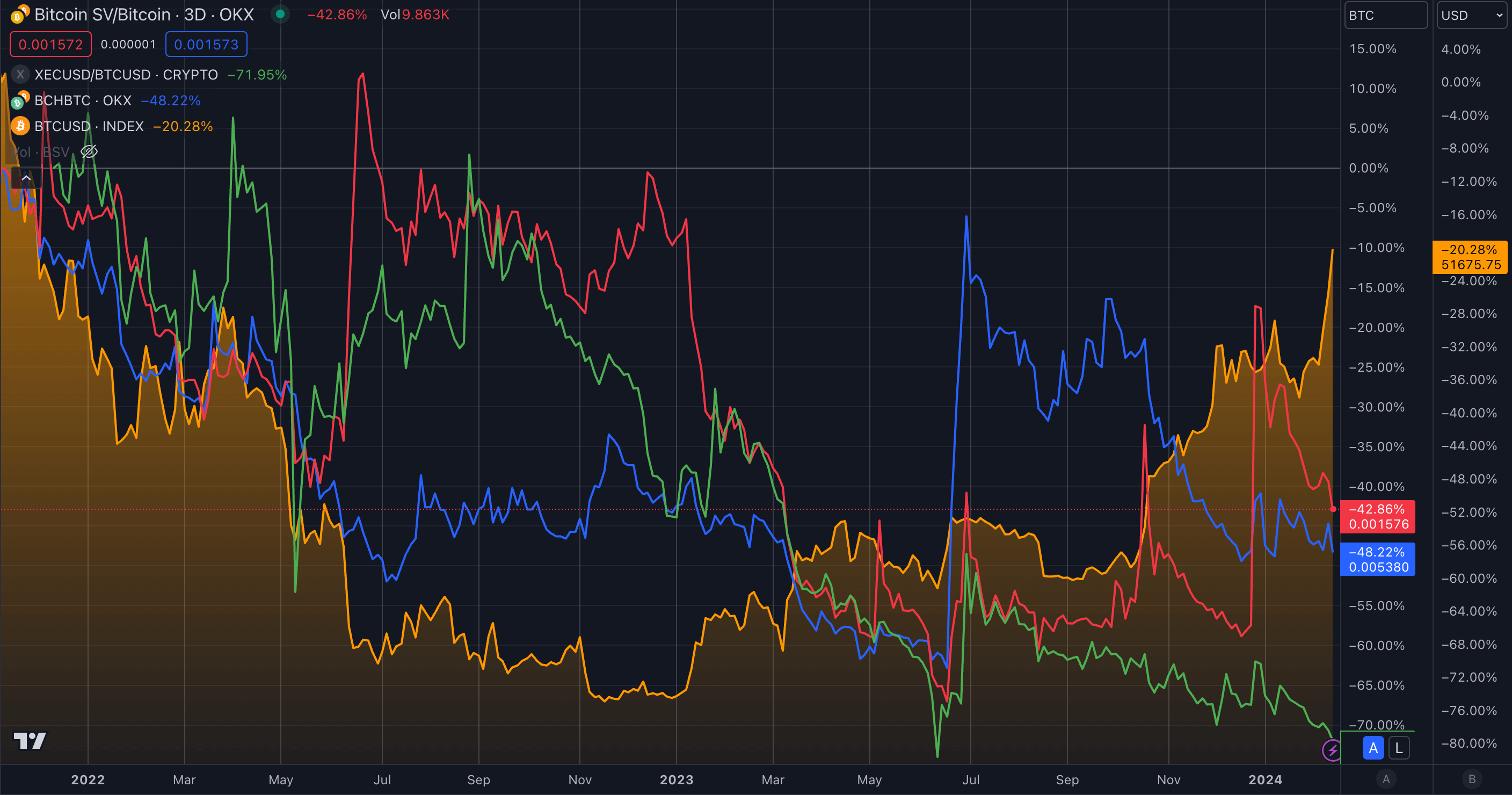

Main Bitcoin forks, together with Bitcoin Money (BCH), Bitcoin SV (BSV), and eCash (XEC, previously Bitcoin Money ABC), have skilled vital value depreciation towards Bitcoin (BTC) since its all-time excessive in November 2021. BCH declined by 48%, BSV by 42%, and XEC suffered a considerable 71% loss towards BTC throughout this timeframe.

This bearish efficiency contrasts with Bitcoin’s trajectory, which has displayed relative resilience, down solely 20% in greenback phrases after it rallied alongside the New child 9’s preliminary software and eventual approval of spot Bitcoin ETFs.

The three foremost Bitcoin forks have a comparatively low beta to BTC, showcasing a damaging correlation in value motion. Whereas Bitcoin declined from November 2021 till January 2023, the forks noticed some optimistic efficiency within the latter half of 2022. Nonetheless, as Bitcoin started to get well from January 2023, the forks then began to retreat.

This development continued till June 2023, when all three forks rose considerably towards Bitcoin, with BCH recovering round 65%. BSV and XEC additionally regained roughly 30% and 20%, respectively, whereas Bitcoin elevated roughly 8% towards the greenback in that interval as BlackRock entered to identify Bitcoin ETF race.

BSV’s value surge of 65% could be linked to a major enhance in buying and selling quantity on Upbit, South Korea’s largest crypto change, the place nearly all of BSV’s buying and selling quantity was concentrated. BCH’s value bounce to a one-year excessive was fueled by a mix of things, together with its inclusion on EDX Markets, rising buying and selling volumes, and a spike in social media curiosity. The XEC mainnet additionally had a number of updates all through 2023, aligning with its value efficiency.

Nonetheless, possible, BlackRock throwing its hat within the ring for a spot Bitcoin ETF on June 15 was a related issue within the forks’ surge. Social media hypothesis that Bitcoin turning into an institutional funding product might have a optimistic impact on forks could have fueled preliminary momentum buying and selling exercise. But, ETF sponsors like BlackRock, Constancy, Ark Make investments, and others launched prospectus updates, figuring out that they might not assist any future or previous forks of their choices. Thus, after the preliminary surge towards Bitcoin, all three forks retraced most of their positive aspects.

BSV had a momentary solo rally in November forward of the COPA vs. Wright trial on the id of Satoshi Nakamoto, gaining round 40% towards BTC. The rally was short-lived because it then continued on its downward trajectory as proof was launched forward of the court docket trial beginning in February 2024.

Whereas broader market forces affect the whole crypto sector, Bitcoin’s strengthening narrative and institutional curiosity seem to have additional amplified losses for BCH, BSV, and XEC. Moreover, controversies surrounding figures equivalent to Craig Wright, who claims to be the pseudonymous Bitcoin creator Satoshi Nakamoto, could contribute to BSV’s declining value efficiency.

The disparity highlights the doubtless waning market dominance of main Bitcoin forks as traders re-evaluate these initiatives amid a aggressive panorama the place Bitcoin continues to solidify its narrative because the premier digital asset.

Bitcoin Market Knowledge

On the time of press 2:50 pm UTC on Feb. 14, 2024, Bitcoin is ranked #1 by market cap and the value is up 5.72% over the previous 24 hours. Bitcoin has a market capitalization of $1.02 trillion with a 24-hour buying and selling quantity of $39.59 billion. Study extra about Bitcoin ›

Crypto Market Abstract

On the time of press 2:50 pm UTC on Feb. 14, 2024, the entire crypto market is valued at at $1.93 trillion with a 24-hour quantity of $84 billion. Bitcoin dominance is at the moment at 52.64%. Study extra concerning the crypto market ›