Bitcoin’s liquid and illiquid provides are very fascinating and helpful metrics for understanding market traits. Liquid provide refers back to the quantity of Bitcoin available for buying and selling, which means it’s held in wallets that steadily interact in transactions. Extremely liquid provide, a subset, denotes Bitcoin that strikes much more steadily, typically utilized by merchants and exchanges. Illiquid provide, conversely, represents Bitcoin held in wallets that hardly ever transfer cash, suggesting long-term holding conduct.

Analyzing these provides offers perception into market sentiment and potential future worth actions. A rise in liquid provide normally signifies increased buying and selling exercise and potential promoting strain, whereas an increase in illiquid provide suggests accumulation and a bullish outlook, as holders count on costs to understand.

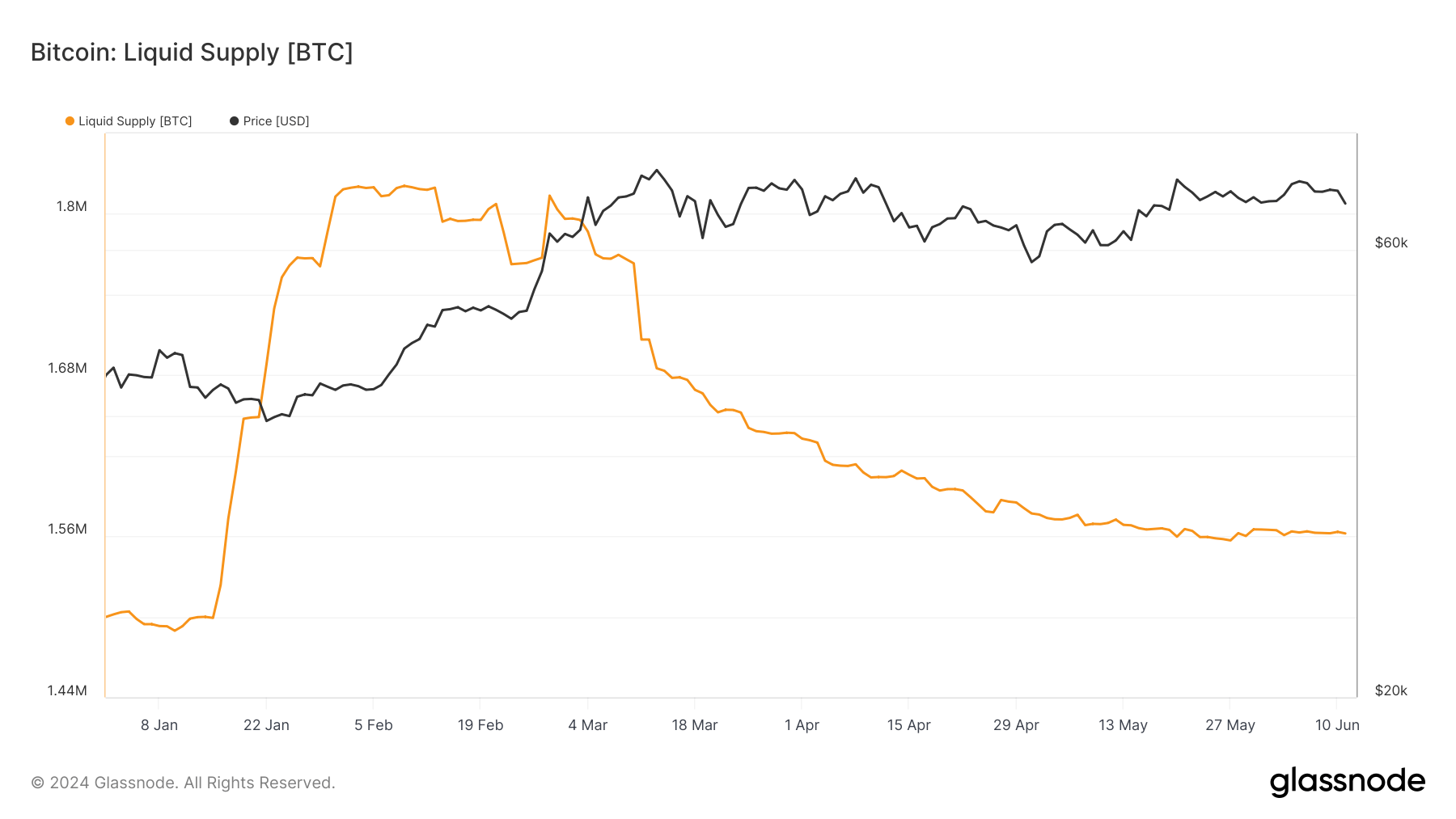

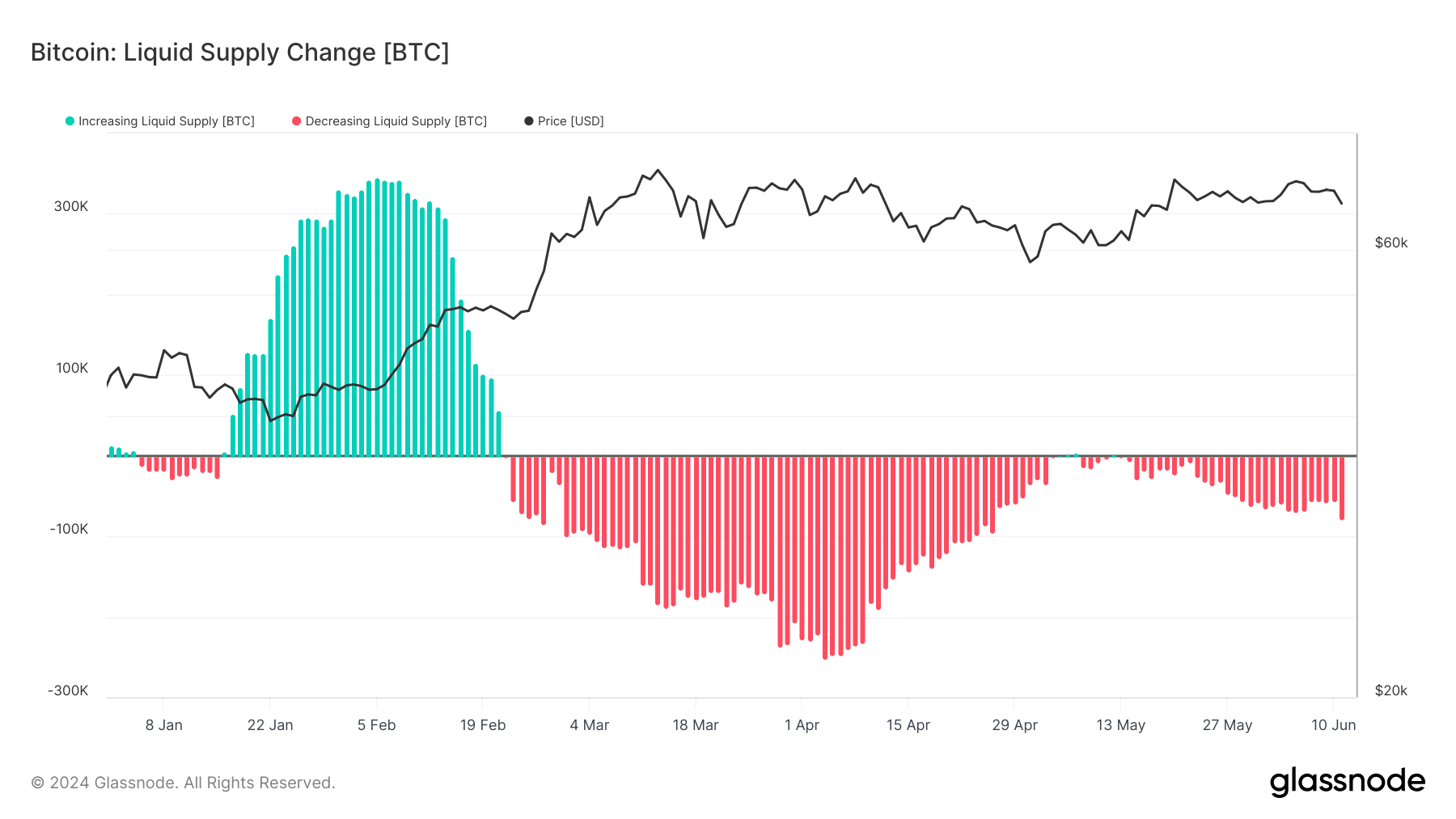

