Bitcoin (BTC) climbed again above $43,000 throughout Asian buying and selling hours following information that BlackRock amended its spot exchange-traded fund (ETF) software to adjust to the U.S. Securities and Alternate Fee (SEC).

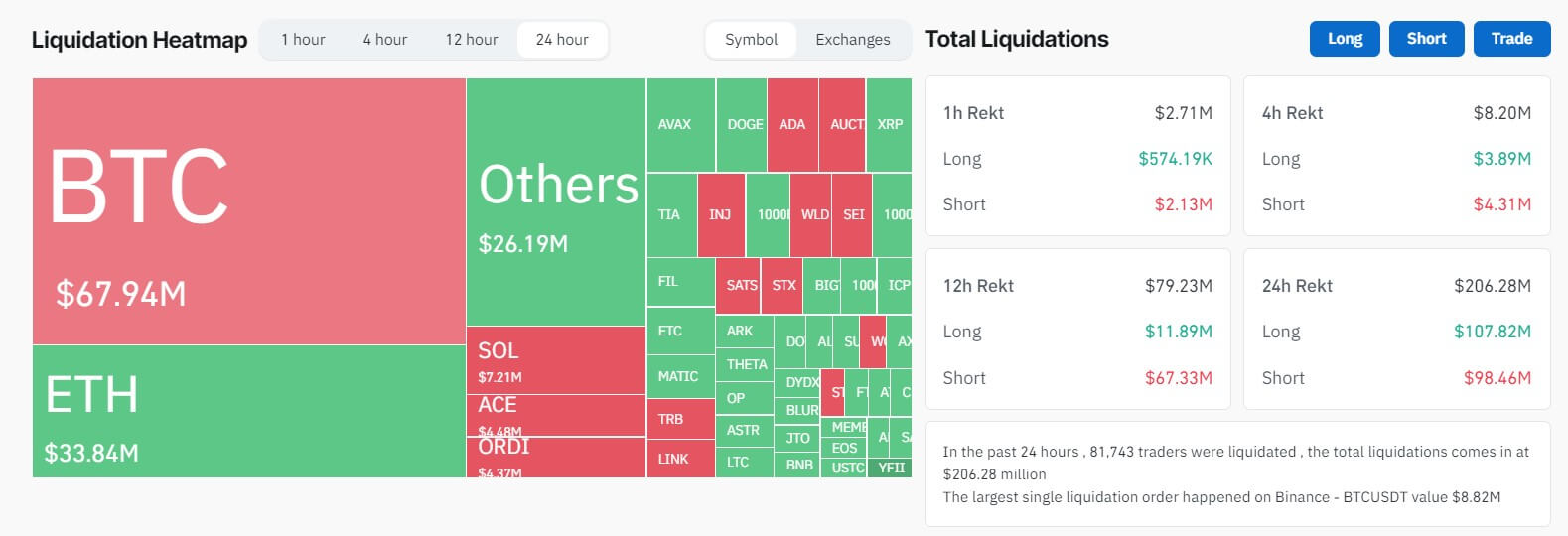

Coinglass information exhibits that the value motion liquidated $206 million throughout all property from greater than 81,000 crypto merchants throughout the previous day. Lengthy merchants misplaced $107.82 million, whereas quick merchants have been liquidated $98 million throughout the reporting interval.

Throughout property, speculators on BTC value accounted for roughly $68 million, or 32%, of the full losses incurred—$42 million have been liquidated from merchants betting towards additional BTC value will increase. Compared, about $26 million was liquidated from long-position holders.

Notably, Bitcoin has additional decreased its low Liquidation Sensitivity Index (LSI) rating of simply $11.72 million USD/%, the bottom degree recorded by crypto-news. This variation suggests markets are additional maturing with much less leverage out there betting towards Bitcoin, with solely $67.9 million liquidated from a 6% value swing.

Ethereum skilled liquidations throughout lengthy and quick positions, with $18.38 million and $16.6 million respectively.

Giant-cap cryptocurrencies like Solana, XRP, and Dogecoin additionally witnessed notable liquidations totaling $7.66 million, $3.2 million, and $3.5 million, respectively.

In the meantime, crypto merchants utilizing the embattled Binance platform accounted for greater than 50% of the full losses suffered out there. The trade customers misplaced $102.85 million throughout the previous day, with essentially the most important single liquidation order being an $8.82 million lengthy place BTC.

Market rebounds

The present value efficiency represents a reversal of fortune for the highest cryptocurrency that had begun the week meekly, falling to round $41,000 on Dec. 18 amid a broader market drawdown.

Nonetheless, its value picked up following information that BlackRock, the world’s largest asset supervisor and one of many candidates for a spot ETF, revised its functions with the SEC.

BlackRock’s new modification revealed an IBIT market ticker and that the related transactions will happen in trade for money.

In a latest notice to buyers, Markus Thielen, the top of analysis at Matrixport, asserted that BTC is the superior asset for this yr, including that extra buyers are pondering whether or not to allocate extra capital subsequent yr.

In the meantime, different high 10 cryptocurrencies, together with XRP, Ethereum, Solana, and Avalanche, noticed beneficial properties of between 3% and 9%, respectively.