Understanding regional market knowledge is turning into more and more essential when analyzing the Bitcoin market. Bitcoin’s world nature means buying and selling exercise in a single area can considerably affect worldwide worth actions. By analyzing the place this exercise is most concentrated, we will acquire insights into which areas exert probably the most affect on Bitcoin’s worth.

Glassnode gives estimates for each the provision and worth change of Bitcoin throughout three main areas: Asia, the European Union (E.U.), and america (U.S.). By correlating the timestamps of all transactions created by an deal with with the working hours of various geographical areas, Glassnode determines the possibilities of every entity’s location. This strategy ensures that regional knowledge is as correct as attainable, given the decentralized nature of Bitcoin.

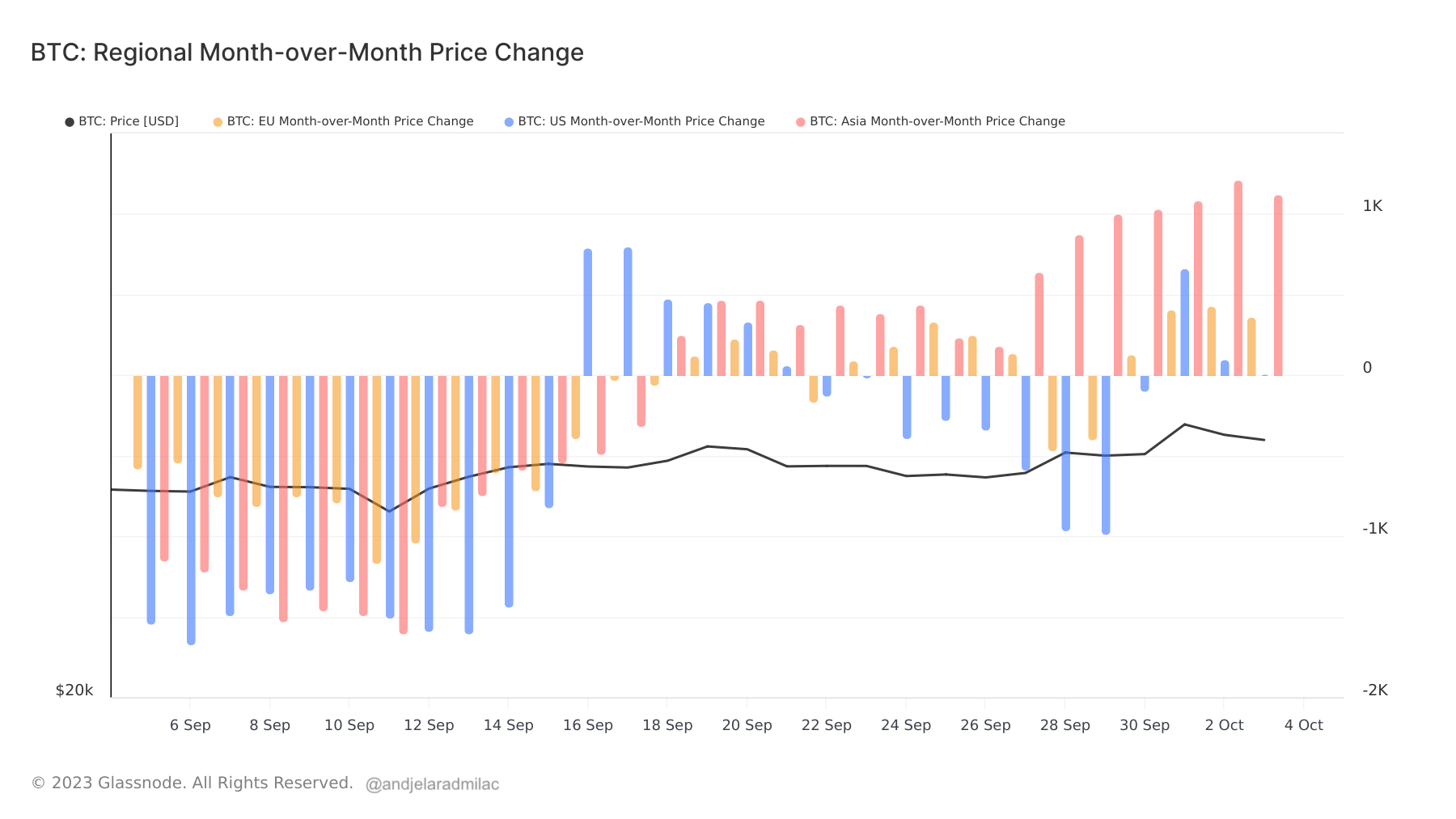

crypto-news evaluation discovered that probably the most vital worth actions aren’t coming from the U.S. As a substitute, the regional month-over-month worth modifications point out that Asia is main the cost. On Oct. 2, the 30-day change in Bitcoin’s worth in Asia mirrored a considerable improve of $1,214. In distinction, the U.S. and E.U. reported extra modest month-over-month worth modifications of $103 and $431, respectively.

