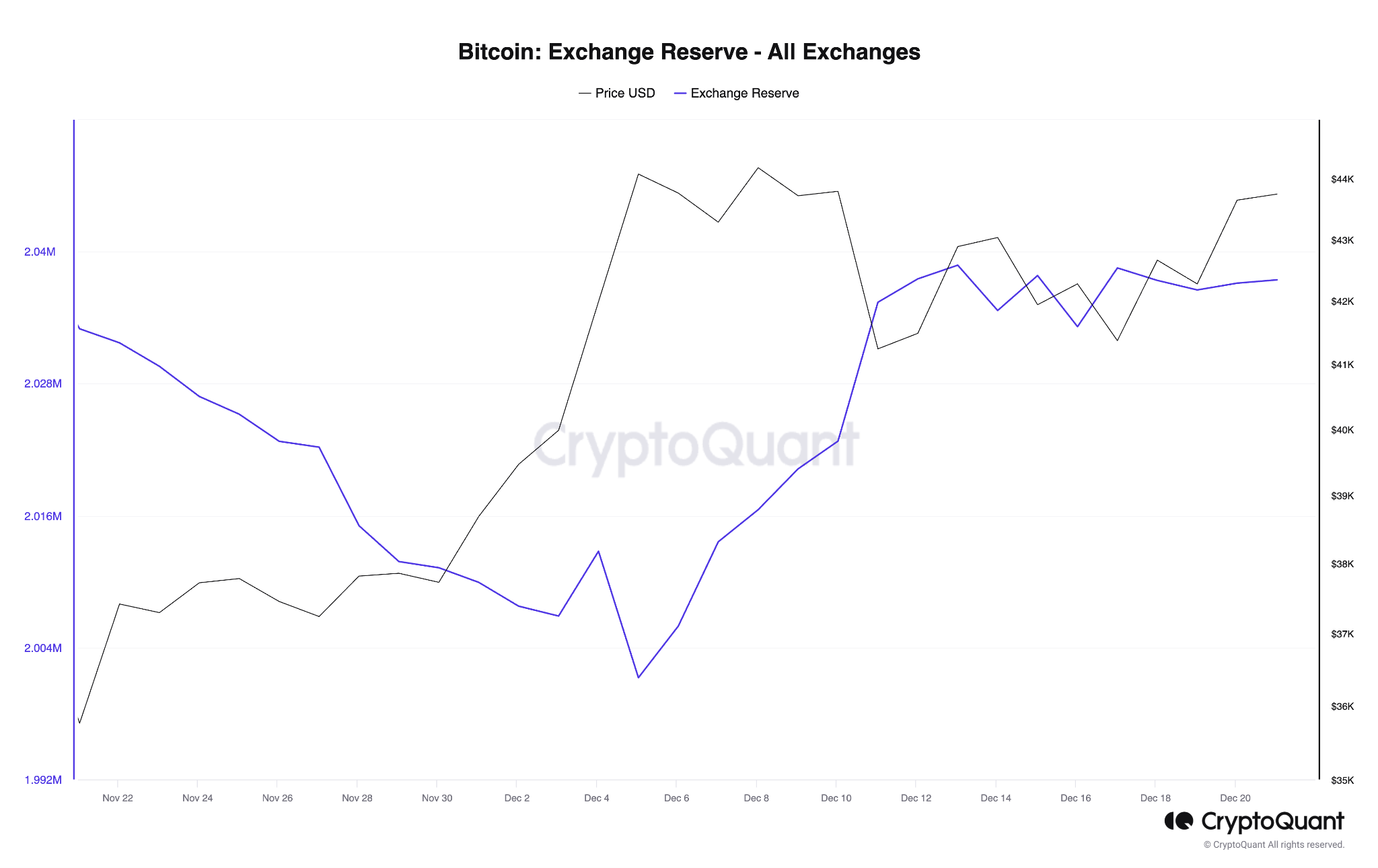

- There was a slight rally in BTC’s trade reserve previously two weeks.

- BTC’s previous efficiency exhibits that each time this occurs, a worth fall is imminent.

- A key on-chain metric exhibits that the BTC market sentiment has modified from capitulation to perception.

In accordance with crypto analyst Ali Martinez, Bitcoin (BTC) would possibly expertise a big decline in worth following the current surge in bullish sentiment.

