Bloomberg analyst Eric Balchunas has decreased the prospect of the SEC denying a spot Bitcoin ETF to only 5%, with fellow Bloomberg reporter James Seyffart indicating solely black swan interventions from Gary Gensler or the Biden administration attainable routes to denial.

Curiously, over the weekend, with the standard markets closed, crypto continued to commerce as typical, with Bitcoin buying and selling sideways and the remainder of the market recording a substantial sell-off. Bitcoin traded between $43,500 and $44,400, exhibiting a mere 2% swing. As of press time, the biggest digital asset by market cap is bang in the midst of this vary at $44,000 per crypto-news information.

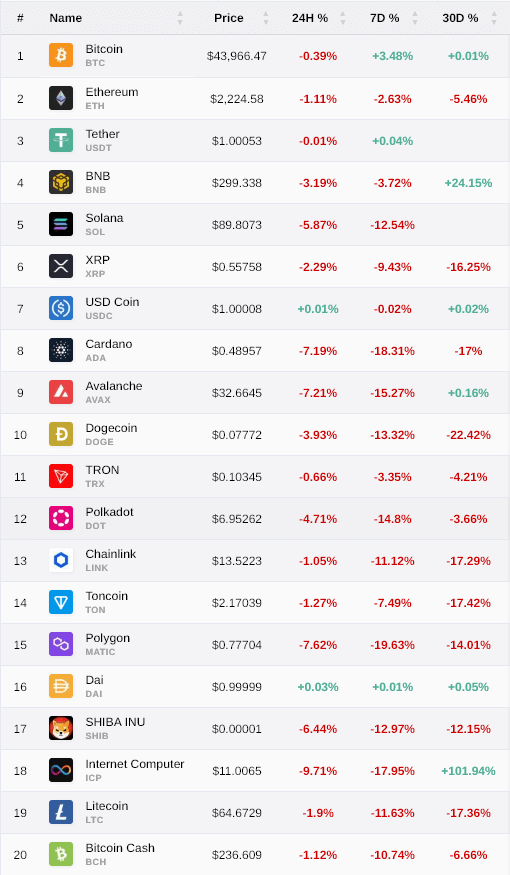

Nevertheless, altcoins akin to BNB, Solana, Cardano, Avalanche, Dogecoin, Polkadot, Polygon, Shiba Inu, and ICP are all down no less than 3% and as a lot as 9.7% as of press time.

Probably the most resilient altcoins look like Ethereum, XRP, Tron, Chainlink Litecoin, and Bitcoin Money, which, whereas all nonetheless down, have recorded lower than a 3% decline over the previous 24 hours.

Since Saturday, Jan. 6, Bitcoin dominance has risen by 1.5%, reaching a peak of 54% earlier than retracing barely this morning, indicating the main digital asset is solidifying its place out there forward of a possible landmark approval this week.

One of many greatest losers of the weekend, Solana, fell as a lot as 13% in opposition to Bitcoin over the weekend and remains to be down round 9%. Solana peaked at $126 on Dec. 26, 2023, but it has fallen 28% within the 13 days since to commerce, as of press time, at $90.

Bitcoin has recovered from its cycle low of 38% dominance within the crypto market in mid-2023 to claw again to 54% on the hype of a attainable spot Bitcoin ETF. This 39% surge places its dominance on the highest stage since April 2021, erasing the entire floor the remainder of the altcoin market made on the asset over the last bull run.

Since Ethereum’s launch in 2015, Bitcoin dominance peaked initially of 2021 at 75% earlier than falling dramatically all through the bull market, finally buying and selling throughout the 39% – 48% vary for round 760 days. Nevertheless, following the previous two Bitcoin halves, BTC dominance has fallen constantly, with a drop of 64% and 38%, respectively, marking bottoms after round 510 days.

Most curiously, as highlighted on the indicator on the backside of the above chart, Bitcoin dominance has had a near-perfect correlation with Bitcoin’s worth because the begin of 2023, the longest interval of correlation since Ethereum’s entrance into the market.

This week is about to be one of many greatest ever for Bitcoin as all eyes are on the spot Bitcoin ETF approval course of. A choice both manner is bound to affect the whole market with volatility anticipated throughout the board.