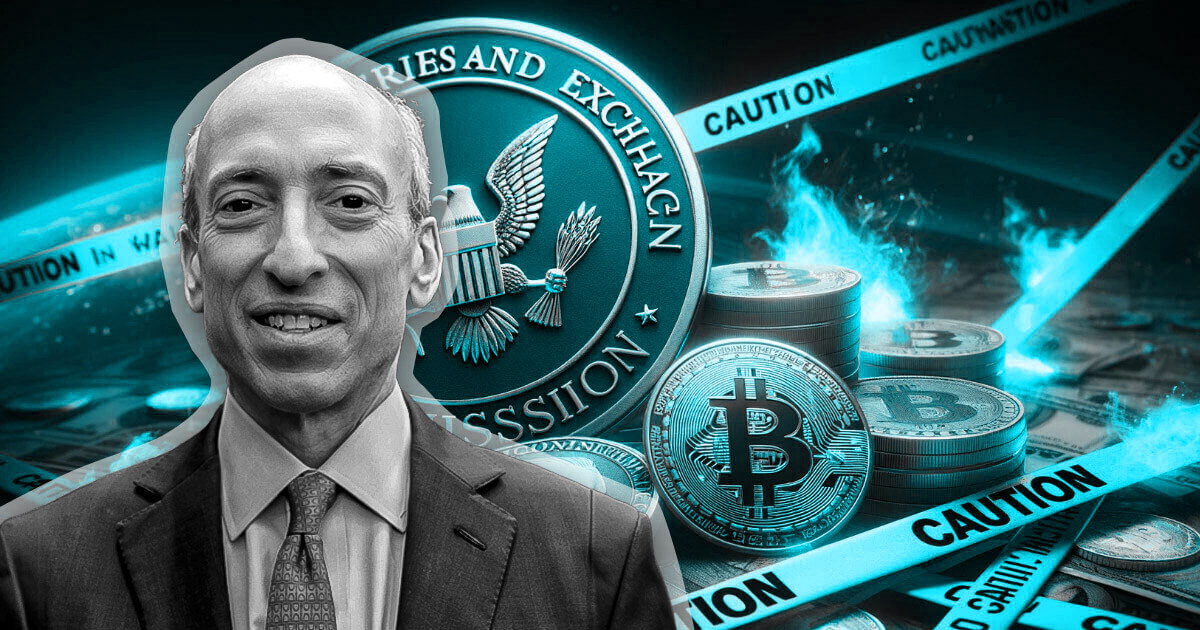

SEC Chair Gary Gensler stated it’s ironic that individuals name the approval of spot Bitcoin ETFs a historic second contemplating its centralized nature, which is the antithesis of Satoshi Nakamoto’s imaginative and prescient.

He stated:

“Take into consideration the irony of those that say this week is historic. This [the approval] was about centralization and conventional technique of finance.”

Gensler made the assertion throughout a CNBC “Squawk Field” interview on Jan. 12, the place he delved into the explanations behind the SEC’s approval and addressed among the considerations raised by Senator Elizabeth Warren.

Respecting the courts

Gensler stated that the SEC accepted the 11 spot Bitcoin ETFs because of the latest courtroom determination within the regulator’s lawsuit towards Grayscale. The courtroom dominated that the SEC didn’t have respectable grounds to reject a spot Bitcoin ETF because it had accepted merchandise primarily based on futures for the flagship cryptocurrency.

Gensler stated that the SEC has the utmost respect for the regulation and can all the time observe the courtroom’s directives relating to regulation. He added that the approval of the ETFs doesn’t equate to an endorsement of Bitcoin, and he continues to carry a vital stance towards the asset.

Based on the SEC chair:

“Bitcoin itself we didn’t approve, we don’t endorse. It is a product referred to as an exchange-traded product that traders can put money into the underlying non-security commodity asset.”

He added that Bitcoin stays a “unstable retailer of worth” that’s not getting used for any respectable funds. Nonetheless, he acknowledged that the underlying know-how holds promise and that approving the ETFs was the “most sustainable path ahead.”

Gensler additionally clarified that Bitcoin is the one cryptocurrency it considers a non-security commodity, likening it to gold and silver-based merchandise. He added that the regulator continues to carry the view that almost all of crypto tokens are securities.

Response to Warren

Gensler’s remarks additionally touched upon Warren’s criticism of the choice. The senator has been a vocal critic of the cryptocurrency market, arguing that the SEC’s approval was legally and policy-wise misguided.

Responding to those considerations, Gensler expressed respect differing opinions however reaffirmed his dedication to following authorized and courtroom directives. He acknowledged:

“Whereas I perceive and respect the considerations raised by Senator Warren, our determination is grounded in a rigorous consideration of the authorized framework and the present monetary realities.”

Regardless of the controversy surrounding the SEC’s determination, the approval of those Bitcoin ETFs signifies a probably new period for cryptocurrency within the mainstream monetary market.

The inaugural buying and selling session following the approval witnessed important exercise, indicating robust investor curiosity and probably paving the best way for extra widespread acceptance of digital belongings.