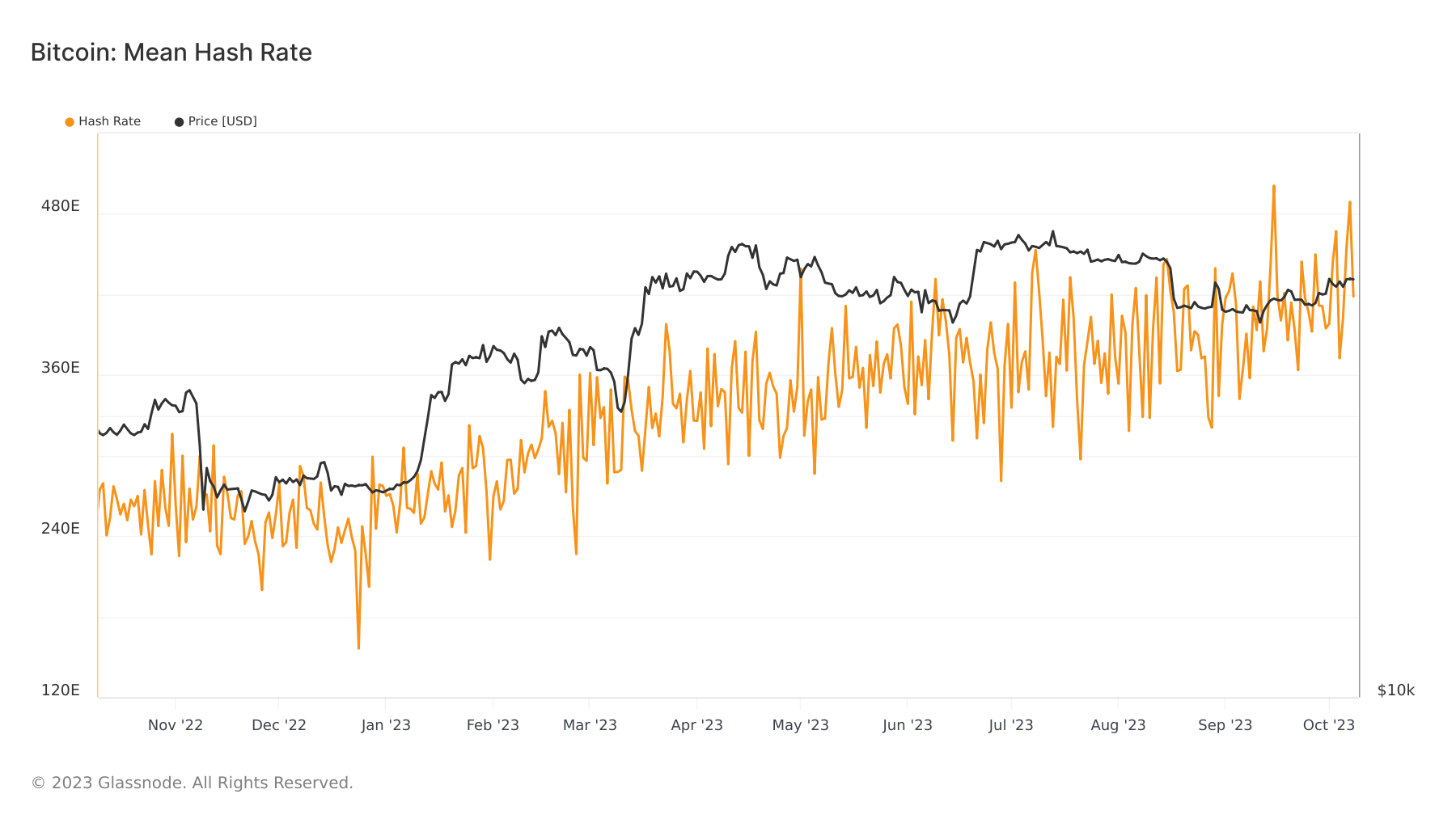

Bitcoin’s hash price represents the whole computational energy employed to mine and validate transactions on the community. Past merely representing the sheer computing prowess, the hash price serves as a barometer for the community’s safety and vitality.

A strong hash price signifies not solely a excessive participation of miners but in addition underscores the community’s resilience in opposition to potential assaults. Monitoring this metric is essential, as fluctuations can supply insights into miner sentiment, potential community vulnerabilities, and the general well being and decentralization of the Bitcoin ecosystem. In essence, the hash price is a multifaceted indicator, reflecting each the technical energy and the collective confidence within the Bitcoin community.

Bitcoin’s hash price has been posting new all-time highs each week since December 2022, peaking at 501 EH/s on Sep. 15. As of Oct. 8, the hash price stands at 418 EH/s.

