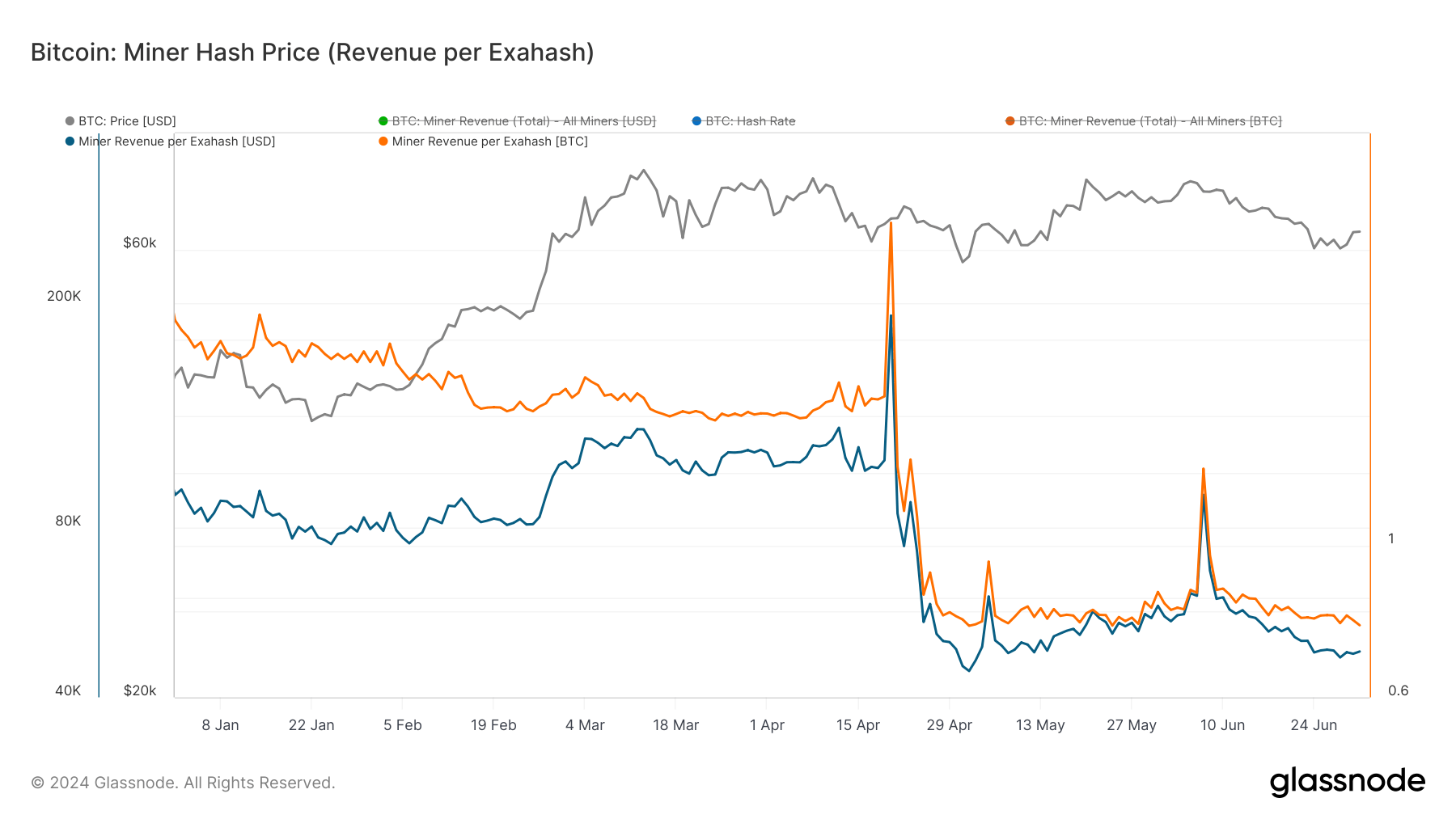

Miner income per exahash measures miners’ every day revenue relative to their contribution to the community’s hash charge, displaying how a lot miners earn per unit of computational energy they contribute. This metric is necessary as a result of it displays the profitability and financial viability of Bitcoin mining, straight influencing selections on useful resource allocation, funding, and operational methods. Given the scale of the Bitcoin mining sector and the efficiency of public mining firms, these metrics change into much more vital.

Since Bitcoin’s fourth halving on April 20, miner income per exahash has declined steeply. Whereas this decline was anticipated and miners have been making ready for it, it brought on vital financial stress for miners. Initially, on April 20, the miner income per exahash was $190,620 or 2.96 BTC. Nevertheless, by Might 2, it had plummeted to an all-time low of $44,538 or 0.76 BTC.