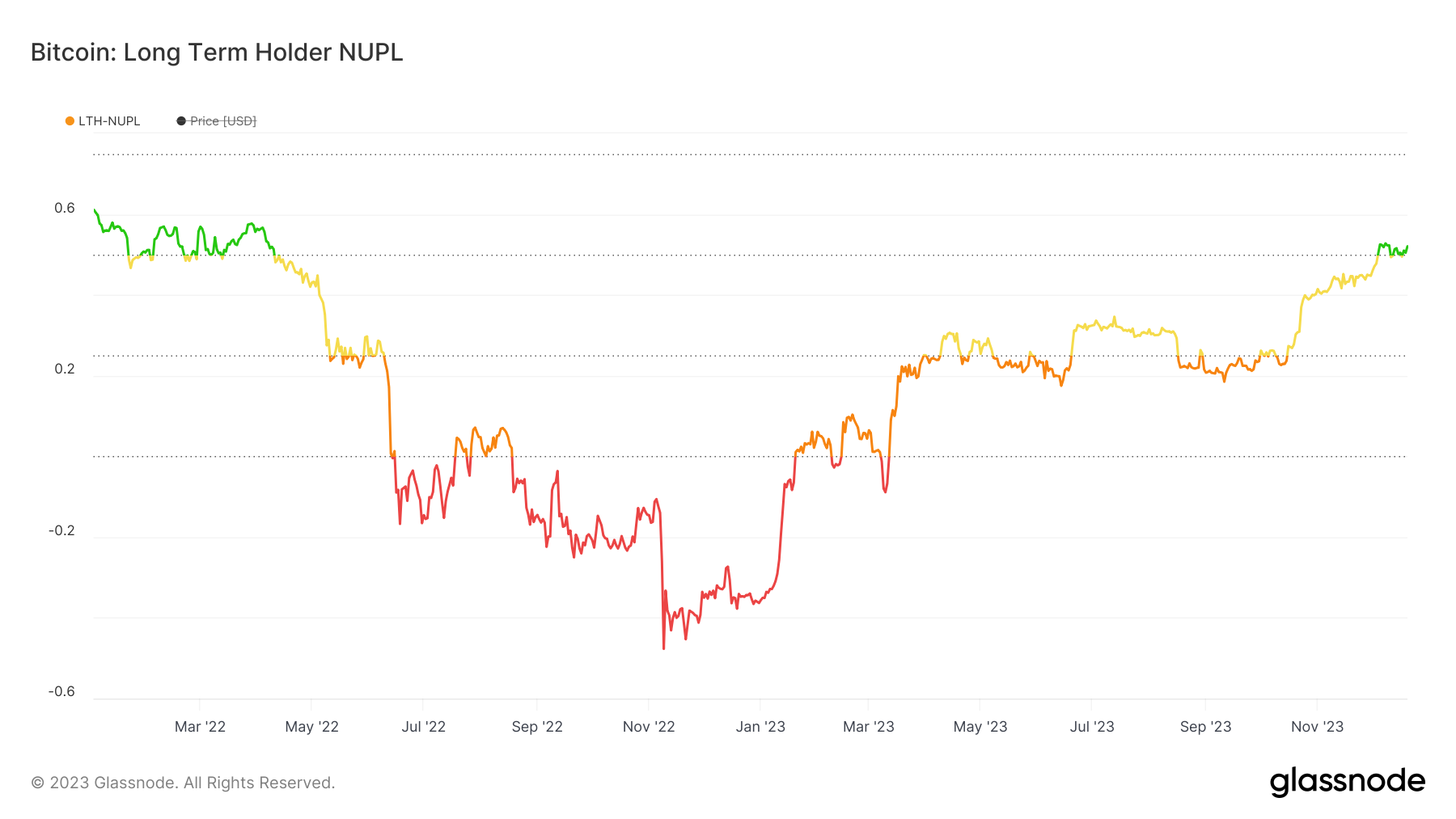

Martinez assessed the historic efficiency of BTC’s Lengthy Time period Holder Web Unrealized Revenue/Loss (LTH-NUPL) and the way the metric motion impacts the coin’s worth.

The NUPL metric assesses the profitability of coin holders. It measures the distinction between the present market worth of all cash in existence and the worth at which they had been final moved on the blockchain.

For LTH-NUPL, it exhibits the common revenue/loss for all long-term BTC holders. It additionally gauges the general confidence and conviction of long-term traders.

Investor sentiments out there can range, shifting from capitulation (evident when the LTH-NUPL experiences a decline) to perception (famous when the metric begins an uptrend) and reaching euphoria (observable when the LTH-NUPL returns very excessive values).

In accordance with Martinez, each earlier shift in market sentiment from capitulation to perception has been adopted by a retracement in BTC’s worth. As of this writing, BTC’s LTH-NUPL was 0.5, displaying that market sentiment has shifted to perception, in line with knowledge from Glassnode.

Bitcoin Lengthy-Time period Holder NUPL: (Supply: Glassnode)

Retracement incoming?

At press time, BTC exchanged fingers at $43,640. Bitcoin’s worth has confronted resistance on the $43,600 worth mark within the final month. There’s a chance that BTC’s worth would possibly witness a minor retraction as a result of resurgence in profit-taking exercise. This thesis is supported by an uptick in a current improve within the quantity of BTC being moved to exchanges. In accordance with knowledge from CryptoQuant this the quantity of BTC held on exchanges has elevated by 2% since December 5.

Bitcoin Alternate Reserve (Supply: CryptoQuant)

When there’s a rise in a coin’s trade reserve, it signifies that there’s greater promoting stress, which places downward stress on worth. At press time, 2.03 million BTC had been held throughout exchanges.

Additional, the coin’s Shifting Common Convergence Divergence (MACD) indicator noticed on a every day chart revealed a downward intersection of the coin’s MACD line with its pattern line of December 12.

BTC/USD 24-Hour Chart (Supply: TradingView)

When the MACD line crosses under the pattern line, it’s seen as a bearish sign, as many view it as time to distribute their holdings.

For the reason that crossover occurred, there was a notable decline in BTC’s key momentum indicators. This confirmed that coin holders have since lowered BTC accumulation.

At press time, the coin’s Relative Energy Index (RSI) was 62.28, whereas its Cash Circulation Index (MFI) was 55.21.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.