As Bitcoin’s market cap rises, evaluating Bitcoin’s worth to that of gold turns into more and more related. This comparability is embodied within the BTC/GOLD ratio, a metric that divides the worth of Bitcoin by the worth of gold per ounce.

The importance of the ratio lies in its capacity to point shifts in investor choice and market dynamics. A rising ratio suggests a rising choice for Bitcoin over gold, usually reflecting investor confidence in Bitcoin as a tough asset and a hedge towards inflation. Conversely, a declining ratio can sign elevated confidence in gold or a cautious method in direction of digital currencies.

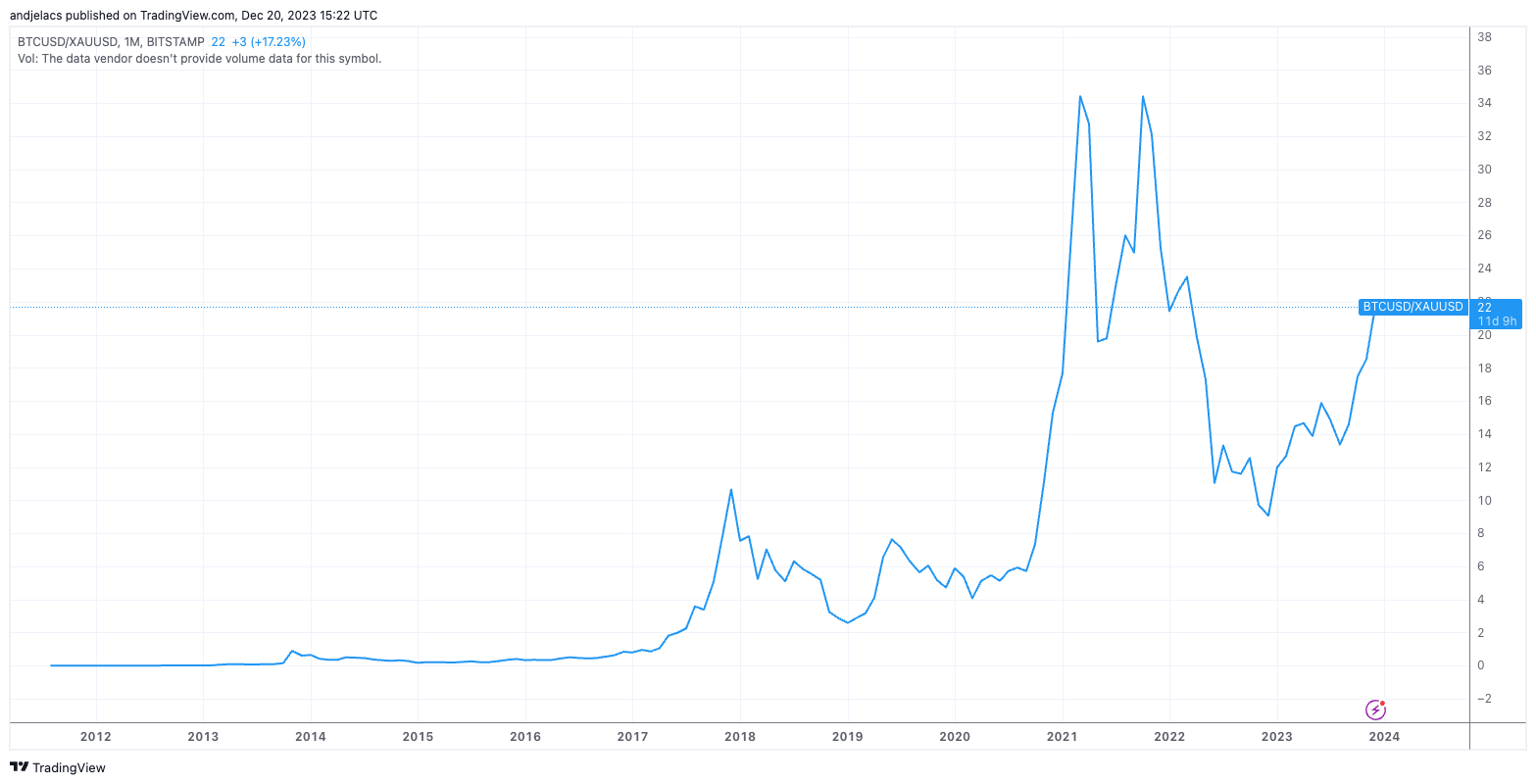

Between 2011 and 2017, the ratio witnessed a gradual and gradual improve, reflecting the rising curiosity and acceptance of Bitcoin. The crypto trade’s first true bull market in 2017 noticed this ratio reaching unprecedented heights, solely to say no sharply by the start of 2019. Particularly, the ratio plummeted by 75.75% from its peak on Dec. 1, 2017, showcasing the market’s volatility and the shifting investor sentiment in the course of the bear market.

The interval between 2019 and 2021 marked an outstanding restoration and progress for Bitcoin, mirrored within the BTC/GOLD ratio. The ratio soared 1,232% between Jan. 1, 2019, and Mar. 1, 2021, attaining an all-time excessive. This era highlighted Bitcoin’s resilience and rising attraction as a digital asset. Nevertheless, this peak was adopted by a 37.94% lower within the ratio by the start of 2023, reflecting the advanced interaction of market forces, regulatory developments, and world financial circumstances.

Nevertheless, this 12 months has been significantly important for the ratio’s efficiency. Because the begin of the 12 months, the ratio has proven a outstanding improve of 139.9%. The typical ratio is roughly 15.31, peaking at about 21.36 and a trough of round 11.99. The usual deviation of roughly 2.66 signifies important variability, underscoring the inherent volatility of Bitcoin’s worth.

The efficiency of the BTC/GOLD ratio in 2023 carries important implications for the valuation and notion of each Bitcoin and gold within the monetary market. The rising ratio signifies the market’s growing choice for Bitcoin over gold, probably as a consequence of its perceived attributes as a digital retailer of worth and a hedge towards inflation. The variability of the ratio, nevertheless, additionally speaks to the persistent uncertainties and the evolving regulatory panorama surrounding cryptocurrencies.

The BTC/GOLD ratio isn’t just a measure of worth comparability — it displays the altering monetary panorama the place digital belongings are more and more pitted towards conventional ones. Whereas Bitcoin continues to realize floor as a possible various to gold, the journey is marked by volatility and uncertainty. This ratio, subsequently, stays an important device for evaluation, providing insights into market sentiments and the evolving position of Bitcoin within the broader monetary market.

The submit Bitcoin challenges gold’s supremacy as secure haven asset appeared first on crypto-news.