Funding charges are an typically neglected but important side of the crypto market. These charges are important in perpetual futures contracts — monetary devices that permit merchants to guess on Bitcoin’s worth with out an expiration date.

Funding charges assist align the value of those contracts with the precise market worth of Bitcoin by way of periodic funds between patrons and sellers. Consumers pay sellers if the speed is optimistic, exhibiting a bullish market temper. Conversely, a adverse price signifies bearish sentiment, with sellers paying patrons.

Funding charges present the market’s leverage path and total sentiment. Excessive funding charges recommend a robust bullish sentiment, with merchants prepared to pay extra to carry onto their bets for rising costs. In the meantime, low or adverse charges trace at a bearish outlook, the place expectations lean in direction of a worth drop.

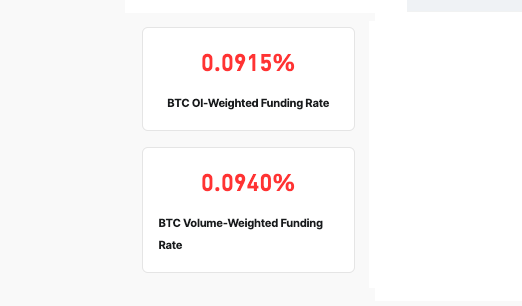

In response to CoinGlass knowledge, the open interest-weighted funding price of 0.0921% and the volume-weighted funding price of 0.0942% confirmed a excessive price for merchants holding lengthy positions in perpetual futures previous to Bitcoin’s March 5 correction. The slight distinction between these charges comes from the distribution of open curiosity and quantity throughout totally different worth factors or occasions, exhibiting a slight distinction in market sentiment and leverage.

This excessive price of holding lengthy positions exhibits that many of the market was anticipating costs to rise even additional within the close to future. That is particularly vital as BTC had been struggling to regain its ATH of $69,000. Bitcoin briefly broke $69,000 on a number of exchanges on March 5, however a swift correction introduced its worth again to $59,500 earlier than recovering to round $67,000.

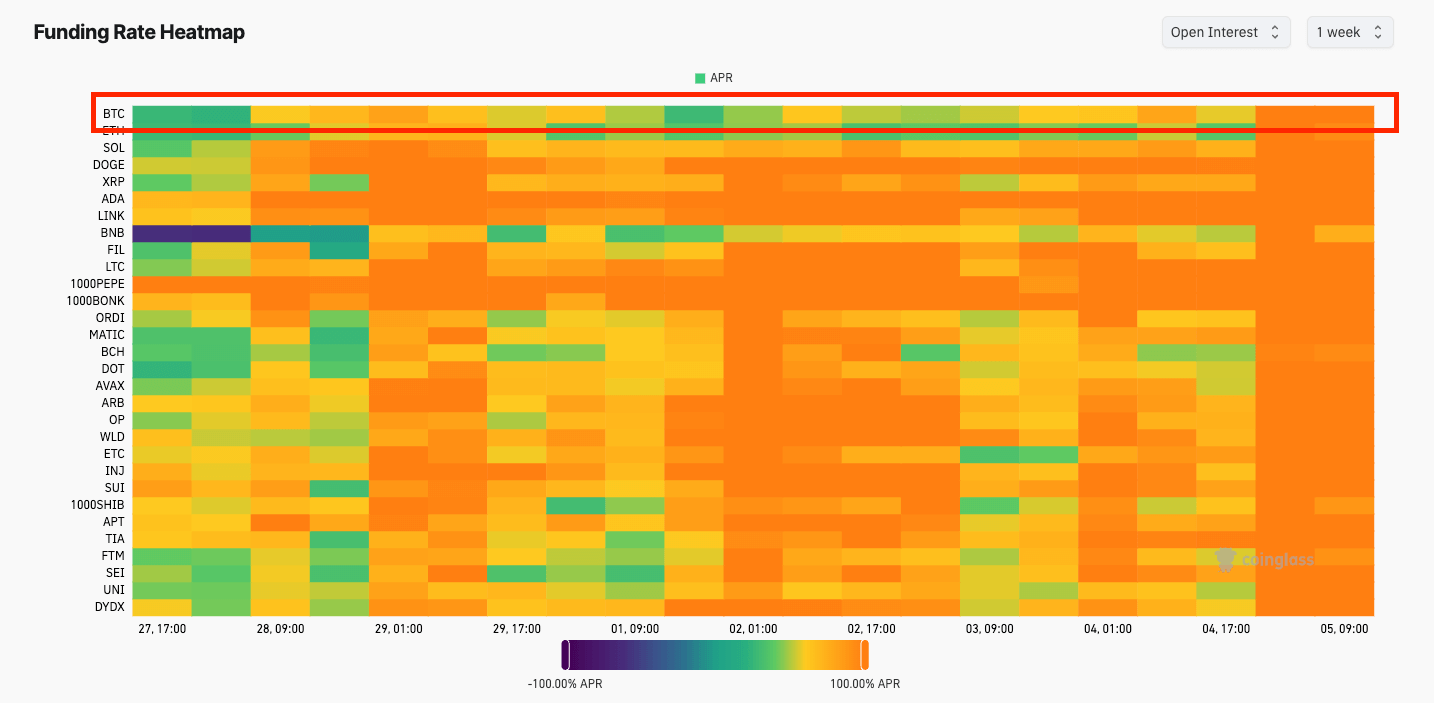

The bullish sentiment was seen within the dramatic improve within the Bitcoin APR. On March 1, Bitcoin’s worth was $61,480, and the funding price APR stood at 27.72%. And whereas an uptick in APR was seen in the previous few days of February, it wasn’t till the start of March that it picked up momentum. The development from 27.72% APR on March 1 to a pointy improve to 117.52% by the morning of March 5 adopted Bitcoin’s worth improve from $61,480 to $68,296 over the identical timeframe.

The rise in funding price APRs, significantly the leap noticed on March 5, exhibits bullish sentiment amongst merchants has intensified. The market is more and more prepared to pay larger premiums to carry lengthy positions in anticipation of additional worth appreciation.

The speedy escalation in APR between March 1 and March 5, significantly the hourly leap between 01:00 and 09:00 on March 5, represents the fruits of speculative fervor, probably pushed by FOMO as merchants rush to capitalize on the bullish development. This situation typically results in a extremely leveraged market the place the price of sustaining lengthy positions turns into exceptionally excessive, mirrored within the surging APR. The fallout of the March 5 worth correction noticed the Open Curiosity weighted funding price fall to 0.0504% as of press time following $309 million in BTC liquidations over the previous 24 hours.

Such situations improve the market’s vulnerability to volatility and corrections. An over-leveraged market is inclined to sudden worth pullbacks, the place even minor sell-offs can set off a cascade of liquidations of leveraged positions, resulting in sharp worth corrections. Traditionally, vital run-ups in worth and funding charges have sometimes preceded corrections.

The put up Funding charges soared as merchants guess huge on Bitcoin’s future features earlier than correction appeared first on crypto-news.