With Bitcoin down some 20% from its year-to-date excessive, it’s typically useful to zoom out and have a look at the broader image. I’ve a saved chart of all of the tokens listed within the Coinbase and Binance lawsuits filed (C&B fits) on June 6 and June 5, 2023, respectively, and their costs as denominated in Bitcoin.

For context, each Binance and Coinbase are at the moment defending their positions in U.S. courts. The central situation in each lawsuits is whether or not the crypto belongings supplied by these exchanges ought to be labeled as securities and, subsequently, fall below SEC regulation.

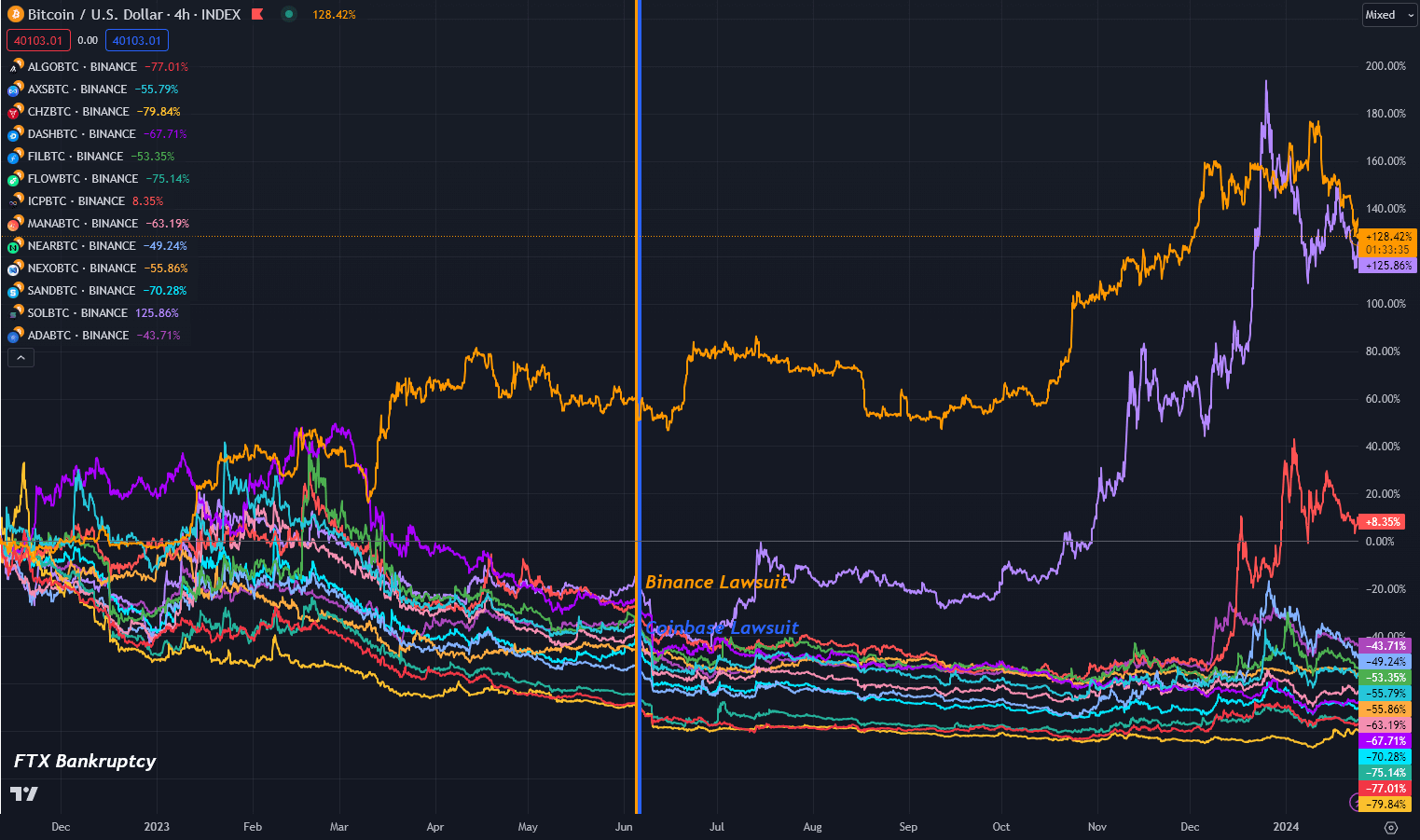

The tokens described as potential securities within the abovementioned lawsuits included Alogrand, Solana, Cardano, Close to, Filecoin, and others, as proven within the chart beneath. Let’s look at how these belongings have carried out in comparison with Bitcoin over the previous 8 months after which have a look at a number of the standout tokens’ efficiency in greenback phrases.

