Monitoring and analyzing switch volumes is essential for understanding the underlying financial exercise inside the Bitcoin community. Spikes in switch volumes present heightened market participation, both from new entrants and institutional buyers — often throughout bull runs — or important transactions by current members — often throughout downturns.

Whereas spikes in switch volumes often come after main value actions and aren’t good predictive instruments for value motion, they’ll nonetheless be used to deduce the degrees of liquidity and potential future volatility out there.

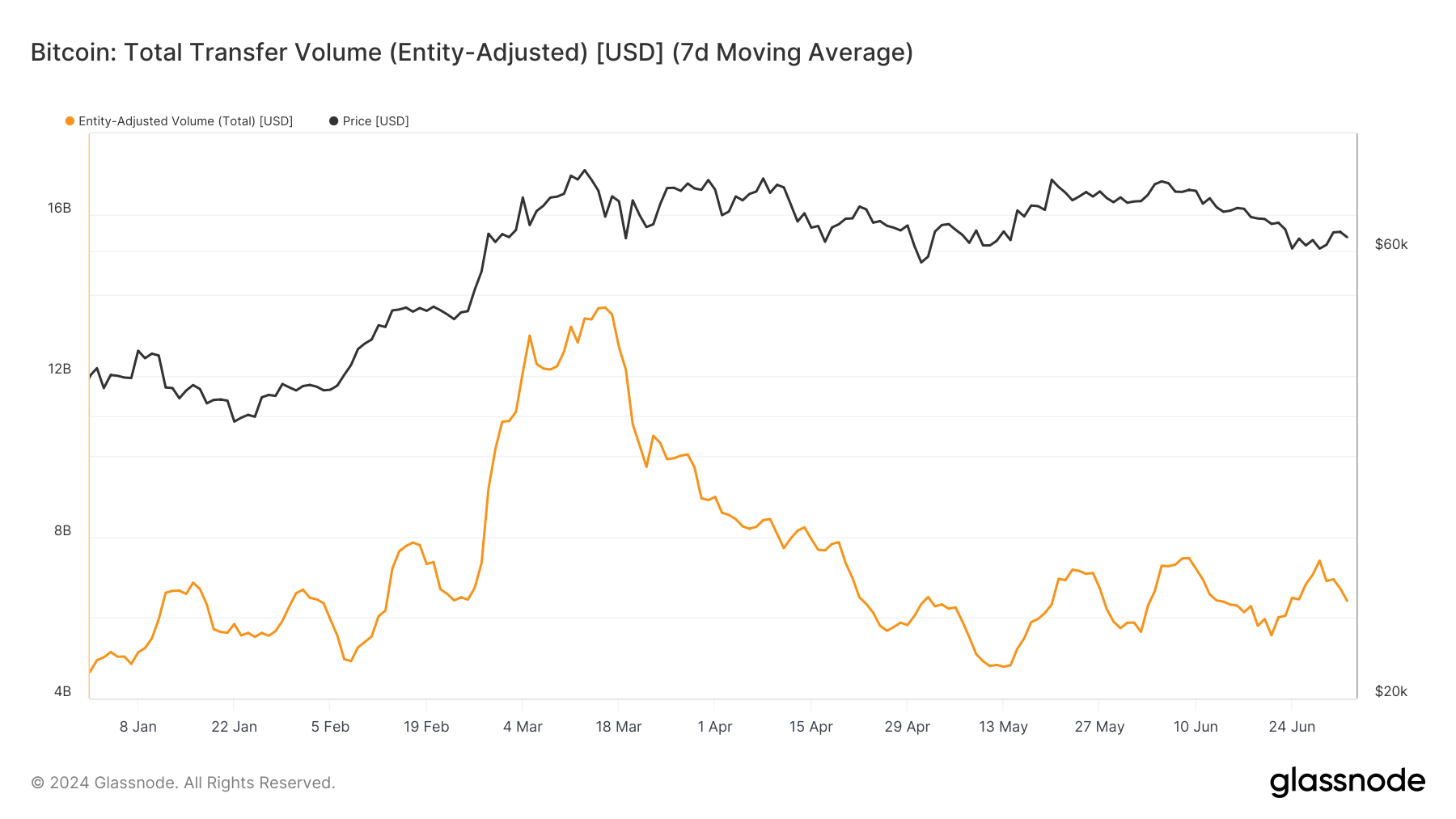

Glassnode’s entity-adjusted switch quantity reveals the precise financial exercise on the Bitcoin community by measuring the USD worth of cash moved between entities. This metric is especially helpful because it filters out inner transactions inside entities like exchanges, offering a clearer image of real market actions.

The overall switch quantity on the Bitcoin community reached its all-time excessive of $13.67 billion on March 15. The ATH was reached simply two days after Bitcoin established its personal excessive of $73,104 on March 13. This reveals {that a} important quantity of BTC was transferred between entities on the top of market euphoria.

Nonetheless, the market failed to achieve anyplace close to that top since mid-March, struggling to surpass $7.5 billion since April 20. The discount in quantity reveals a cooling off from the height market exercise, which comes as Bitcoin’s value consolidates and it struggles to interrupt away from its sideways buying and selling sample.

The comparatively secure switch quantity we’ve seen over the previous month or so reveals a market in a wait-and-see mode, the place neither sturdy bullish nor bearish currents dominate the quantity. Bitcoin has remained sure in a spread, fluctuating between $60,000 and $65,000, seeing upward actions solely on massive regulatory or broader market actions.