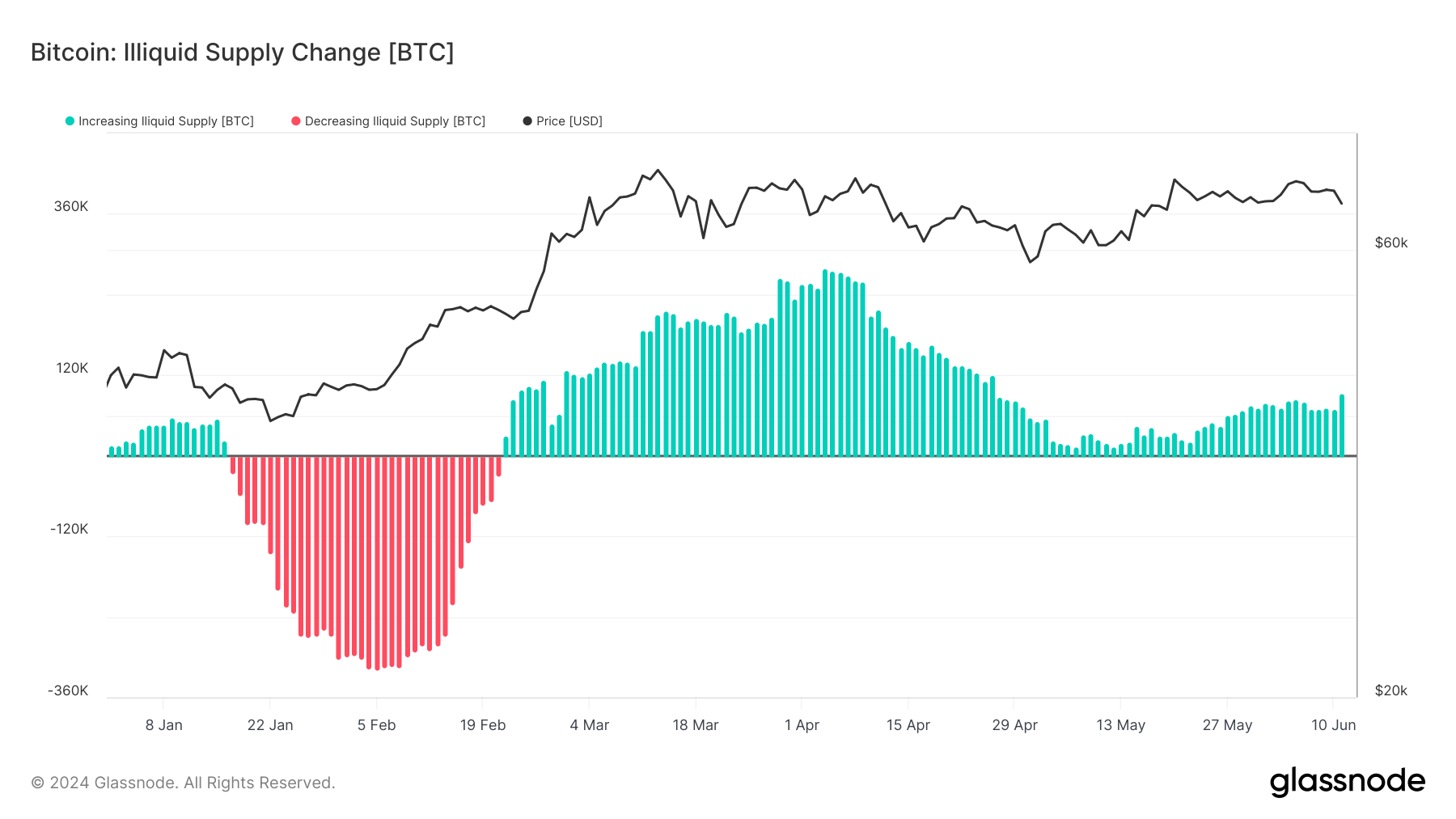

All through this yr, we’ve got seen vital fluctuations in these provides. The liquid provide was at 1.501 million BTC on January 1 and elevated to 1.813 million BTC by February 28. Nevertheless, there was a constant decline from April onwards, with the liquid provide dropping to 1.562 million BTC by June 11. This discount alerts a lower in readily tradable Bitcoin, indicating decreased promoting strain as fewer cash can be found for fast trades.

