Bitcoin crossed the $57,000 mark on Feb. 27, reaching its highest degree since November 2022. This surge, driving the worth from $54,000 to $57,300 inside 24 hours, led many to see it as the start of a bull rally, particularly vital in a Bitcoin halving yr.

Regardless of the blistering positive factors, the anticipated wave of liquidations didn’t comply with go well with.

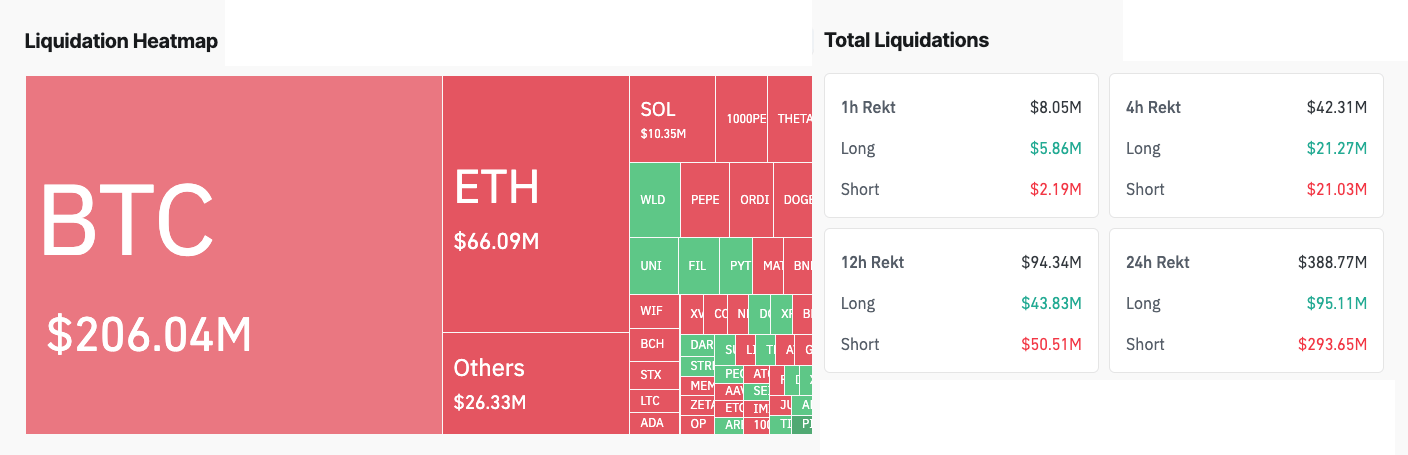

Between Feb. 26 and Feb. 27, 86,351 merchants confronted liquidation, cumulating to $387.15 million throughout the board. Nevertheless, Bitcoin-specific liquidations stood at round $206 million. This determine, divided between $175 million in shorts and $30 million in longs, signifies a market thatremained resilient in opposition to huge liquidation triggers opposite to expectations.

The comparatively muted response when it comes to liquidations following Bitcoin’s sharp value improve will be attributed to a number of elements that cushion the affect of such unstable actions available on the market’s by-product section.

Firstly, the distribution of liquidations signifies that the market was not closely leveraged. In eventualities the place the market sentiment is overwhelmingly bullish or bearish, a sudden value motion in opposition to the bulk place can set off a cascade of liquidations.

Nevertheless, the extra balanced positioning on this case means that merchants weren’t excessively leaning in the direction of a bearish outlook, which might have been extra weak to being squeezed out by the worth spike.

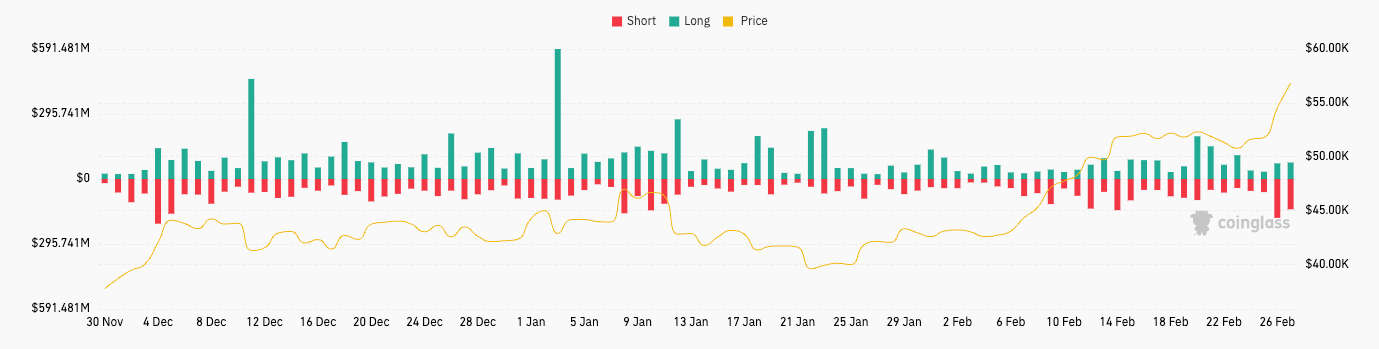

These balanced liquidations aren’t an outlier however moderately a part of a constant sample noticed in latest weeks. The overall quantity of BTC liquidations on Feb. 27, though vital, didn’t deviate markedly from the every day averages seen over the earlier weeks.

This steadiness suggests a shift amongst market contributors in the direction of extra conservative leverage ranges and a extra even distribution throughout bullish and bearish positions. Such strategic positioning inherently buffers the market in opposition to the shock of sudden value actions, mitigating the danger of large-scale liquidations.

That is according to crypto-news’s earlier evaluation of the derivatives market, which discovered an virtually equal break up between calls and places in Bitcoin choices. Whereas the rise in open curiosity in February signaled a dominant bullish outlook out there, the balanced call-to-put ratio confirmed warning amongst merchants.

This warning, seen within the noticeable uptick in defensive methods and bearish bets, was possible what prevented a domino impact of cascading brief liquidations that might have eroded Bitcoin’s positive factors for the day.

The publish Bitcoin’s surge to $57K didn’t end in liquidation storm, defying anticipated development appeared first on crypto-news.