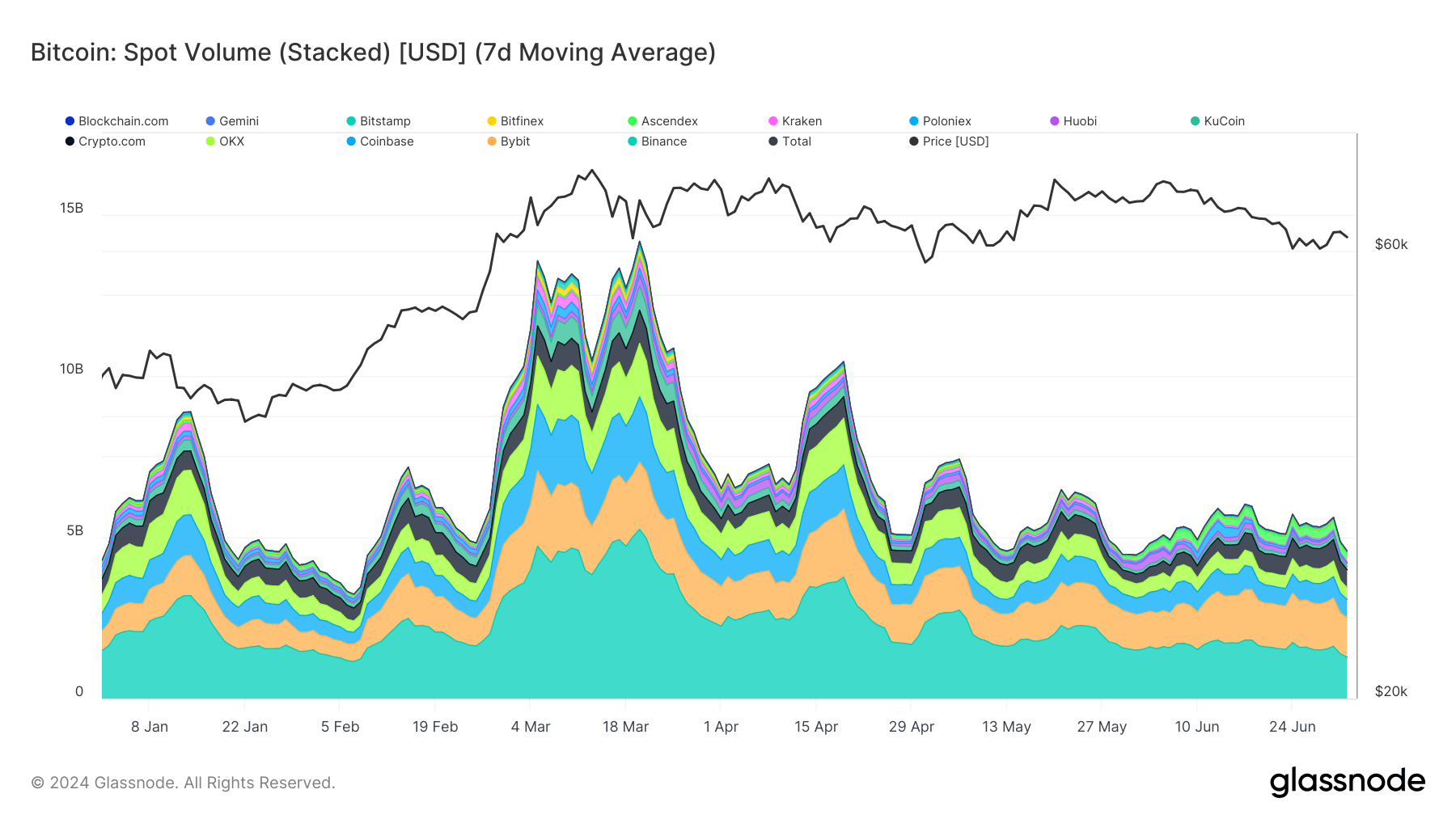

The stagnation in market exercise can be seen by Bitcoin’s spot buying and selling quantity. Whereas each are important, the whole switch and spot volumes present barely totally different insights into the market. Spot quantity represents the cumulative buying and selling quantity on exchanges, reflecting the buying and selling exercise in opposition to USD-backed currencies, together with each fiat and stablecoins.

Because of this spot quantity is extra indicative of the speedy buying and selling habits and market liquidity on centralized exchanges fairly than the broader market. Whereas switch volumes give a way of the general motion of worth throughout the community, spot volumes present buying and selling patterns and investor sentiment within the shorter time period.

Traditionally, spot volumes are inclined to peak barely later than switch volumes, as evidenced by the info exhibiting a dip in spot quantity to $10.465 on March 13 regardless of Bitcoin hitting its ATH. The yearly excessive for spot quantity was reached on March 20 at $14.156 billion, demonstrating the lag between value and buying and selling quantity peaks.

In contrast to switch volumes, spot volumes are inclined to peak in response to sharp value drops, not simply upward motion, as merchants react to mitigate losses. During times of value stability, spot volumes have a tendency to say no. This phenomenon has been significantly evident over the previous two months, the place spot volumes have remained beneath $6 billion, mirroring the shortage of considerable exercise in switch volumes.

The info reveals a definite pattern: market members turn out to be much less lively as Bitcoin’s value stabilizes inside a sure vary. This sample has turn out to be extra obvious previously few weeks, the place Bitcoin has traded between $60,000 and $65,000, resulting in diminished buying and selling volumes. Regardless of secure costs, the drop in spot volumes by over $1 billion because the starting of July reveals the market continues to be reluctant to interact closely with out clear directional actions.

The market is at the moment in consolidation, the place members are ready for brand new basic drivers or exterior components to make their subsequent transfer. Earlier crypto-news evaluation recognized related developments by different metrics — all pointing to a tense market that refuses to maneuver with out important outdoors components.

If Bitcoin stays inside its present vary, we are able to anticipate low buying and selling volumes. Nonetheless, any regulatory, political, or macroeconomic developments might flip right into a spark that ignites the market and breaks this sample.

The submit Market in wait-and-see mode as Bitcoin volumes stagnate appeared first on crypto-news.