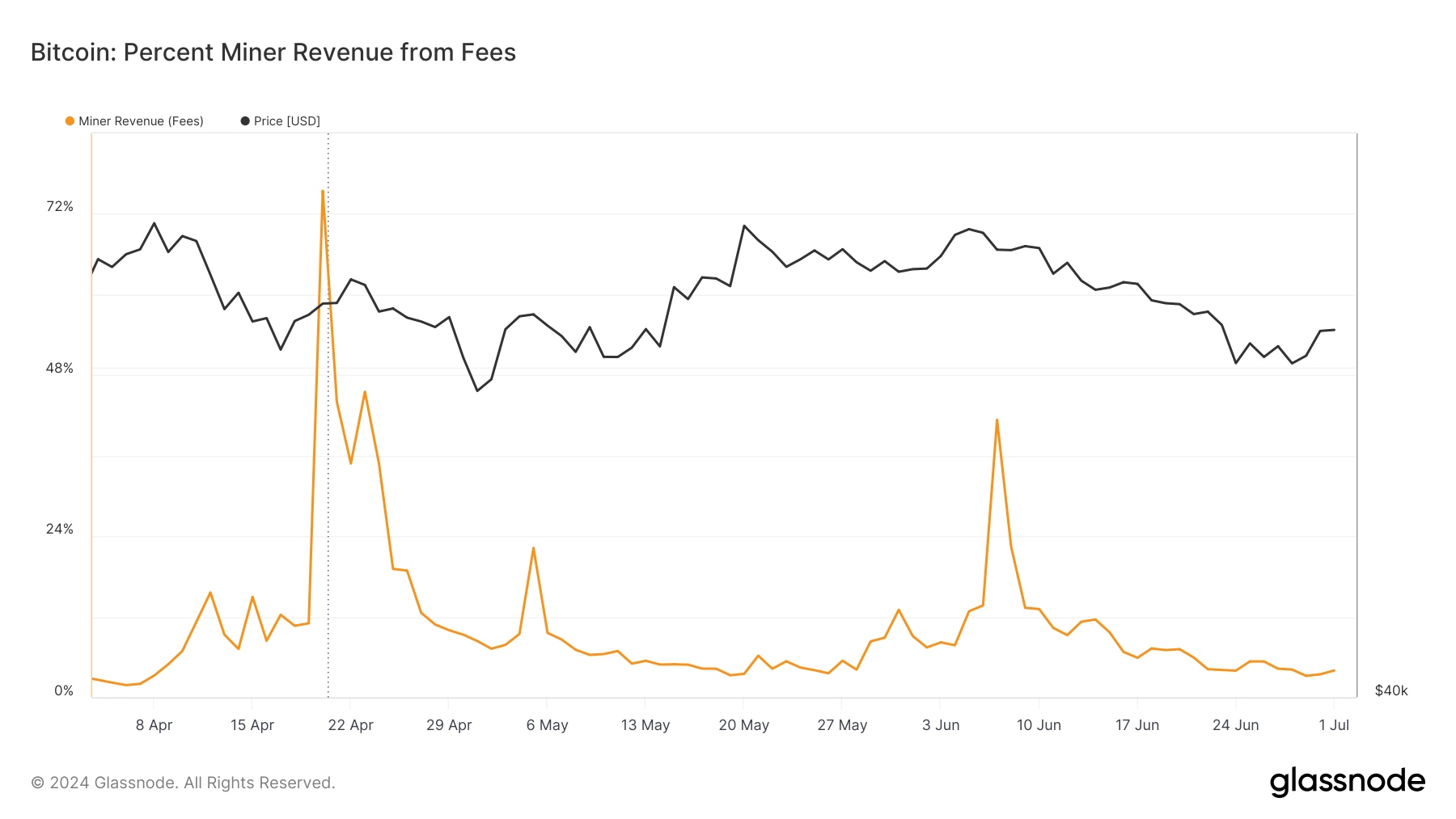

Glassnode’s information confirmed a quick income restoration peaking on June 7 with $91,774 or 1.29 BTC per exahash. This momentary enhance was pushed by a big surge in transaction charges resulting from community congestion, with charges comprising 41.335% of miner income on that day, a considerable rise from simply 7% three days earlier. This peak reveals the occasional spikes in miner income resulting from community exercise and highlights the significance of transaction charges as a supplementary revenue stream for miners, considerably when block rewards diminish.

As of July 1, miner income per exahash stands at $48,230 or 0.76 BTC, indicating a decrease stabilization stage than pre-halving figures. This extended interval of decreased income poses challenges for miners, notably these with increased operational prices or much less environment friendly {hardware}.

