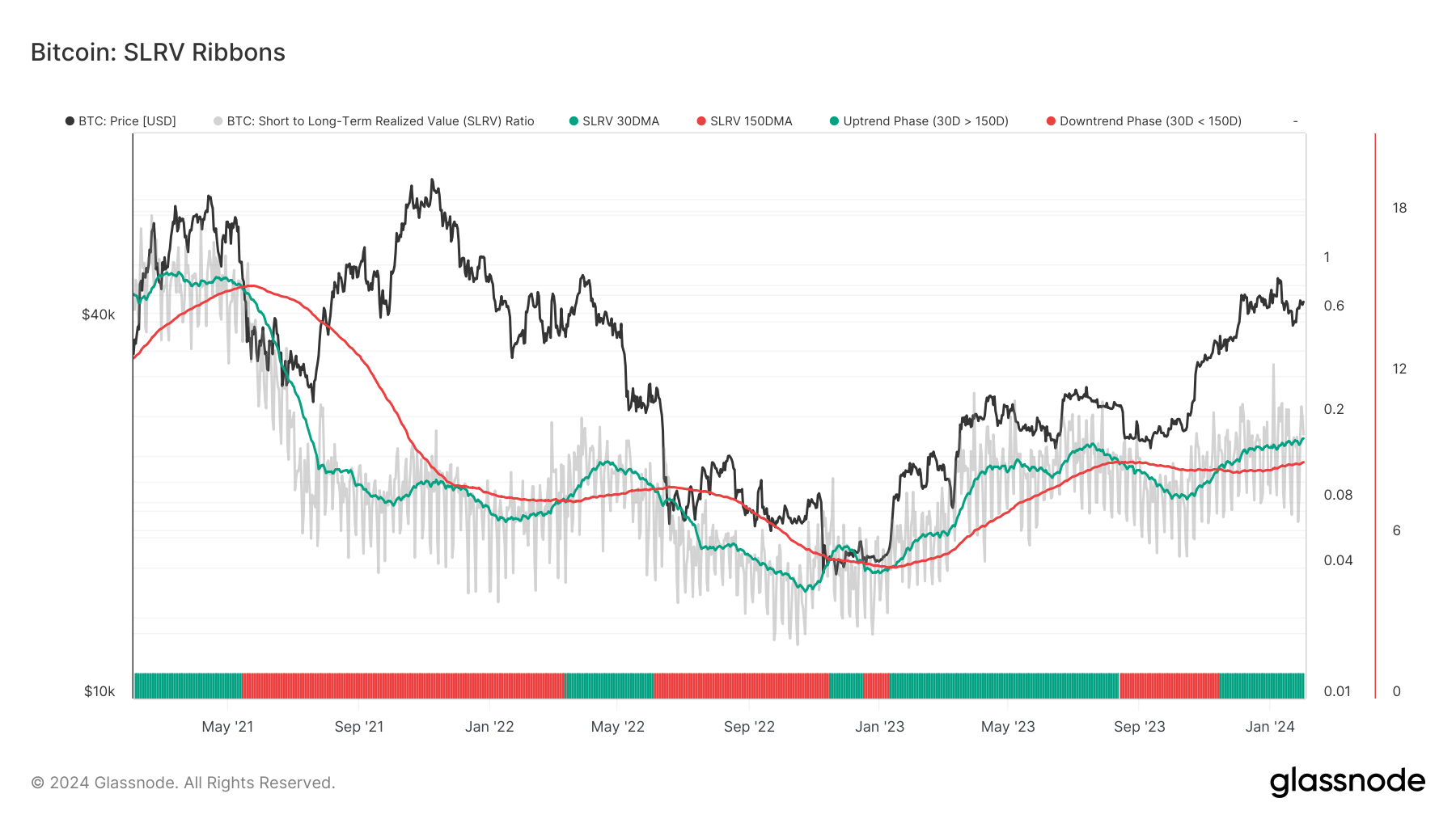

The short-to-long-term realized worth (SLRV) ratio is an often-overlooked metric that gives nuanced insights into investor sentiment. The ratio compares the proportion of Bitcoin that was final moved inside a brief timeframe (24 hours) in opposition to the proportion moved in an extended timeframe (6-12 months) to point out whether or not the market leans extra in direction of hodling or buying and selling.

Nonetheless, the SLRV ratio alone normally isn’t sufficient to determine broader developments, as there are important each day variations within the metric. Making use of and analyzing the ratio by means of shifting averages, particularly the 30-day easy shifting common (SMA) and the 150-day SMA, permits us to get a transparent image of sustained market developments.

On Feb. 1, the SLRV 30D SMA reached its highest stage since July 2021 as Bitcoin’s value crossed $43,000. This peak represents a continuation of a constructive uptrend that started on Nov. 14, 2023, when the SLRV 30D SMA crossed above the 150D SMA.

The SLRV 30D SMA reaching ranges not seen in two and a half years exhibits a big improve in short-term transactional exercise relative to long-term holding. This may very well be attributed to a myriad of various components, but it surely’s normally a results of value volatility. The rise in short-term transactional quantity usually correlates with heightened market hypothesis as traders and merchants rush to capitalize on value actions. It could point out a market pushed by bullish sentiment or elevated speculative curiosity spurred by latest market developments.

The introduction and adoption of spot Bitcoin ETFs within the U.S. more than likely performed a big position. The highly-anticipated buying and selling product has pushed Bitcoin into the mainstream, bringing establishments and superior traders from tradfi into the market. Other than having a psychological impact in the marketplace and boosting investor confidence in BTC, these ETFs additionally present liquidity to Bitcoin. This elevated liquidity may cause larger buying and selling volumes, as traders can enter and exit their positions in Bitcoin by means of the ETFs extra shortly, inflicting spikes within the SLRV 30D SMA because of this.

It’s not simply the rise within the SLRV 30D SMA that exhibits a change in market sentiment. Its sustained place above the 150D SMA since mid-November exhibits that short-term transactional exercise not solely spiked however maintained a better stage over an prolonged interval.

The sturdiness of this development, which is on its technique to enter its third consecutive month, exhibits that market exercise isn’t a short-lived speculative burst however a extra entrenched habits sample amongst traders.

Traditionally, short-term SMAs crossing above long-term SMAs have been used as a technical indicator for constructive momentum and potential bullish developments in varied property, together with Bitcoin. The prolonged interval the place the SLRV 30D SMA stays above the 150D SMA might present a broader market transition from risk-off to risk-on allocations, the place traders are extra prepared to interact in speculative investments or allocate a bigger portion of their portfolio to Bitcoin.

The submit Quick-term buying and selling quantity peaks as Bitcoin crosses $43,000 appeared first on crypto-news.