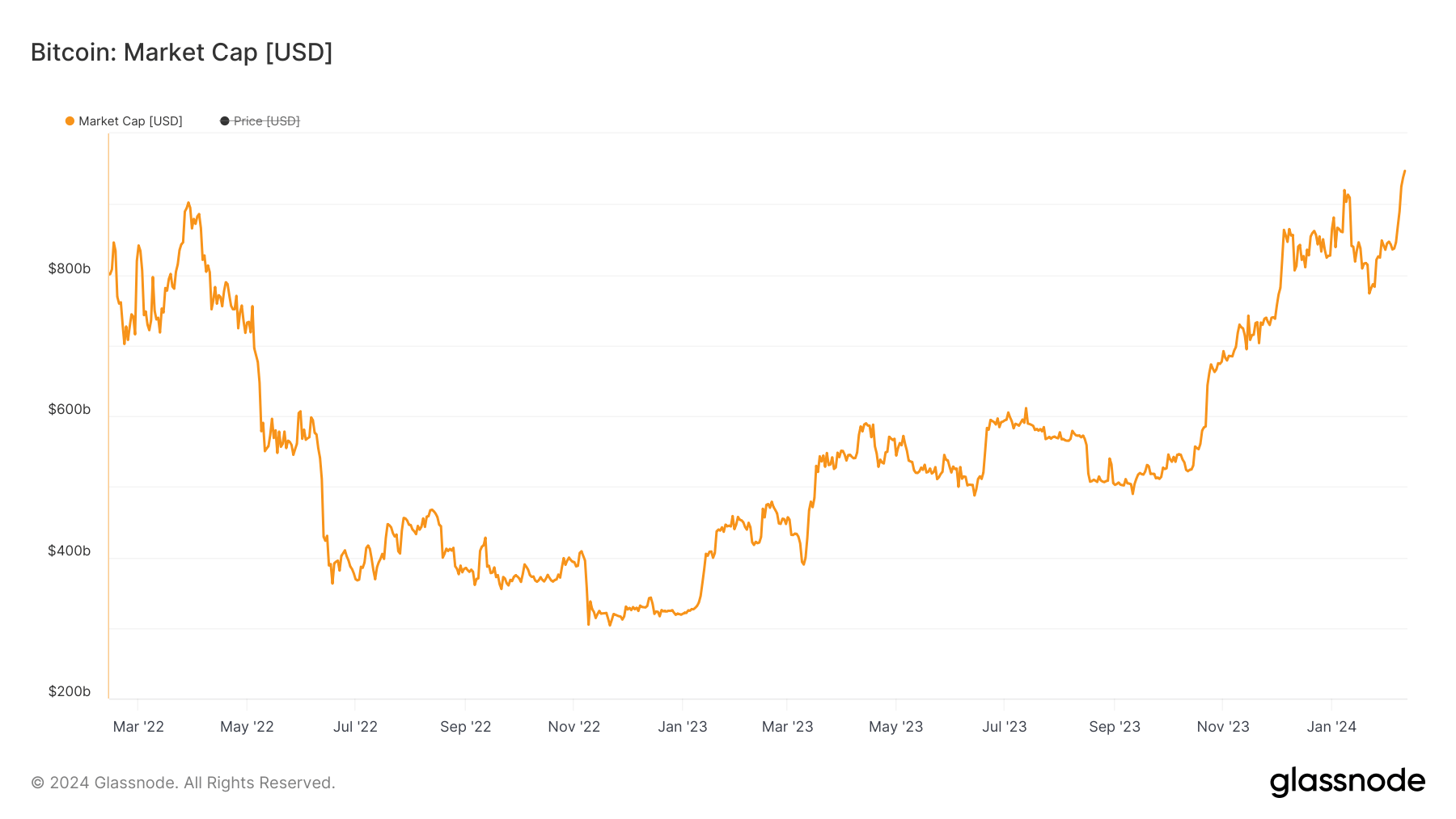

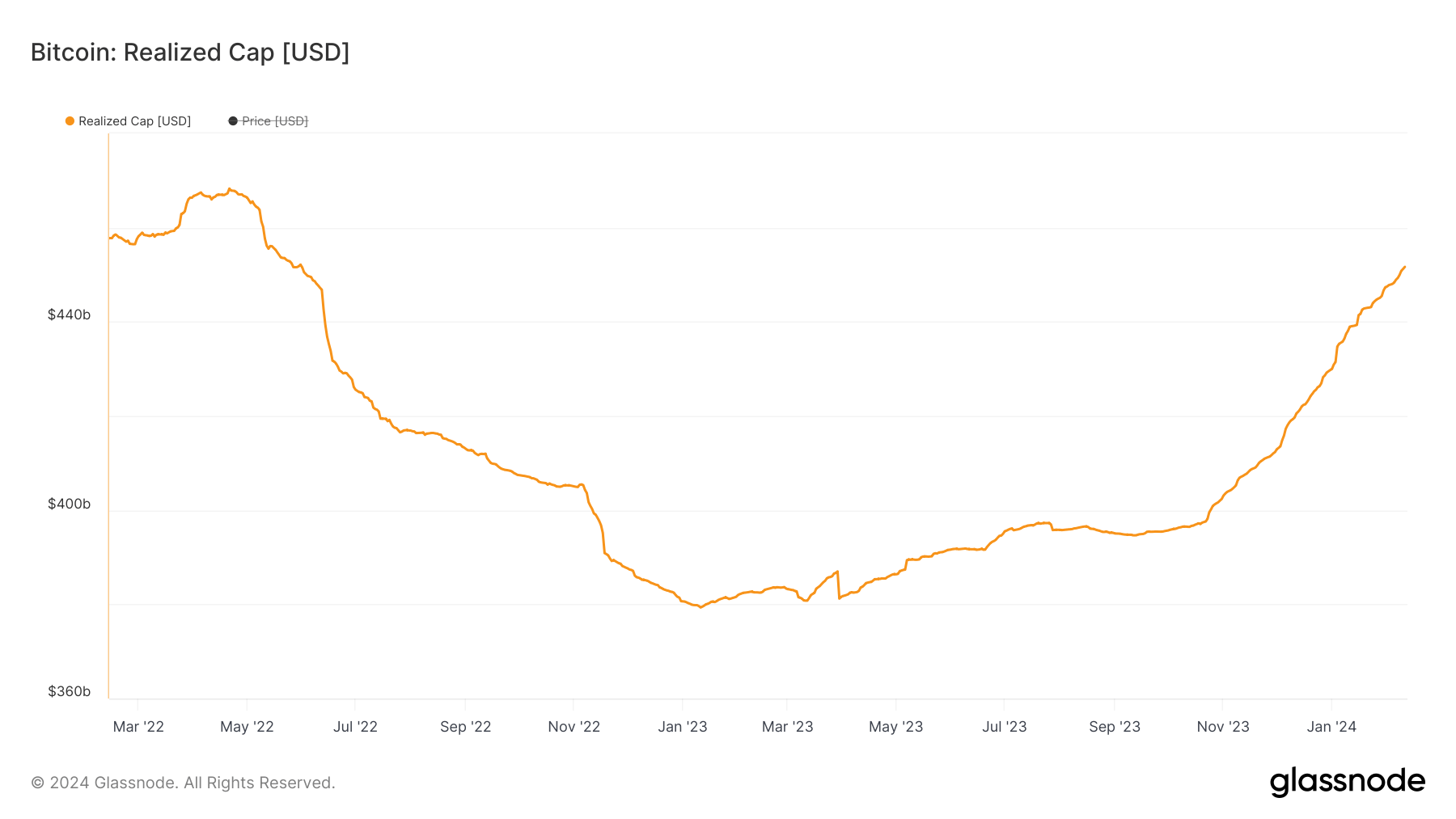

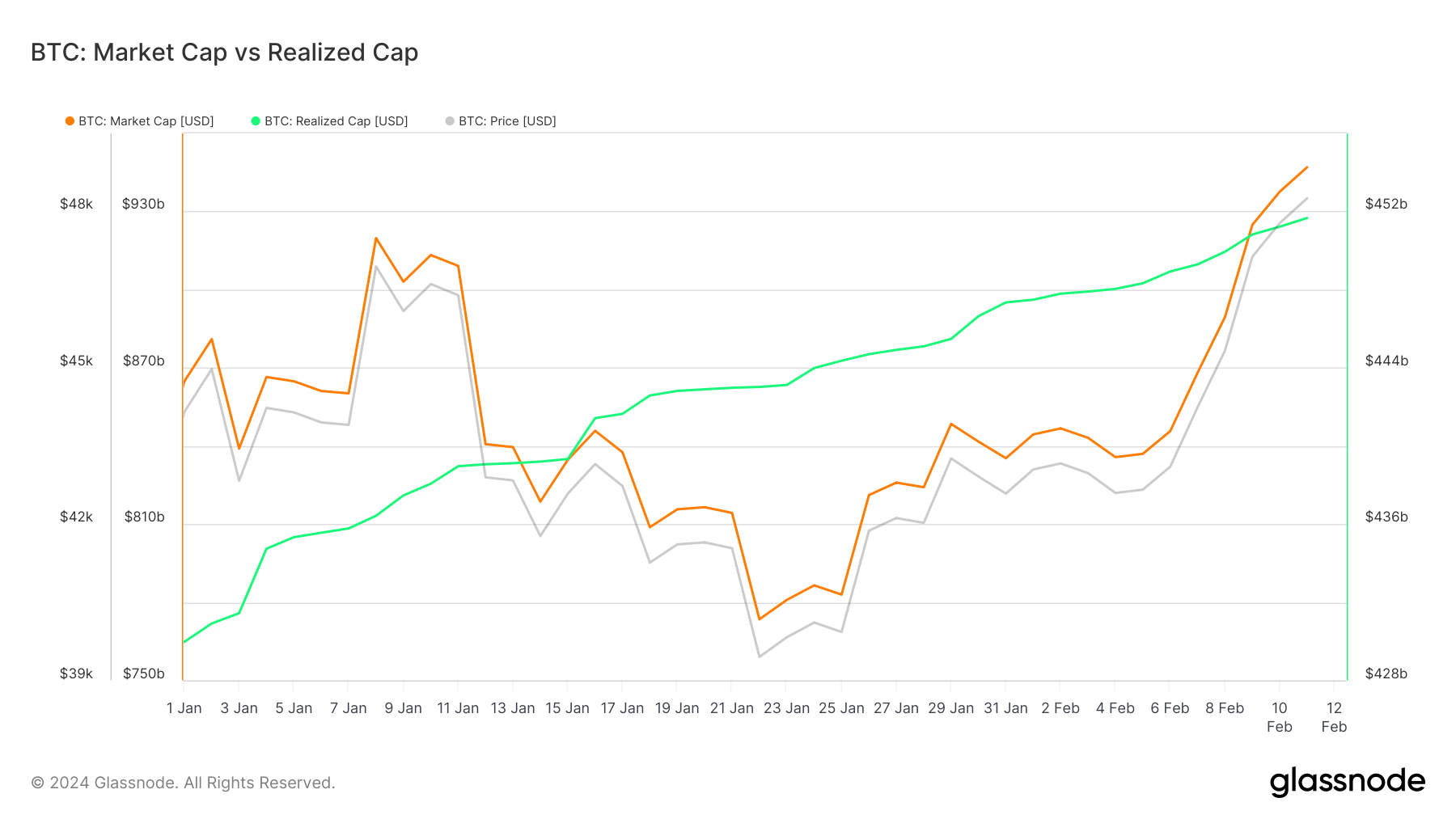

Bitcoin’s value noticed a major enhance in February, leaping from $43,049 at the start of the month to $49,900 on Feb. 12, as of press time. Crossing $49,000 marks a major milestone for BTC, because it signifies the potential to breach the $50,000 resistance and transfer nearer to its all-time excessive. Alongside its value surge, Bitcoin’s market capitalization elevated dramatically by over $102.5 billion in February. Throughout the identical timeframe, Bitcoin’s realized cap noticed a extra modest enhance, rising simply over $4 billion, from $447.48 billion to $451.66 billion.

Understanding the variations and will increase in these two metrics is essential for market evaluation. Whereas each may appear too broad to supply perception into refined market actions, their distinction, and long-term developments are sometimes among the many finest market well being indicators. That is very true for realized cap, an typically ignored metric that gives worthwhile details about the mixture value foundation for all the market.

Market capitalization is calculated by multiplying Bitcoin’s present market value by the full variety of cash in circulation. It’s a really crude metric however a extensively used one, because it’s the easiest way to current the dimensions of a selected asset or market. Market cap is extremely responsive to cost fluctuations and sometimes experiences vital shifts inside quick intervals, mirroring the fast market sentiment and speculative actions. An uptick in Bitcoin’s market value can shortly and aggressively increase the market cap, displaying the present valuation of all Bitcoins at BTC’s newest market value.