Notably, the U.S. skilled a dip within the final week of September, with its most important lower being -$987 on Sep. 29. This means that whereas Asian merchants are accumulating Bitcoin, their counterparts within the U.S. and E.U. are extra reserved, with the U.S. even exhibiting indicators of distribution.

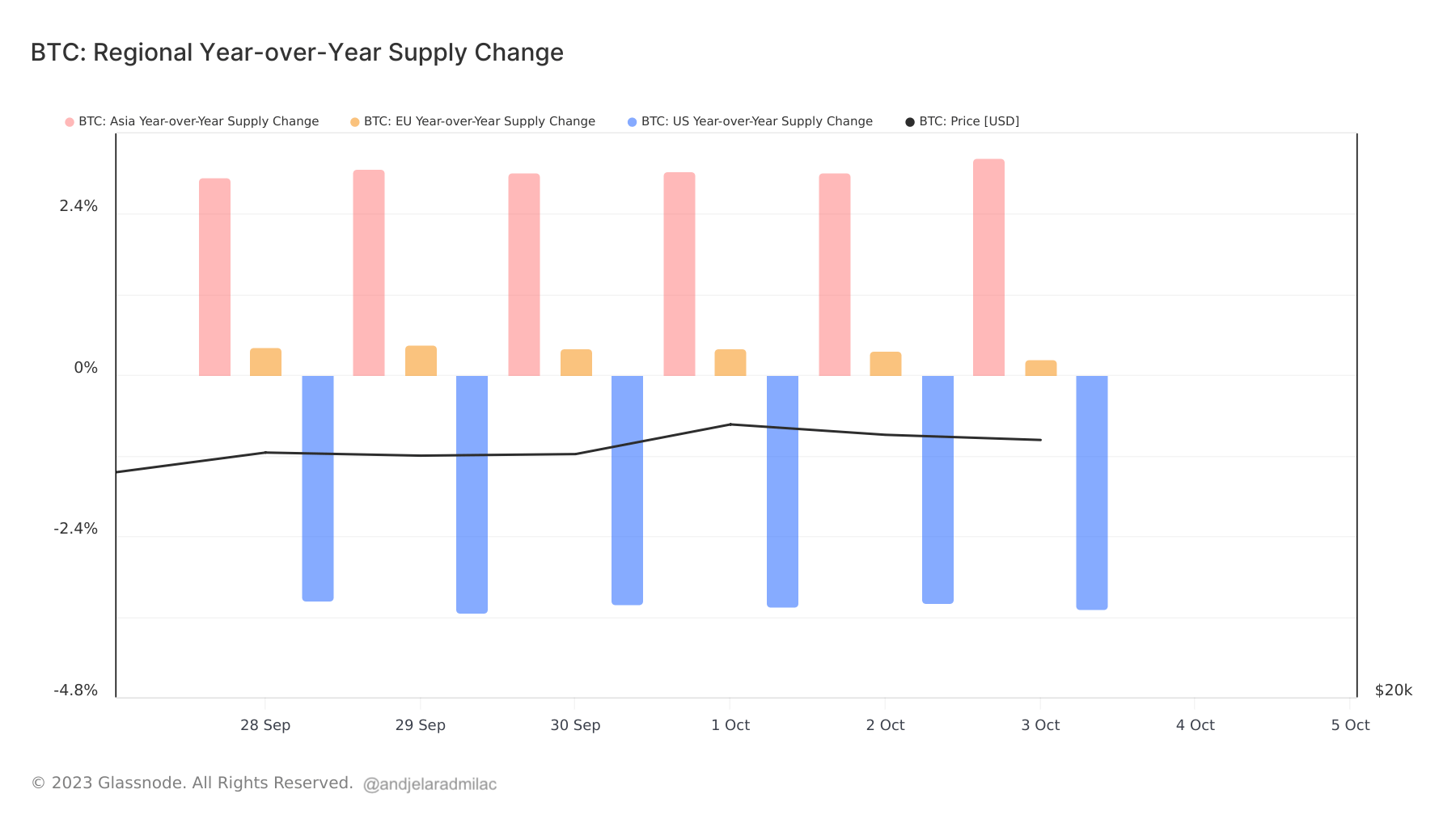

The regional year-over-year provide change gives additional insights. On Oct. 3, the Asian Bitcoin provide elevated by 3.23% YoY. The E.U. additionally reported a slight uptick, with a 0.24% improve. Nevertheless, the U.S. provide confirmed a lower of three.48% YoY.

