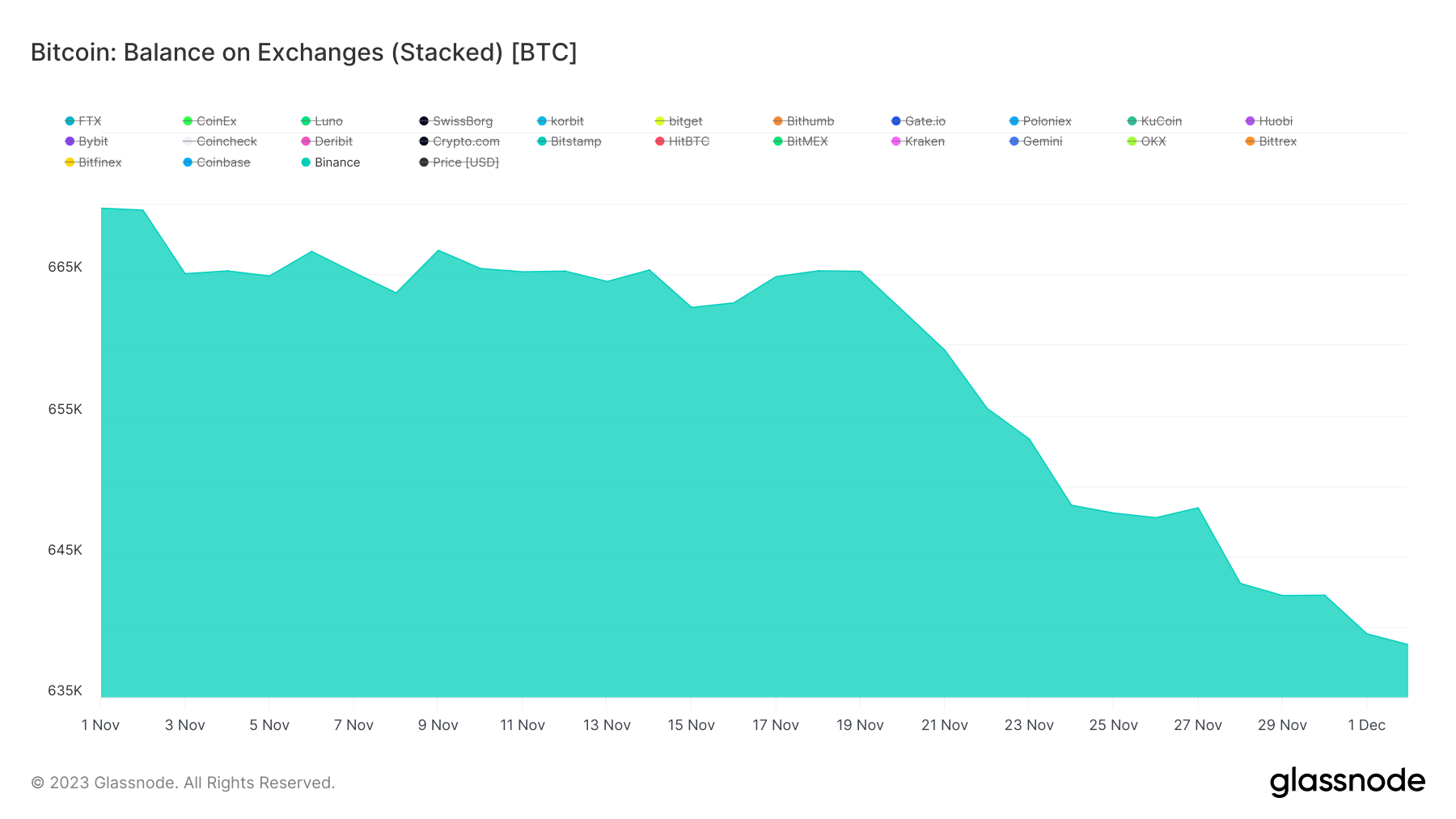

In response to its newest proof of reserves report, Binance skilled a major decline in its Bitcoin steadiness in November, dropping by over 23,000 BTC, or roughly 4%, coinciding with the trade’s regulatory points with U.S. authorities.

In response to information from Binance’s web site, the entire BTC steadiness of its clients was 584,659 BTC firstly of November. Nevertheless, the steadiness had decreased to 561,003 BTC by the beginning of December. This means a considerable withdrawal of property from the platform in the course of the regulatory challenges it confronted.

A crypto-news Perception evaluation highlighted a definite pattern amongst Binance customers throughout this era. The platform witnessed important BTC outflows from bigger holders, whereas incoming funds primarily originated from retail customers.

Supporting this statement, DeFillama’s information dashboard revealed that Binance encountered outflows surpassing $2 billion between Nov. 1 and Dec. 1.

This decline in Binance’s Bitcoin holdings occurred because the platform resolved to a settlement exceeding $4 billion with the U.S. authorities on points regarding a number of violations of a number of monetary legal guidelines. Moreover, the trade’s founder, Changpeng ‘CZ’ Zhao, stepped down as CEO after pleading responsible to costs associated to cash laundering.

Different asset balances

Binance’s web site additional reveals that the platform balances on different main cryptocurrencies additionally recorded declines in the course of the interval.

For context, Ethereum holdings for Binance customers dropped by roughly 0.67%, shifting from 3.91 million to three.88 million as customers withdrew their property.

Related traits had been noticed in balances for different property similar to XRP, Litecoin, USDC, and Binance’s native BNB token.

In distinction, Binance noticed a greater than 5% surge within the steadiness of Tether’s USDT, reaching $15.2 billion. This enhance coincided with over 860 million models of the stablecoin being despatched to the platform by customers throughout the identical interval.

Some analysts consider that the upsurge in USDT’s steadiness on Binance is linked to the stablecoin’s rising market provide. As Binance maintains its place because the main cryptocurrency trade by buying and selling quantity, crypto merchants more and more deposit their USDT on the platform for buying and selling functions.

Regardless of regulatory issues, information on Binance’s web site signifies that the trade’s property stay totally backed.