Realized cap, however, gives a extra nuanced perspective of Bitcoin’s worth. In contrast to market cap, which solely considers Bitcoin’s newest market value, realized cap considers the historical past of every coin to grasp its contribution to the full worth of the Bitcoin community. This technique seems on the value at which every Bitcoin was really moved. By specializing in these transaction costs, realized cap provides a snapshot of the market that considers the precise costs folks paid for his or her BTC quite than the present market value, which could be influenced by short-term buying and selling.

When Bitcoins are traded at costs increased than the worth at which they had been final moved, the realized cap will increase. It is because the newer, increased transaction costs at the moment are thought of, elevating the general “value foundation” or the mixture quantity spent on buying Bitcoins. If, however, Bitcoin is simply being moved at costs decrease than their final transaction value, the realized cap decreases.

This “mixture value foundation” is an important idea because it gives perception into the precise funding poured into Bitcoin. It provides a extra steady and fewer unstable metric than the market cap, which may swing wildly with value adjustments. The realized cap, subsequently, could be seen as a extra grounded measure of Bitcoin’s financial footprint, reflecting the steadfast dedication of traders to the community over time.

The distinction seen in February — the place the market cap noticed a considerable rise whereas the realized cap noticed a extra modest enhance — reveals a interval of great value appreciation. This divergence is attributable to the market cap’s direct reflection of present value actions, versus the realized cap.

The surge in market cap signifies the overarching market sentiment and liquidity. A bullish sentiment can catalyze extra shopping for, propelling each the worth and market cap upwards. Nonetheless, the realized cap won’t promptly mirror this enthusiasm if this shopping for exercise is concentrated inside the younger provide quite than involving long-held cash.

The rise in realized cap suggests {that a} vital quantity of Bitcoin has modified palms at costs increased than the historic common at which they had been beforehand acquired. The continual enhance in realized cap since September 2023 reveals that the market is steadily absorbing promoting strain, with each new and current traders displaying readiness to purchase at or above present costs.

This basis can function a launchpad for future value will increase, because it displays a strong underlying investor confidence and a valuation foundation that’s much less more likely to be eroded by short-term market volatility.

The submit Why did Bitcoin’s market cap surge by over $102 billion whereas realized cap solely grew by $4 billion? appeared first on crypto-news.