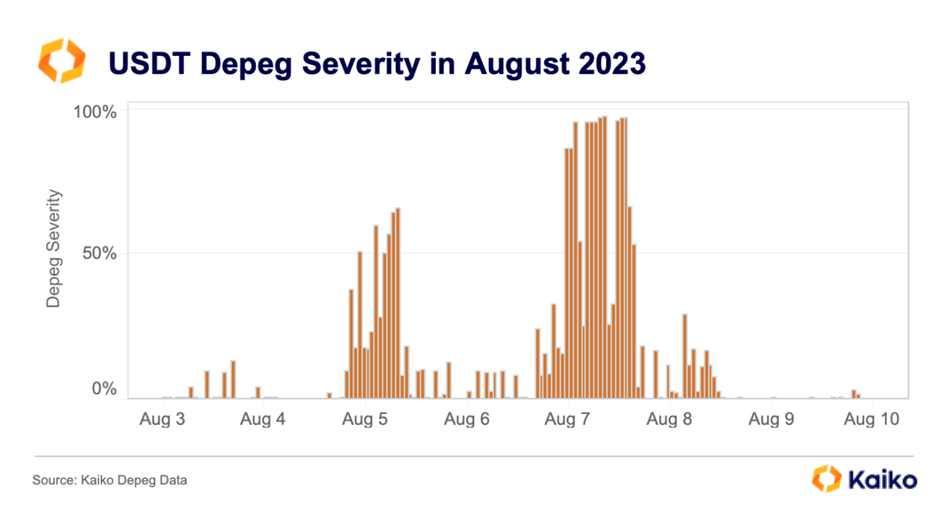

- Kaiko researcher Riyad Carey revealed an intricate USDT depegging sample in August.

- USDT skilled a extreme 98% depeg on August 7, when the stablecoin traded at a 2% low cost.

- Low liquidity and excessive redemption charges are the foremost elements that led to the USDT depegging.

A current evaluation introduced by a Kaiko researcher Riyad Carey, revealed an intriguing growth on the earth of stablecoins, offering insights into the intricate depegging sample that the biggest stablecoin USDT witnessed the final month. In accordance with the analysis, Tether’s USDT skilled a extreme 98% depeg, on August 7, when the stablecoin traded at round a 2% low cost on virtually each alternate.

Earlier at the moment, the analyst took to Twitter to ask the readers’ consideration to the unnoticed USDT depegging that happened within the month of August. Clarifying the readers’ ambiguities, the researcher elucidated that the platform launched a brand new metric that assesses “the severity of stablecoin depegs”.

As per Kaiko’s report, on August 7, at round 8 a.m. (UTC), USDT traded at a cheaper price, in comparison with its $1 peg. The platform defined that the month’s USDT depegging adopted the web promoting of the token price $500 million throughout the main crypto buying and selling platforms together with Binance, Uniswap, and Huobi.

Whereas Kaiko’s new metric creates a singular depeg threshold for every stablecoin, the evaluation recognized that the USDT has the smallest depegging threshold, whereas DAI has the biggest. Notably, the metric works on the precept that stablecoins with greater buying and selling volumes could be much less open to depegging whereas extremely traded stablecoins are extra weak to getting depegged.

Whereas analyzing historic developments, it’s notable that the USDT depegging is far influenced by a number of elements together with decrease liquidity, redemption price, and Tether’s minimal necessities for USDT provide. Justifying historical past, the USDT depegging in August can also be a results of decrease liquidity and redemption charges. The extended crypto winter can also be one of many main causes for the stablecoin’s instability and the resultant depegging.

The analyst instructed {that a} discount within the redemption charges might presumably sort out the prevailing dilemma within the USDT ecosystem. He added that the $850 million revenue reported within the second quarter of 2023 wouldn’t be affected by the redemption price removing.