- Bitfinexed accused the Binance CEO of buying and selling buyer funds, in a current submit on X.

- Paxos Belief’s newest report reveals Changpeng Zhao took a $250 million mortgage in December.

- In January, Paxos returned transformed funds to BAM Buying and selling.

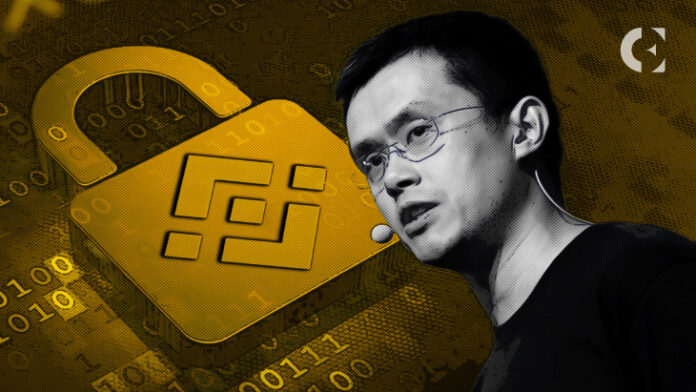

A well-liked account within the crypto X (previously Twitter) house just lately accused Binance CEO Changpeng Zhao of buying and selling with buyer funds. On September 19, Bitfinexed tweeted in regards to the rise within the worth of Bitcoin again in January, claiming that it had been triggered after Zhao “loaned himself $250 million {dollars} from his personal trade.”

The account shared screenshots on X from Paxos Belief’s Transparency Report which highlighted quite a lot of questions together with the explanation behind why Paxos Belief Firm transferred $183 million to BAM Buying and selling, a Binance crypto trade in January. The reply famous that in December 2022, Zhao obtained a $250 million convertible be aware from BAM Administration US Holdings, Inc.

To amass this be aware, he used BUSD, with $183 million of that quantity being forwarded to Paxos Belief Firm, the issuer of BUSD, for its conversion into USD. Henceforth, in January 2023, these transformed funds have been subsequently transferred to BAM Buying and selling.

In late February, the New York Division of Monetary Companies (NYDFS) instructed Paxos to cease issuing BUSD after Paxos obtained a Wells discover from the Securities and Alternate Fee (SEC) for alleged violations of investor safety laws. Binance, which held 90% of BUSD at that second, introduced in August that the trade would finish help for the stablecoin in 2024. Moreover, Binance urged customers to transform their BUSD to TrustToken’s TUSD, which surpassed BUSD’s market provide on September 5.

As talked about in Bitfinexed, Binance rallied initially of the yr, Based on CNBC’s report from January 16, the main crypto had grown nearly 28% because the starting of the yr, reaching as excessive as $21,000 for the primary time since November 2022.

On the time of writing, BTC is buying and selling at $27,170, as per information from CoinMarketCap.

Nevertheless, Glassnode’s on-chain information concluded that Bitcoin is at present present process a interval of fluctuation. Whereas there was an influx of recent capital into the market in 2023, this inflow lacks important momentum. Moreover, a majority of short-term holders discover themselves “underwater on their place,” suggesting prevalent detrimental sentiment.