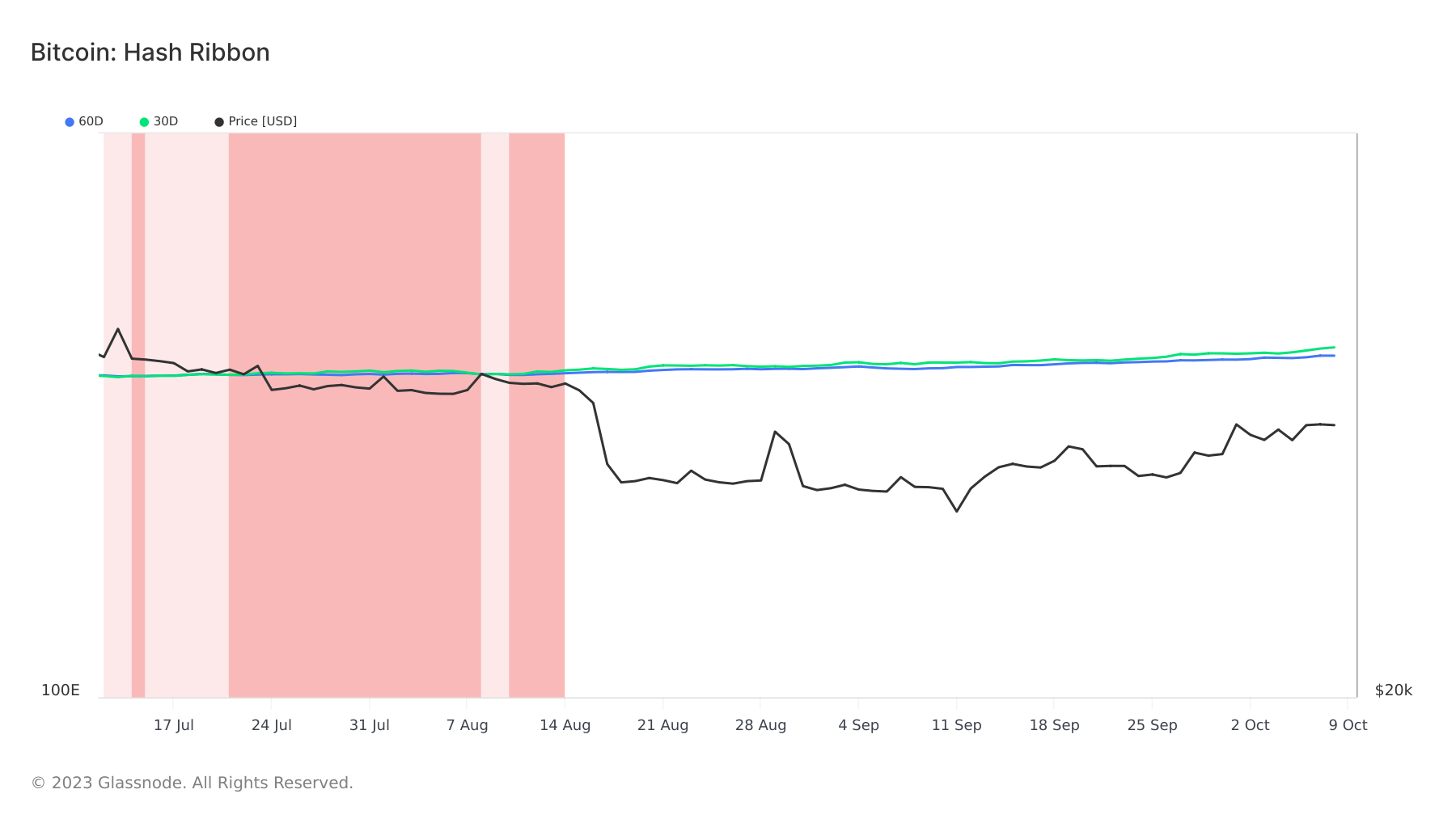

Nevertheless, merely trying on the hash price fails to offer extra context to market sentiment. To get a greater understanding of miner well being, we should analyze the convergence and divergence of the transferring averages of the hash price. Monitoring this metric is essential, as fluctuations can supply insights into miner sentiment, potential community vulnerabilities, and the general well being and decentralization of the Bitcoin ecosystem. Hash ribbons are a multifaceted indicator, reflecting each the technical energy and the collective confidence within the Bitcoin community.

Since mid-August, the 30-day MA of Bitcoin’s hash price has persistently outpaced the 60-day MA. Notably, the ribbons underwent compression in July and August, a phenomenon traditionally indicative of miner capitulation. Nevertheless, the divergence between these two transferring averages has been widening for the reason that begin of October 2023, coinciding with Bitcoin’s ascent to $28,000. This divergence means that miners are bullish, ramping up their operations in anticipation of upper costs.