For context, we’ll first have a look at the efficiency of this cohort of digital belongings because the black swan occasion that preceded the C&B fits, particularly the chapter submitting and subsequent collapse of FTX. The change filed for Chapter 11 chapter on Nov. 11, 2023, when Bitcoin was priced round $16,900. Since then, it has soared by roughly 140% towards the greenback, with solely two belongings outperforming it.

Solana and ICP noticed will increase of their worth in BTC phrases, growing 116% and 9% respectively. All different tokens listed as potential securities declined towards Bitcoin between -41% and -80%

The most effective was Cardano, which misplaced 41% of its worth towards Bitcoin; the worst was Chilliz, which declined -80%. In greenback phrases, Cardano is up 50%, whereas Chilliz is down -53%, showcasing the power of Bitcoin over the previous 15 months.

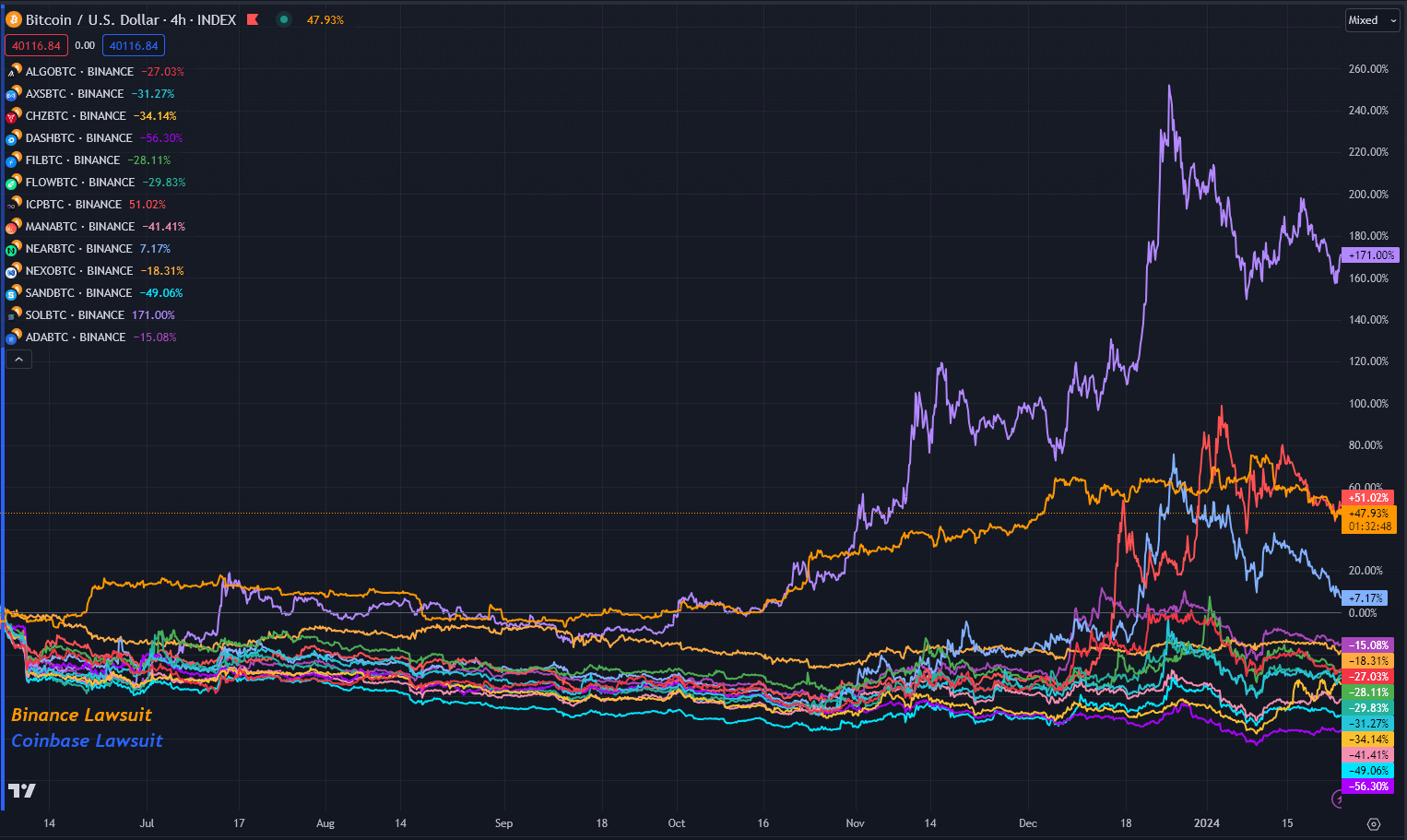

Efficiency since Coinbase and Binance SEC lawsuits.

