The M1 cash provide, a key financial indicator, represents the full quantity of bodily foreign money in circulation, together with cash, notes, traveler’s checks, and demand deposits.

Basically, it measures an economic system’s liquidity and the general public’s spending energy.

Within the context of the cryptocurrency market, evaluating Bitcoin’s spot worth to the M1 cash provide offers an fascinating perception into the digital asset’s relative value and potential for future development.

This comparability can function a device for traders and economists to evaluate the dimensions of Bitcoin in relation to conventional cash provide and its potential implications on international financial constructions.

Furthermore, monitoring adjustments in Bitcoin’s worth in opposition to the M1 cash provide can probably spotlight shifts in public sentiment in the direction of conventional fiat currencies and digital property, providing a singular perspective on the evolving monetary panorama.

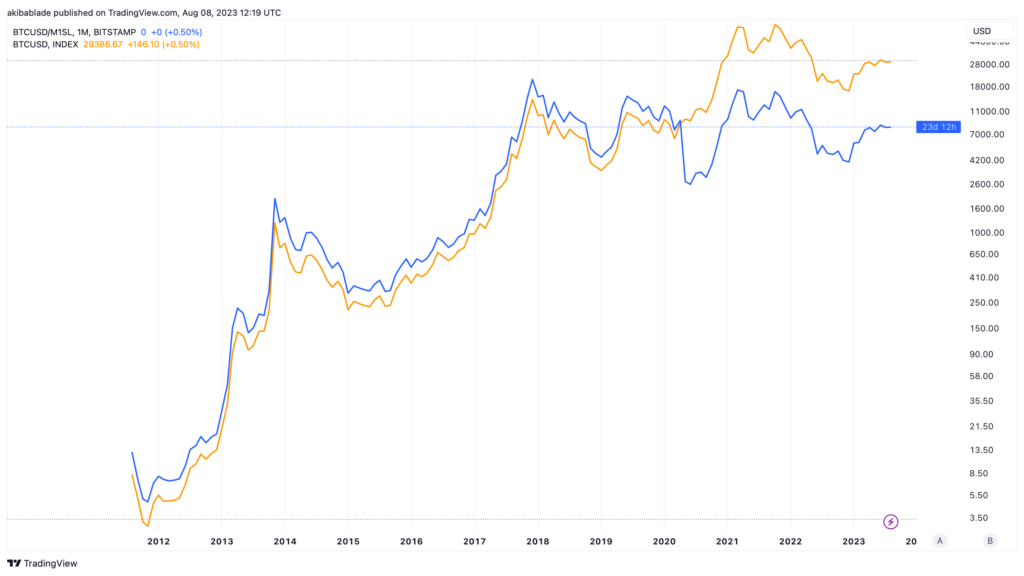

Within the chart beneath, the ratio of Bitcoin’s spot worth to the M1 cash provide (BTCUSD/M1SL) is at all times increased than Bitcoin’s spot worth till Q1 2020.

This development has been noticed on a logarithmic scale, emphasizing the relative development charges and proportional adjustments between these metrics. Notably, Bitcoin’s worth, when adjusted for the M1SL hasn’t reached an all-time excessive since 2017.

Presenting Bitcoin’s spot worth as constantly decrease than BTCUSD/M1SL signifies that the expansion price of Bitcoin’s worth was lagging behind the expansion price of the M1 cash provide or that the M1 cash provide was rising at a better price than Bitcoin’s worth.

This aligns with the macroeconomic evaluation of the time, provided that conventional fiat currencies and liquidity within the economic system have been increasing extra quickly than the demand or valuation of Bitcoin. Bitcoin was additionally much less correlated with standard monetary markets and financial indicators throughout this era.

