Cathie Wooden, CEO of ARK Make investments, despatched shockwaves by the cryptocurrency market by revising her Bitcoin value predictions upward in gentle of the SEC’s latest inexperienced gentle for spot ETFs.

Wooden, already recognized for her bullish stance, now sees the digital asset doubtlessly hitting $1.5 million by 2030, eclipsing her earlier $1 million projection.

Bitcoin ETF Approval Ignites Bullish Surge

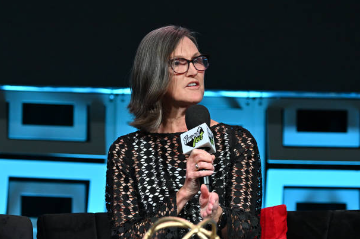

This newfound optimism stems from the “inexperienced gentle” Wooden perceives the SEC approval to be. In a CNBC interview, she acknowledged, “We predict the chance of the bull case has elevated with this SEC approval. It is a inexperienced gentle.”

ARK’s preliminary $1 million prediction was based mostly on a number of elements, together with the highest crypto’s hashrate, long-term holder provide, and energetic addresses, all of which have remained robust in comparison with earlier downturns. The ETF approval has merely added gasoline to the hearth.

Cathie Wooden makes her $1.5 million bull case for the worth of bitcoin by 2030. https://t.co/r34iRNA9bG pic.twitter.com/chWWDH7ioE

— CNBC (@CNBC) January 11, 2024

However Wooden isn’t alone in her bullish outlook. Normal Chartered Financial institution lately predicted Bitcoin might attain $200,000 by 2025, drawing parallels to the launch of the primary gold ETF in 2004.

Past value predictions, Wooden emphasised the broader implications of the ETF approval. She described Bitcoin as a “public good” and a “monetary superhighway,” highlighting its potential to revolutionize the way in which we work together with cash. She additional believes institutional buyers’ entry by ETFs will considerably influence the digital asset’s value and trajectory.

BTC market cap presently at $900.106 billion. Chart: TradingView.com

Curiously, Wooden doesn’t anticipate the everyday “sell-on-the-news” situation, suggesting market positioning has already adjusted to the ETF information. As a substitute, she expects substantial inflows from each institutional and retail buyers, with retail doubtlessly main the cost.

Nonetheless, Wooden’s optimism is tempered with a dose of warning. She acknowledges short-term volatility however expresses robust long-term confidence in Bitcoin. In the end, she sees the restricted provide of 21 million cash as a robust driver of future worth, even with modest institutional allocation.

A Vital Turning Level

Whereas Cathie Wooden’s revised Bitcoin value prediction is undoubtedly attention-grabbing, it’s essential to keep in mind that it’s only one perspective. Cryptocurrencies are inherently unstable, and predictions are notoriously troublesome to ensure.

Regulatory uncertainties and potential market bubbles stay considerations, highlighting the significance of thorough analysis and threat evaluation earlier than making any funding choices.

One factor is for certain: the SEC’s approval of spot Bitcoin ETFs marks a major turning level for the world’s hottest cryptocurrency. Whether or not it fulfills Cathie Wooden’s bold imaginative and prescient for a $1.5 million Bitcoin future stays to be seen, nevertheless it has undoubtedly opened a brand new chapter within the ongoing digital foreign money saga.

Bitcoin surged to over $49,000 on Thursday, reaching its highest level since December 2021, pushed by the launch of U.S.-listed spot bitcoin exchange-traded funds (ETFs) and heightened anticipation. The cryptocurrency initially rose from under $46,000 to over $47,000, peaking at $49,042 in the course of the early U.S. buying and selling session. Nonetheless, it later retraced all good points and fell under $46,000.

Featured picture from Getty Photographs