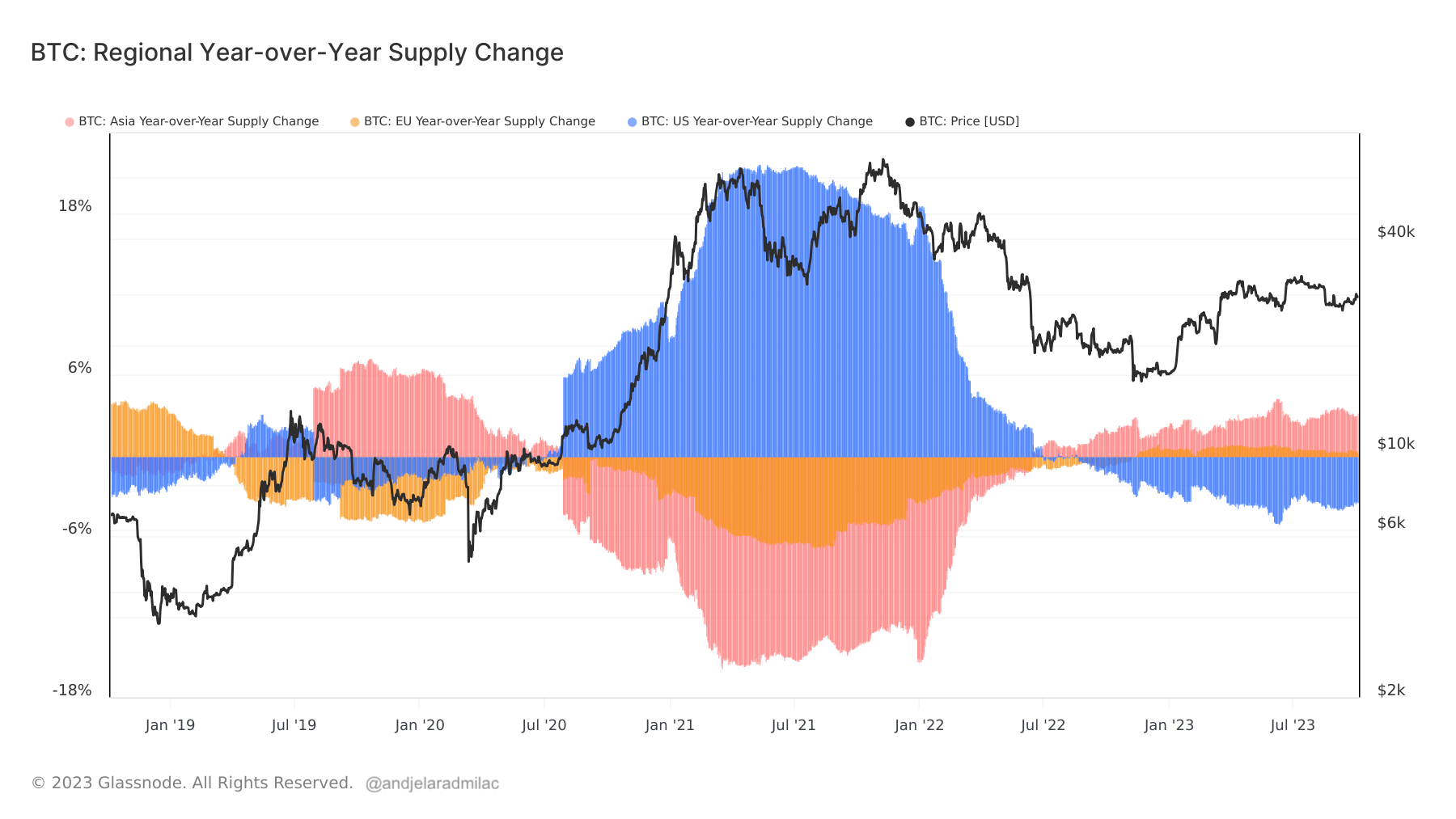

This decline is a part of a broader pattern that started in 2022, with the U.S. Bitcoin provide experiencing a gradual deflation. Since Aug. 2022, the U.S. provide has persistently proven damaging YoY development. Curiously, after years of decline, the E.U. provide started its upward trajectory in Nov. 2022. The Asian provide, alternatively, has been rising in tandem with the lower within the U.S. provide, suggesting a near-perfect inverse relationship.

The info means that whereas Asian merchants are bullish on Bitcoin, the U.S. and E.U. markets are extra cautious. The rise in provide in Asia signifies a rising confidence within the cryptocurrency, whereas the lower within the U.S. suggests a extra conservative stance. The E.U.’s modest improve might be indicative of a cautious optimism.

Regional knowledge supplies helpful insights into the worldwide Bitcoin market. The present developments recommend a shift in market dynamics, with Asia rising as a dominant drive in Bitcoin buying and selling.

The submit Bitcoin’s regional dynamics: Asia bullish, U.S. and E.U. in distribution mode appeared first on crypto-news.