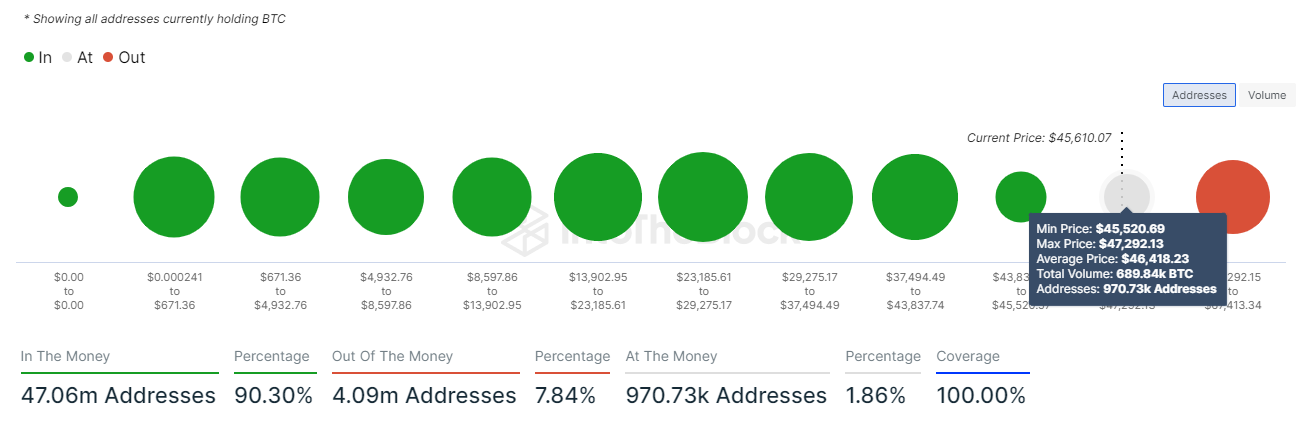

- 90% of Bitcoin holders (970K addresses) are at present in revenue, regardless of market turbulence brought on by pretend spot Bitcoin ETF approval information.

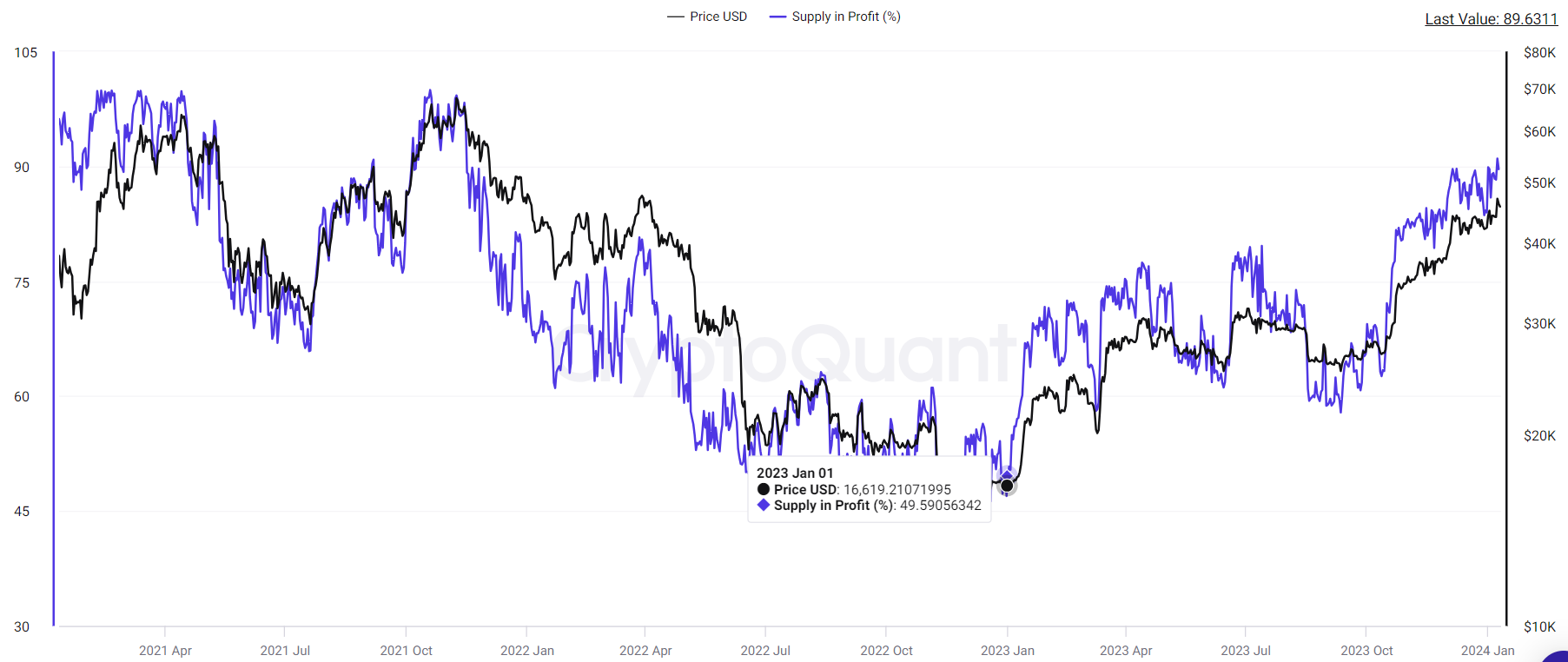

- Lower than half of Bitcoin holders had been in revenue firstly of 2023, CryptoQuant reveals.

- A report warns that Bitcoin reaching $48,500 may set off a market correction, with assist ranges at $34,000 and $30,000.

A wave of optimism has swept by way of the Bitcoin market, with 90% of holders now sitting comfortably in revenue territory. This surge comes amidst rising anticipation for the approval of a U.S. spot Bitcoin exchange-traded fund (ETF), a possible catalyst for additional worth appreciation.

Following the false announcement of a spot Bitcoin ETF approval posted on a hacked U.S. SEC Twitter account, Bitcoin costs surged to a 19-month excessive, reaching $47,900, solely to expertise a quick dip to $45,100. Regardless of this transient market turbulence, greater than 970K addresses are at present in revenue, with BTC buying and selling at round $45,600 on the time of writing.

Notably, information from CryptoQuant reveals a dramatic shift in investor sentiment in comparison with the beginning of 2023, when lower than half of Bitcoin holders had been within the black. The worth rally, which noticed Bitcoin climb nearly 160% in 2023 and 50% previously six months, has successfully introduced many long-term traders (HODLers) into worthwhile positions.

Nevertheless, amidst the euphoria, a word of warning emerges from CryptoQuant analysts. Their current report highlights the potential risks related to the excessive focus of unrealized earnings amongst Bitcoin holders. This, they argue, creates fertile floor for a pointy worth correction, whilst sturdy demand for the Grayscale Bitcoin Belief (GBTC) and rising buying and selling volumes level in the direction of continued optimism for the ETF’s approval.

One situation outlined by CryptoQuant posits {that a} Bitcoin worth reaching $48,500, the common unit worth for holders with a 2-3 years funding horizon, may set off a market correction. In such an occasion, potential assist ranges lie between $34,000 and $30,000, marking a possible decline of 10-20%.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.