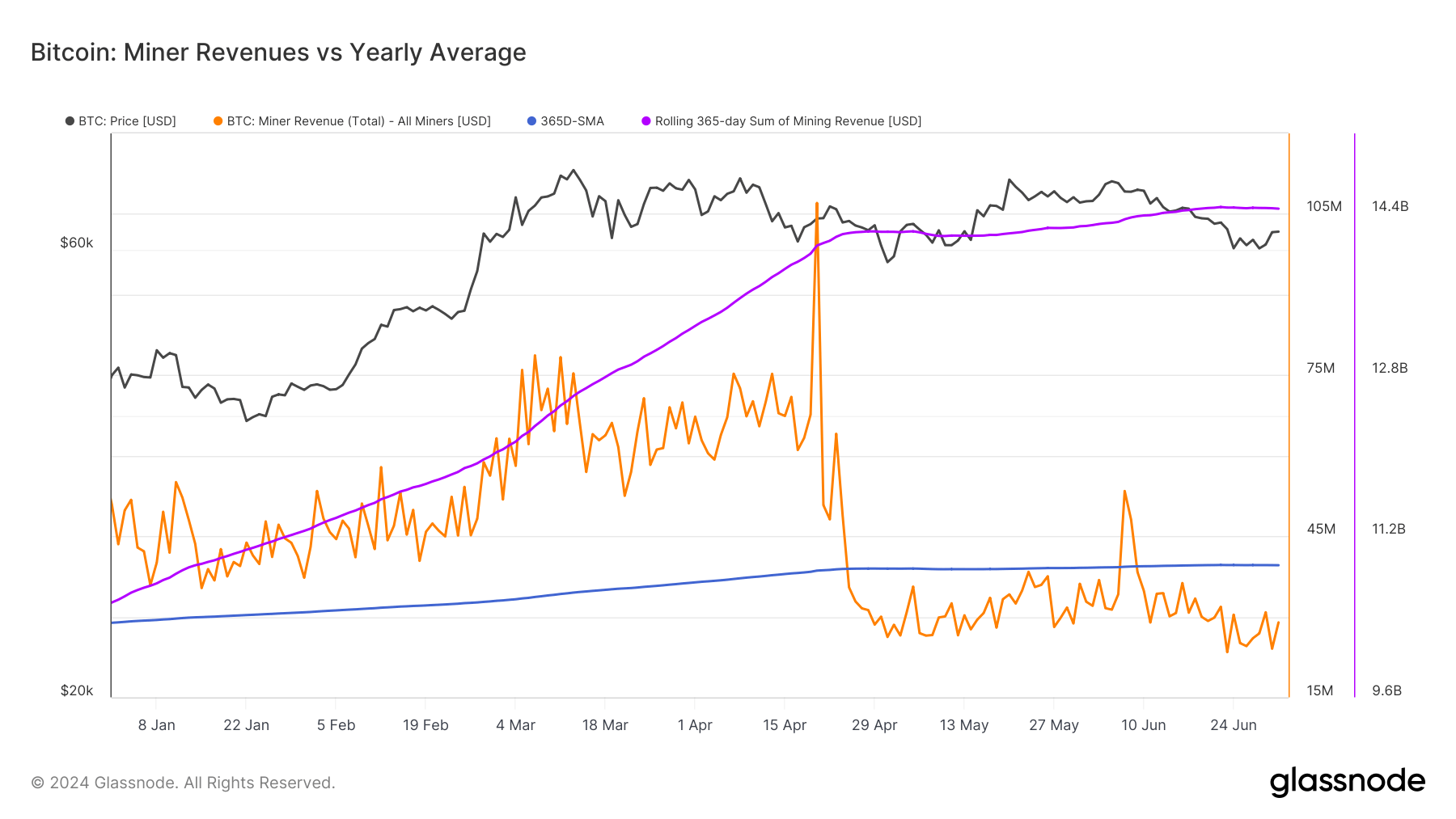

In evaluating miner income towards the yearly common, we see that whole every day USD income paid to Bitcoin miners has remained beneath the 365-day easy transferring common since April 25, apart from the spike on June 7. This vital pattern marks a departure from the earlier 15 months, the place miner income usually exceeded the yearly common. Sustained income beneath the annual common suggests a interval of decreased profitability for miners, which might result in broader implications for the mining business and the Bitcoin community.

The drop in income relative to the yearly common highlights elevated volatility and the potential for monetary pressure on miners. In response to those financial pressures, Bitcoin miners have been endeavor numerous methods to mitigate the impression of decreased revenues. CleanSpark’s acquisition of GRIID Infrastructure for $155 million reveals firms are consolidating to leverage economies of scale. Bitdeer’s announcement of a 570 MW growth in Ohio demonstrates the identical strategic strategy: rising operational capability to boost total output and mitigate the results of decrease income per unit of hash energy.

Marathon’s diversification into mining altcoins like Kaspa is one other instance of miners in search of various income streams. By not solely counting on Bitcoin, Marathon Digital is hedging towards Bitcoin-specific market dangers and broadening its income base. Core Scientific signed a $3.5 billion cope with CoreWeave to diversify past Bitcoin mining into AI-related actions, showcasing one other shift in technique.

The marginal drop in Bitcoin mining problem reveals that a number of miners discover it difficult to stay operational. This problem adjustment might assist rebalance the community, permitting remaining miners to learn from barely decreased competitors and doubtlessly increased revenues if the Bitcoin value or transaction charges enhance.

Nevertheless, the boldness within the mining sector solely appears to develop. US-listed Bitcoin miners noticed a large surge in inventory value over the previous week, reaching a file market capitalization of $22.8 billion. This means traders are optimistic concerning the long-term prospects of Bitcoin mining firms, possible resulting from their strategic variations and the potential for future income progress as community congestion and transaction charges fluctuate.

The submit Bitcoin miners diversify and consolidate to outlive income drop appeared first on crypto-news.