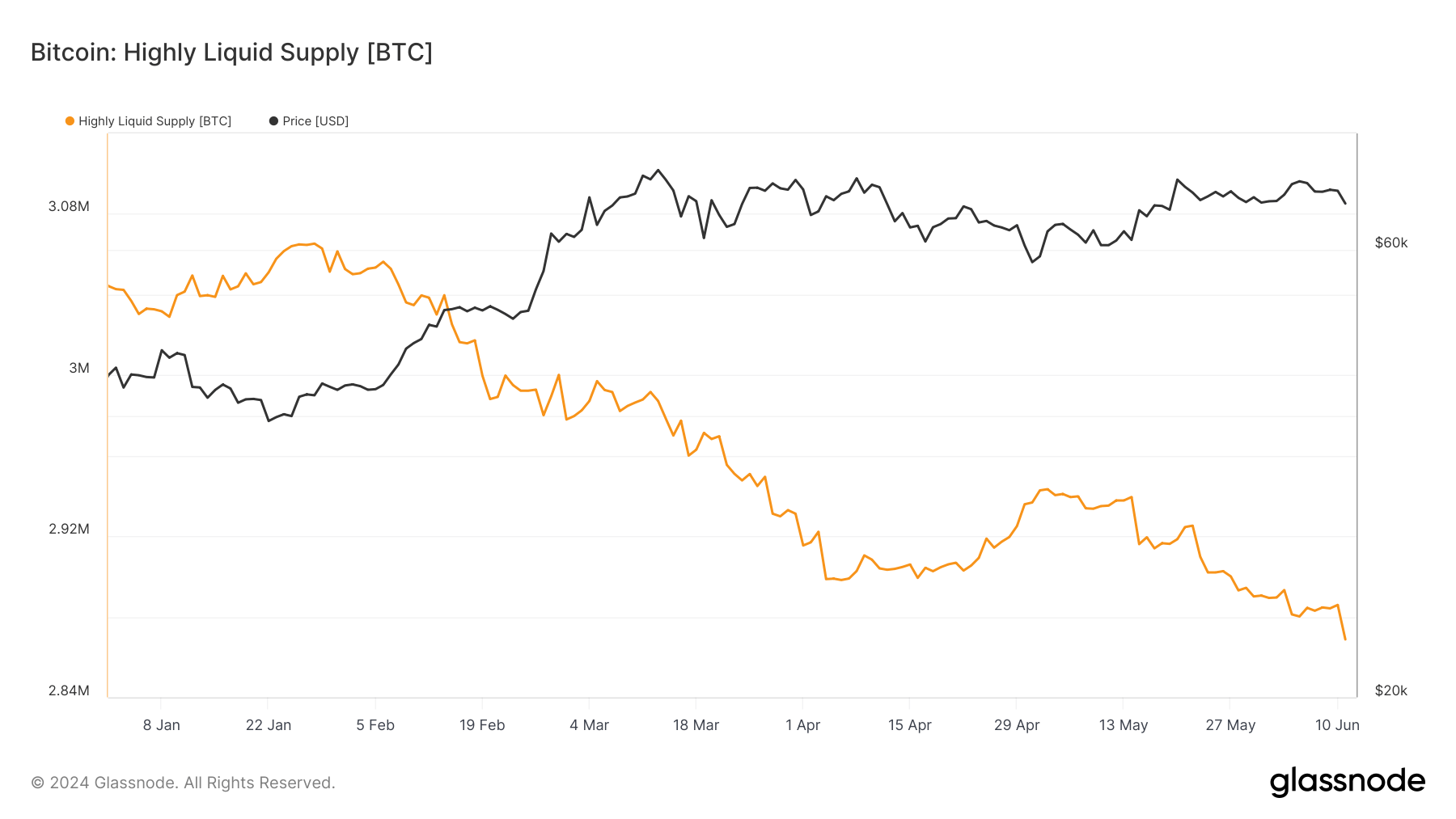

Extremely liquid provide additionally declined, beginning at 3.044 million BTC on January 1 and reaching 2.868 million BTC by June 11. This constant drop over a number of months highlights a discount in essentially the most simply accessible Bitcoin, which might imply that lively merchants and exchanges are holding much less, probably attributable to a shift in the direction of holding or decreased buying and selling exercise.