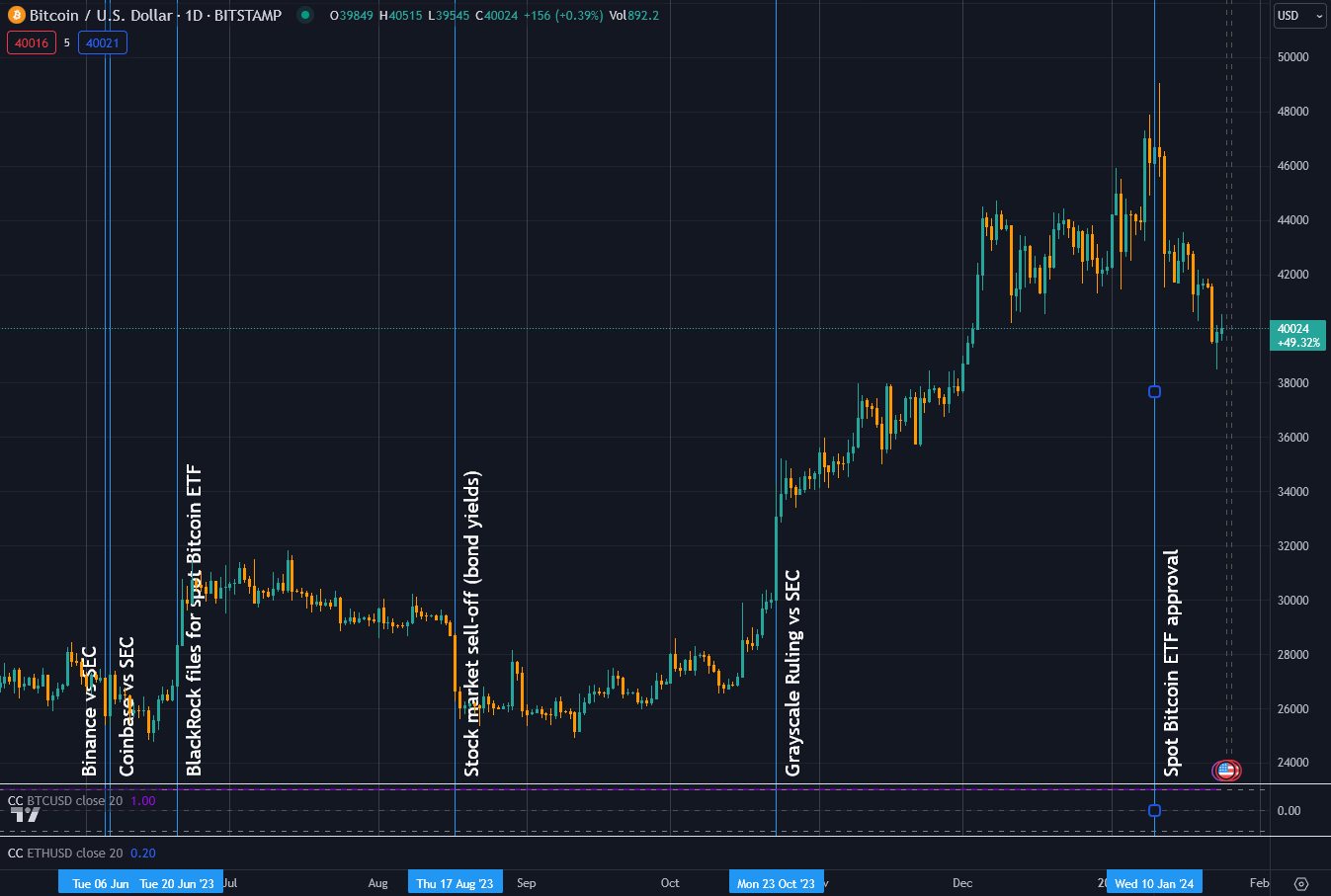

When Binance and Coinbase had been hit with SEC lawsuits inside a day of one another final June, the market reeled from the influence of the 2 most outstanding names in crypto exchanges being so immediately focused. On June 5, when Binance was served, Bitcoin fell to $25,300 from round $26,800. Nonetheless, on the day Coinbase was served, it regained its worth earlier than slowly bleeding out to round $25,00 mid-way by the cash.

On June 20, 2023, BlackRock filed its utility for a spot in Bitcoin ETF, which noticed Bitcoin’s worth elevate to over $30,000 till a inventory market sell-off in August reversed the features. From there, it traded sideways till Grayscale’s victory in court docket towards the SEC, when the worth took off towards its eventual 2-year excessive of $49,000 on the day the spot Bitcoin ETFs launched. At this peak, Bitcoin was up 90% because the C&B fits.

As of press time, having retraced considerably, Bitcoin is up 47% because the C&B fits, with three belongings having carried out higher. Solana and ICP outdid Bitcoin, this time by 169% and 49%, respectively. Nonetheless, Close to Protocol can also be up 8% on Bitcoin.

All different tokens threatened with categorization as a Safety fell towards Bitcoin inside the timeframe, the worst now Sprint declining -56%, with the least affected being Cardano, down -15%.

Notably, towards the greenback, Solana, ICP, and Close to are up 286%, 265%, and 145%, respectively, over the identical timeframe. Furthermore, even the largest loser towards Bitcoin, Sprint, is up 4%, and Cardano is up 87% towards the greenback.

While you worth all the things in {dollars} in crypto, you’ll be able to miss that your belongings have declined in Bitcoin phrases.