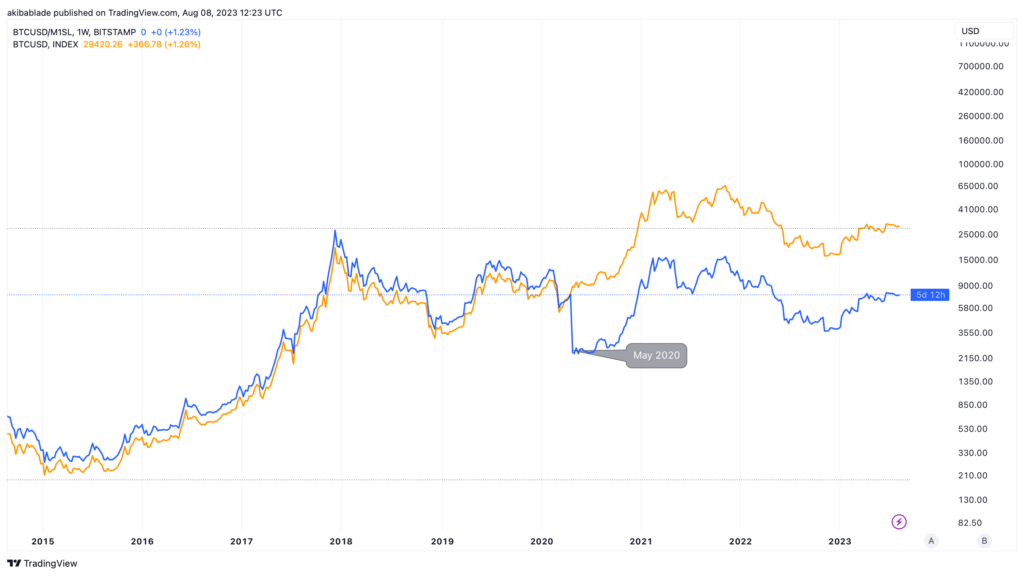

Then, the shift from Might 2020, when Bitcoin’s worth started to rise after the halving, seems to point that Bitcoin’s development price began to outpace the expansion price of different property.

Nevertheless, the BTCUSD/M1SL chart exhibits that the worth of Bitcoin relative to the full quantity of fiat cash in circulation decreased. This could possibly be attributed to a few components.

One could possibly be the results of the financial insurance policies enacted by the Federal Reserve. Because the COVID-19 pandemic hit, central banks injected massive quantities of liquidity into their economies to curb the anticipated financial downturn. This led to a rise within the M1 cash provide, subsequently inflicting a lower within the BTCUSD/M1SL ratio.

Nevertheless, it’s necessary to notice that this lower within the BTCUSD/M1SL ratio doesn’t essentially point out a discount within the intrinsic worth or potential of Bitcoin. As an alternative, it displays the adjustments in financial situations and market sentiment on the time.

Whereas the value of Bitcoin elevated in greenback phrases, the relative liquid value of the greenback additionally declined as provide skyrocketed. The M1SL rose 426% over 700 days, growing the M1 provide to $20.8 trillion from $3.95 trillion. The equal change in Bitcoin provide could be to go from 21 million cash to 88 million.

Sooner or later, ought to the BTCUSD/M1SL chart flip the BTCUSD worth once more, it might sign an acceleration in Bitcoin’s precise greenback worth. The present hole between the orange and blue strains on the chart primarily represents the surplus liquidity within the US markets post2020. On this scenario, both the Bitcoin worth rises relative to the M1SL or the M1SL declines whereas Bitcoin holds regular.

Nevertheless, if the M1SL declines in tandem with a lower in Bitcoin’s worth, it could signify a decreased perceived greenback valuation for the highest cryptocurrency by market cap.

The noticed developments between BTCUSD and BTCUSD/M1SL present useful insights, highlighting components past easy worth comparisons wanted to realize a real sense of the worth of digital property equivalent to Bitcoin.

It serves as a reminder that even within the quickly evolving world of cryptocurrencies, conventional financial indicators just like the M1 cash provide nonetheless maintain relevance and might present useful context for understanding crypto market dynamics.

The publish Adjusting Bitcoin’s worth for US liquidity reveals key indicator for bull run appeared first on crypto-news.