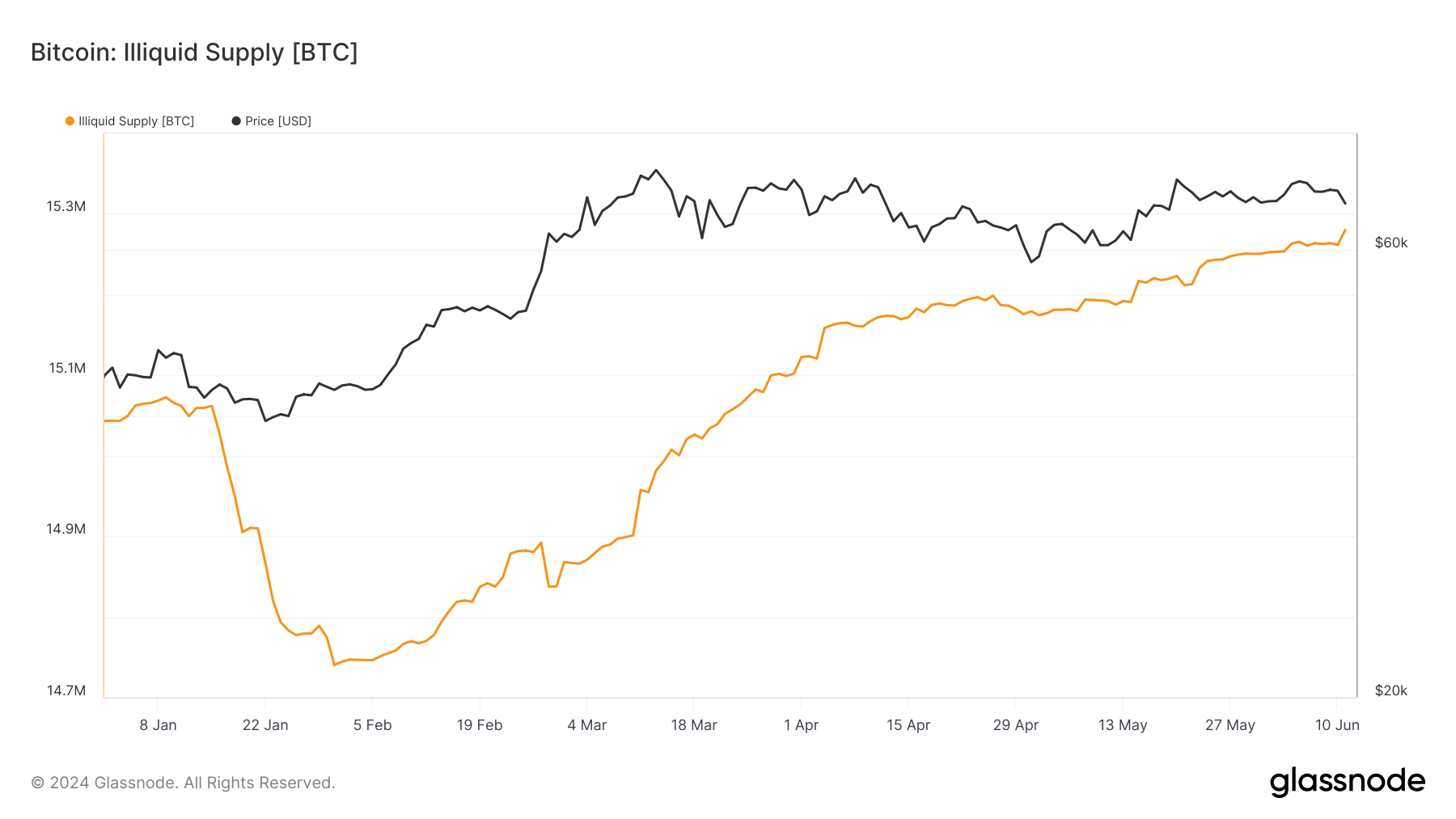

Conversely, the illiquid provide confirmed a gradual improve. It started at 15.043 million BTC on January 1 and rose to fifteen.280 million BTC by June 11. This pattern of accelerating illiquid provide means that extra Bitcoin is being moved into long-term storage, indicating confidence in Bitcoin’s future worth and a lower within the speedy availability of cash for buying and selling.

The 30-day internet change information additional helps these observations. The liquid and extremely liquid provides have been persistently destructive since February 22, with essentially the most substantial decline of 252,000 BTC on April 4. As of June 11, the web change stays destructive at -79,306 BTC. This persistent destructive change reinforces the concept Bitcoin is frequently shifting out of liquid and extremely liquid wallets, decreasing market provide.

However, the illiquid provide’s 30-day internet change has been constructive since February 22, with a peak improve of 279,587 BTC on April 4. As of June 11, this internet change stands at +92,834 BTC, indicating a sturdy and ongoing accumulation pattern amongst long-term holders.

The patterns stay constant when evaluating the broader yearly pattern to the previous month. Each the liquid and extremely liquid provides proceed to lower, albeit at a slower tempo, whereas the illiquid provide steadily grows. This continued divergence between liquid and illiquid provides exhibits a market wherein extra individuals are inclined in the direction of holding somewhat than buying and selling, reflecting a bullish sentiment.

The publish Bitcoin’s liquid provide reducing whereas illiquid confidence grows appeared first on crypto-news.