World digital asset funding merchandise noticed important inflows final week, totaling $1.1 billion, propelling the year-to-date determine to $2.7 billion.

The newest weekly report from CoinShares confirmed the surge within the influx of funds into digital asset funding merchandise, which pushed the belongings below administration to a peak not seen since early 2022, now standing at $59 billion. The US spot ETF market performed a pivotal function on this improvement, capturing $1.1 billion of final week’s inflows.

Bitcoin stays the clear market chief, garnering roughly 98% of whole inflows final week. Elevated confidence additionally permeated via to Ethereum and Cardano, receiving inflows of $16 million and $6 million, respectively. Altcoins comparable to Avalanche, Polygon, and Tron noticed minor but sustained inflows all through the interval. Blockchain equities exhibited combined outcomes as a single issuer predominantly drove outflows; others within the sector noticed incremental positive aspects.

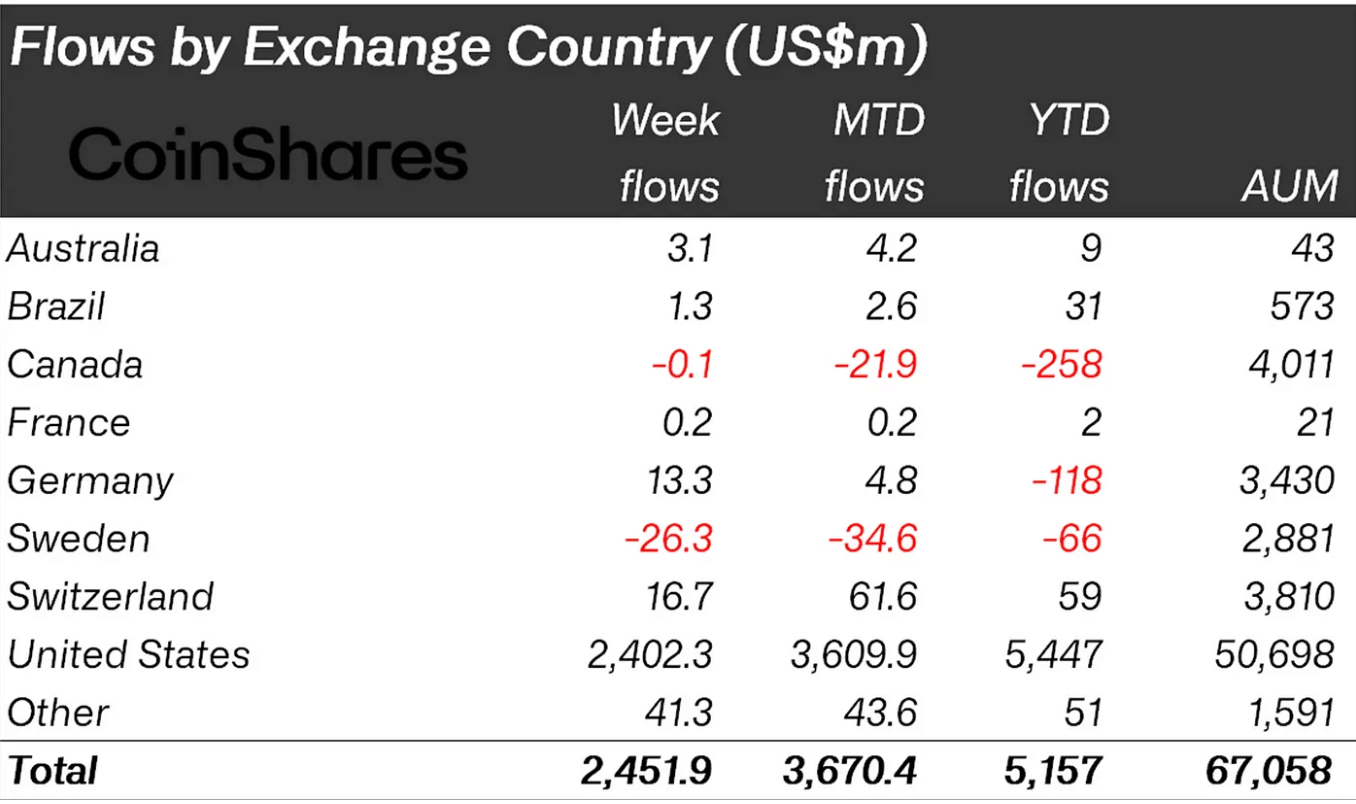

The report additionally sheds mild on the regional traits of those inflows. Whereas the US leads, different areas have proven combined reactions. Switzerland, as an illustration, reported $35 million in inflows, contrasting with minor outflows from Canada and Germany. This geographical distribution of inflows and outflows highlights the nuanced international perspective on digital asset investments.