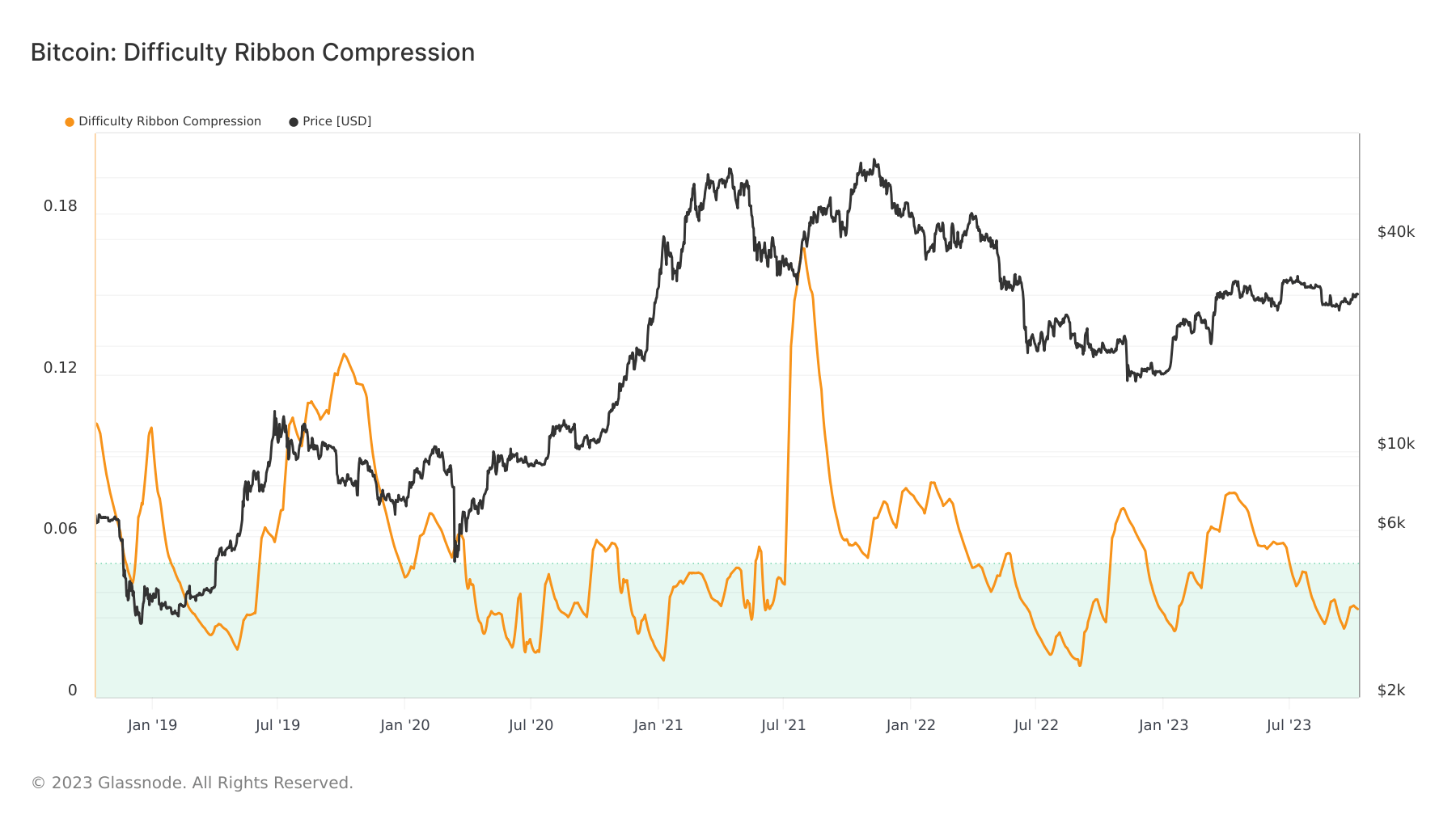

Mining issue, one other cornerstone metric, adjusts roughly each two weeks to make sure that blocks are added to the blockchain at a constant interval. The Problem Ribbon Compression metric supplies insights into miner promoting strain. Traditionally, excessive compression zones, marked by low values on this metric, have signaled profitable shopping for alternatives for Bitcoin. Conversely, spikes on this metric have usually been in tandem with Bitcoin’s value surges. As of June 30, the issue ribbon compression was beneath the 0.05 threshold, and as of October 8, it stood at 0.032, suggesting potential upward value momentum.

The rising hash price underscores a strong and safe community, whereas the hash ribbons and issue ribbon compression trace at bullish miner sentiment and potential value appreciation.

The submit Mining metrics recommend bullish sentiment for Bitcoin appeared first on crypto-news.