A preferred crypto analyst has defined how the Bitcoin value may very well be liable to additional draw back primarily based on the present distribution of BTC provide across the value.

This Bitcoin Value Vary Holds A Essential Provide Barrier

In a latest submit on the X platform, outstanding crypto pundit Ali Martinez mentioned how the worth of Bitcoin may endure extra decline. The rationale behind this bearish projection revolves across the common price foundation of a number of BTC buyers.

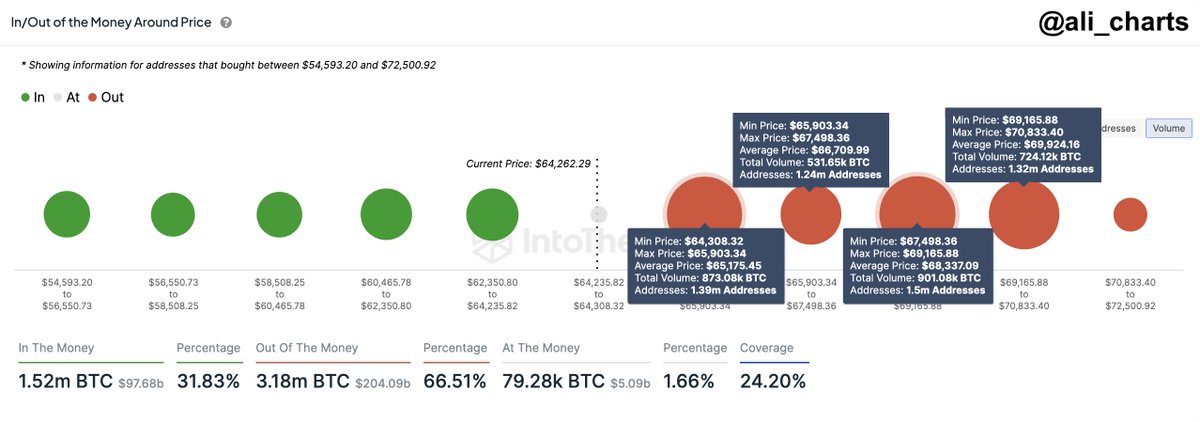

Knowledge from IntoTheBlock exhibits that round 5.45 million addresses bought roughly 3.03 million BTC inside the value vary of $64,300 and $70,800. As highlighted by Martinez, this has led to the formation of an important provide barrier inside this value bracket.

For context, a provide barrier refers to a value vary the place a considerable amount of cryptocurrency was acquired. From the dimensions of the dots within the graph beneath, it seems that Bitcoin at the moment has a big provide barrier above it.

A graph exhibiting the distribution of BTC provide round numerous value ranges | Supply: Ali_charts/X

This value vary turns into particularly related when the Bitcoin value falls beneath this stage, as BTC holders inside the provide barrier would possibly begin promoting in an effort to reduce their losses. This might result in intensified promoting stress and doubtlessly steeper value correction for the premier cryptocurrency.

Moreover, a large-scale offloading and steady value decline may negatively affect the market sentiment, triggering panic promoting amongst different buyers. If the promoting stress is important, this might add to the downward stress on the worth of BTC.

As of this writing, the Bitcoin value stands round $64,460, reflecting a mere 0.2% improve prior to now 24 hours.

Bitcoin Miners Are Capitulating

Typical buyers won’t be the one class of individuals contributing to the promoting stress going through the Bitcoin value in the meanwhile. The newest on-chain revelation exhibits that the Bitcoin miners have additionally been energetic out there in latest weeks.

Based on information from IntoTheBlock, Bitcoin miners have offloaded greater than 30,000 BTC (valued at roughly $2 billion since June). This represents the quickest price of decline in BTC miners’ reserves in over a 12 months.

The blockchain analytics pegged this sell-off to the decreased profitability of the miners following the latest halving occasion. The fourth halving occasion, which occurred in April 2024, noticed the miner’s reward fall from 6.25 BTC to three.125 BTC.

The worth of Bitcoin makes an attempt to cross $65,000 on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView