- Litecoin’s current unfavorable sentiment raises worries amongst crypto fanatics.

- Constructive indicators emerge, however issues persist over Litecoin’s long-term prospects.

- Analyst Benjamin Cowen advises warning, citing Litecoin’s poor efficiency in opposition to BTC.

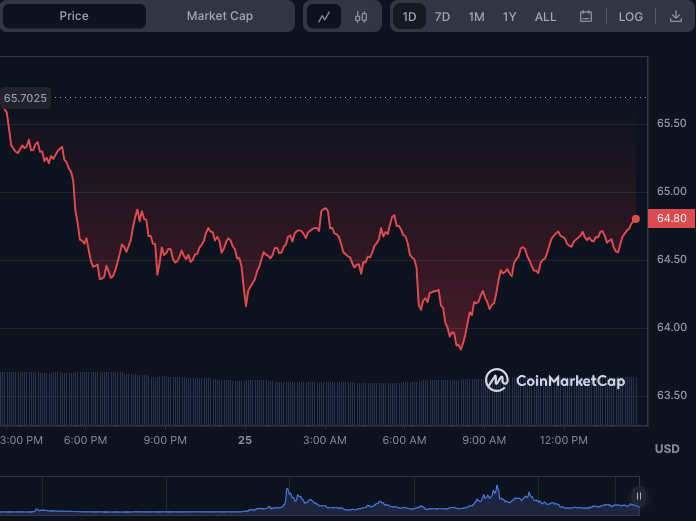

Regardless of Litecoin (LTC) halving on August 2, unfavorable sentiment has prevailed, prompting alarm amongst crypto fanatics in current weeks. As well as, bears have dominated within the final 24 hours, sending LTC costs down from a excessive of $65.74 to a low of $63.84 earlier than leveling out.

Litecoin (LTC) was buying and selling at $64.77 at press time, down 0.89% from its intra-day excessive. Consequently, Litecoin’s market cap dropped to $4,765,362,120, whereas its 24-hour buying and selling quantity fell to $252,653,192, a drop of 1.57% and 99.43%, respectively, demonstrating the dwindling confidence from buyers.

LTC/USD 24-hour worth chart (supply: CoinMarketCap)

Crypto analyst Benjamin Cowen has just lately sounded the alarm about Litecoin. In line with Cowen, the coin’s efficiency in opposition to Bitcoin (BTC) has been dismal. Particularly, Litecoin has depreciated by 95% in opposition to BTC since 2013.

Cowen means that Litecoin is a high-risk funding with very low reward, particularly given the financial backdrop of the Federal Reserve’s money-printing spree. Consequently, Cowen advises buyers to remain away, as his Monte Carlo simulations present a 0.0% allocation to Litecoin yields one of the best risk-adjusted returns.

LTC/USD Technical Evaluation

Nevertheless, some glimmers of hope emerge when inspecting the LTCUSD technical indicators. The Relative Energy Index (RSI) on Litecoin’s 2-hour worth chart is rising and at present sits at 49.12. Though this stage is beneath 50, indicating promoting stress, it means that bearish momentum might wane.

Moreover, the Transferring Common Convergence Divergence (MACD) has moved above its sign line with a studying of -0.209937. The histogram additionally reveals smaller inexperienced bars, indicating decreased promoting stress.

LTC/USD worth chart (supply: TradingView)

The Cash Circulate Index (MFI) factors upward at 48.39, suggesting that purchasing stress would possibly enhance. Therefore, these indicators would possibly sign a shift in market sentiment in the direction of bullishness.

Regardless of these constructive technical indicators, Cowen’s evaluation have to be addressed. He factors out that Litecoin’s rug pull cycles result in decrease highs, making it a hazardous alternative for long-term buyers. Moreover, LTC has struggled to interrupt previous its resistance, casting a shadow of doubt on its future efficiency.

In conclusion, whereas technical indicators might level in the direction of a possible reversal in bearish sentiment, the long-term outlook stays bleak. Buyers ought to weigh the risk-reward equation rigorously earlier than diving in, particularly when analysts have raised important issues.

Disclaimer: The views, opinions, and data shared on this worth prediction are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be responsible for direct or oblique injury or loss.