CoinShares’ evaluation signifies a slowdown in outflows from incumbent digital asset funds, though issues linger over the potential impression of Genesis’ $1.6 billion holdings sale.

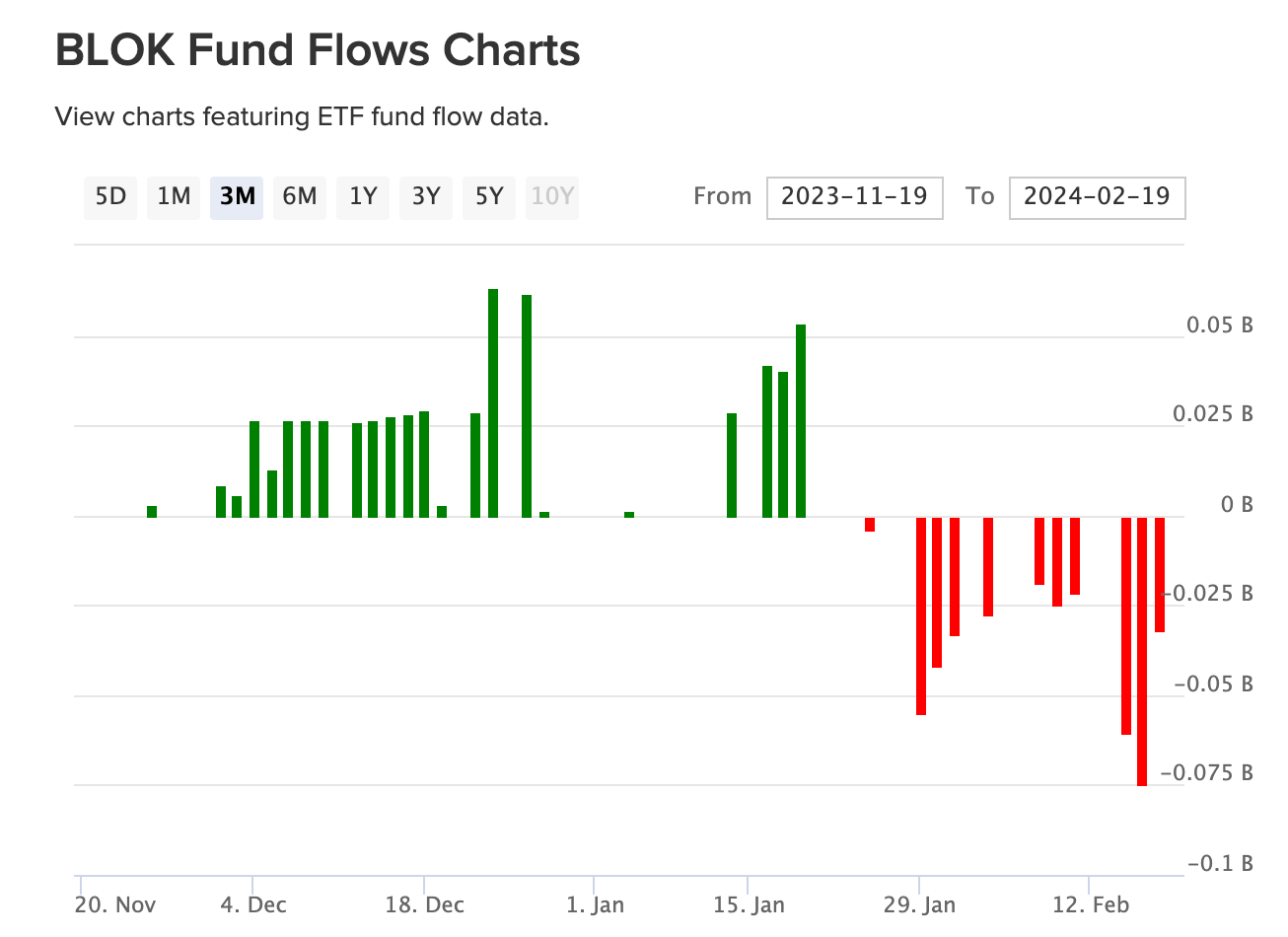

The general development in digital asset funding merchandise is optimistic. Blockchain equities, nevertheless, skilled a combined bag, with a notable outflow from Amplify Transformational Information Sharing ETF (BLOK) totaling $67 million, whereas others noticed collective inflows of $19 million. This distinction illustrates the various investor sentiment and methods at play inside the broader crypto and blockchain funding panorama. In line with the VettaFi ETF Database, BLOK has seen persistent outflows since mid-January.

In abstract, the most recent CoinShares report emphasizes a sturdy inflow of capital into digital asset funding merchandise, with a continued focus on Bitcoin. The numerous inflows, the best AuM since early 2022, and the regional variations in funding stream replicate the rising maturity and complexity of the crypto funding house.