Binance and Coinbase defend their positions in court docket.

Though many of the business has been targeted on ETFs this yr, Binance’s case was heard on Jan. 22 in a Washington courtroom, with Decide Amy Berman Jackson of the District of Columbia presiding, and Coinbase appeared in a New York court docket on Jan. 17, with Decide Katherine Polk Failla overseeing the proceedings.

The SEC’s argument towards Binance targeted on Binance’s BUSD stablecoin and BNB token, suggesting that not less than the BNB token may need initially been bought as an funding contract. Binance’s protection challenged the applicability of the Howey take a look at to cryptocurrencies and disputed the SEC’s comparisons to different court docket instances, akin to Zakinov v. Ripple Labs.

Coinbase additionally contested the relevance of the Howey take a look at for cryptocurrencies. The SEC’s broad method raised considerations about extending the definition of securities to embody classes sometimes outdoors its purview, akin to collectibles. Decide Failla acknowledged the complexity of the difficulty and deferred her resolution.

Elliott Stein, a senior litigation analyst at Bloomberg, assessed a 70% chance of the SEC’s June 2023 lawsuit towards Coinbase being dismissed. Nonetheless, a victory for the SEC in both case may have important implications for the cryptocurrency business. It may mandate crypto exchanges to deal with digital tokens as securities, essentially altering how these belongings are dealt with and controlled within the U.S.

The outcomes of those instances will set precedents for the long run regulation of digital belongings within the nation and can seemingly have a tangible influence on the tokens named within the C&B fits.