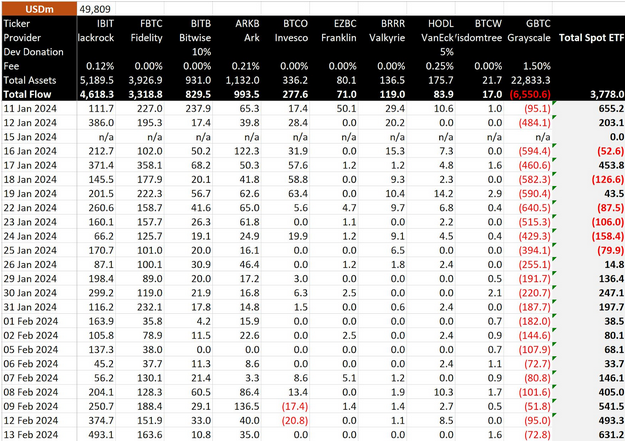

In a publish on X, BitMEX Analysis famous that February 13 noticed a optimistic internet circulation of $631 million to BTC-based funding autos throughout all ETF issuers. Among the many U.S.-listed ETFs, BlackRock’s IBIT skilled essentially the most vital inflow. Particularly, BlackRock recorded over $493 million on Tuesday, adopted by Constancy at $163.6 million.

Equally, Bitwise Bitcoin ETF witnessed an influx of $10.8 million, and Ark Make investments recorded $35 million. Nonetheless, different funds, resembling Invesco, Franklin, Valkyrie, and VanEck, registered zero influx. Concurrently, Grayscale skilled a big detrimental progress of $72.8 million.

Total, the online inflow of $631 million into Bitcoin-based funding autos on Tuesday displays a 21% progress from the $493.3 million determine recorded on Monday. Notably, in BTC figures, the disclosure prompt that the spot exchanged traded funds consumed 12,735 Bitcoin tokens.

This uptrend coincided with Bitcoin cracking the $50k vary yesterday, with the asset buying and selling at $51,254 at press time.

In the meantime, a separate report by crypto asset supervisor CoinShares outlined the weekly motion of funds by cryptocurrency-based funding merchandise. The report revealed inflows of $1.115.9 billion over the previous week. CoinShares talked about that the determine contributed to year-to-date inflows amounting to $2.7 billion.

Considerably, Bitcoin accounted for practically 98% of the inflows, totaling $1.089 billion, in response to CoinShares. Moreover, minor inflows had been noticed in Avalanche (AVAX), Polygon (MATIC), and Tron (TRX), which collectively recorded roughly $1.3 million.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.