Bitwise predicts that in 2024, the value of Bitcoin (BTC) will surpass $80,000. This forecast follows an excellent 2023 efficiency. With a 128% improve, bitcoin has surpassed different main asset lessons, outperforming the S&P 500, gold, and even bonds.

Bitwise’s Ryan Rasmussen printed 10 optimistic predictions for the cryptocurrency market in 2024 on X (beforehand Twitter) on December 13. The speedy growth of the stablecoin market was one of many essential themes of his put up.

Bitcoin’s Potential Triggers: ETF And Halving

We anticipate two important triggers to drive the worth of Bitcoin within the upcoming yr. The primary is the anticipated early 2024 launch of a spot Bitcoin ETF, which can attract a big inflow of contemporary funding from institutional and retail traders alike.

Prediction #1: Bitcoin will commerce above $80,000, setting a brand new all-time excessive.

There are two main catalysts that can assist get us there: the anticipated launch of a spot Bitcoin ETF in early 2024 and the halving of recent bitcoin provide across the finish of April. pic.twitter.com/KvHNx9XINz

— Ryan Rasmussen (@RasterlyRock) December 13, 2023

The second is the looming April or Might 2024 Bitcoin halving occasion, which might halve the annual quantity of recent Bitcoin that enters the market, so decreasing the availability by an quantity equal to $6.2 billion at current charges.

Speculations abound that BTC markets would possibly see an inflow of as a lot as $100 billion following regulatory approvals. Discussing the potential affect of such a considerable sum getting into the markets, ETF analyst James Seyffart expressed skepticism, deeming it an “overestimation of demand.”

Bitcoin barely under the $43K stage as we speak. Chart: TradingView.com

To contextualize, Seyffart identified that gold ETFs, which have been current within the U.S. since 2004, presently boast roughly $95 billion in belongings.

In line with one other Bitwise forecast, Coinbase’s earnings will double and surpass Wall Avenue estimates by a minimal of ten instances.

This expectation is predicated on previous developments, which present that Coinbase sees increased commerce volumes during times of bull market.

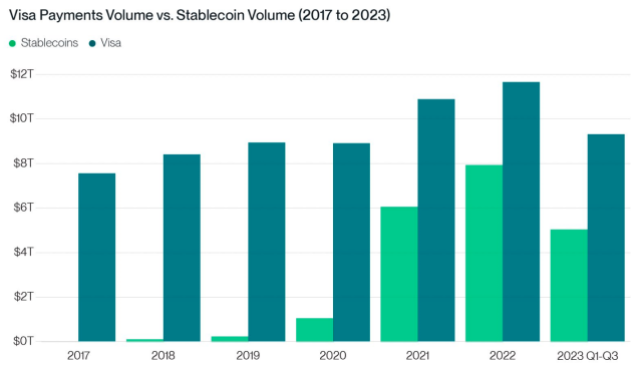

Supply: Bitwise Asset Administration with knowledge from Coin Metrics and Visa.

Extra Predictions From Bitwise

The forecast made within the thread that follows is that stablecoins might be used to settle extra monetary transactions than Visa.

The market capitalization of stablecoins, that are tethered to quite a lot of belongings, together with the US greenback, has surged from virtually nothing to $137 billion over the past 4 years.

Analysts see this progress development to proceed, with stablecoins rising in significance and quantity of commerce.

Circle CEO Jeremy Allaire stated that over the subsequent few years, as traders search for the safety of digital {dollars} with web connectivity, the demand for stablecoins will soar in an interview with CNBC on December 13.

Moreover, Bitwise anticipates substantial developments within the tokenization of real-world belongings, predicting that JPMorgan might tokenize a fund on-chain as the marketplace for tokenized belongings grows quickly.

Bitwise is the world’s largest crypto index fund supervisor. It is likely one of the 13 monetary establishments that the US Securities and Trade Fee has acquired functions from for a licensed spot Bitcoin ETF.

On the time of writing, Bitcoin was buying and selling at $42,856, up 4% within the final 24 hours, knowledge from CoinMarketCap exhibits.

Featured picture from Shutterstock