Bitcoin’s value begins the brand new week within the pink after a surge in Ordinals minting resulted in a clogged blockchain community over the weekend.

Information from crypto-news reveals that BTC’s value fell by round 2% throughout Asia buying and selling hours to $41,189, harking back to how the flagship digital asset started the earlier week.

Equally, different large-cap various cryptocurrencies like Ethereum, Solana, Cardano, and Avalanche recorded substantial losses between 2% and 5% throughout buying and selling hours.

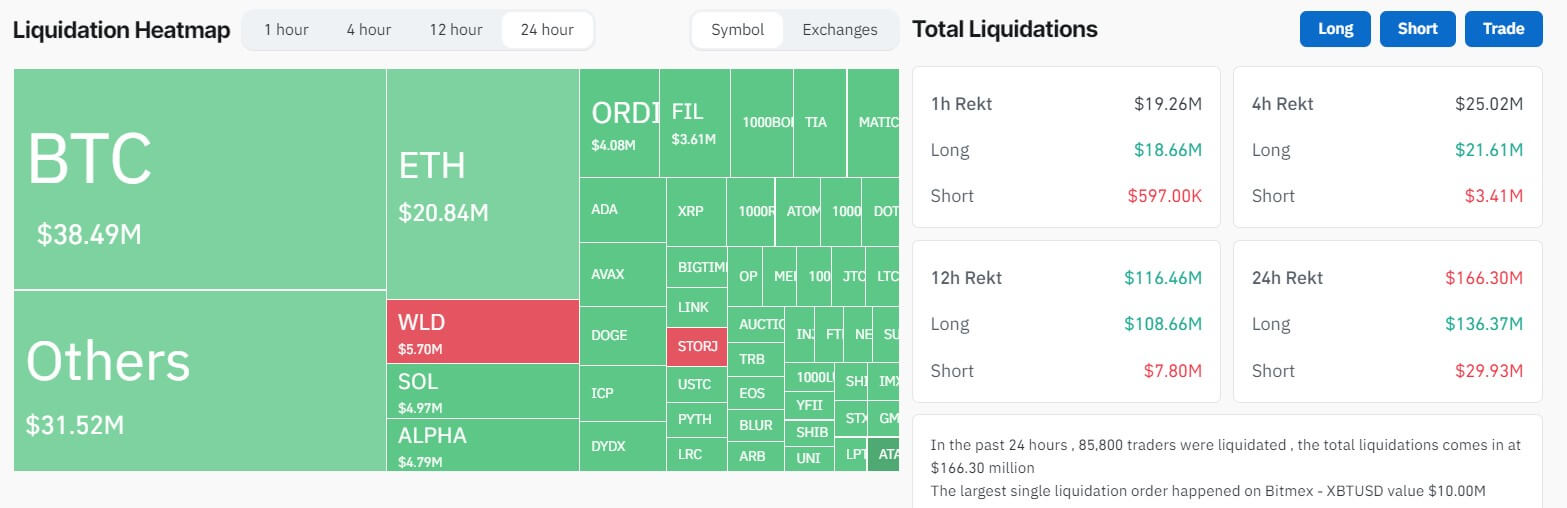

$166M liquidated

Coinglass information reveals that the latest value decline prompted roughly $166 million in losses for roughly 85,000 crypto merchants with energetic market positions.

The breakdown of those liquidations reveals that lengthy merchants suffered essentially the most vital losses, totaling $136 million, whereas brief merchants misplaced $30 million.

Merchants with positions on BTC noticed losses totaling over $40 million throughout completely different positions. Lengthy positions, or these speculating on greater BTC costs, contributed $38 million to this sum, whereas brief place holders, or merchants betting on decrease costs, accounted for $7 million.

Ethereum traders additionally skilled notable losses, with roughly $20 million liquidated from lengthy positions and $2.66 million from brief positions.

Throughout exchanges, Binance and OKX recorded essentially the most substantial losses, with liquidations exceeding $74 million and $42 million, respectively. Notably, essentially the most vital particular person loss was a $10 million lengthy wager on Bitcoin’s value by means of BitMEX.

Notably, Bitcoin retains a low Liquidation Sensitivity Index (LSI) rating of simply $15.5 million USD/%, highlighting the discount in leverage in comparison with the 2021 bull run, which noticed a mean of $74 million liquidated per 1% change in Bitcoin’s value.

Clogged community

Over the weekend, a surge in Ordinals Inscriptions resulted in a clogged blockchain community that pushed the common transaction price on Bitcoin to over $37, based on BitInfoCharts information.

Information from Mempool additional reveals that these transactions resulted in over 288,000 unconfirmed transactions as of press time.

Earlier within the month, Ordinals generated heated debate among the many BTC neighborhood, with purists arguing that these property have been exploiting a vulnerability within the Bitcoin Core to spam the blockchain.

Nonetheless, many in the neighborhood oppose this view, arguing that inscriptions won’t ever cease and are an evolution of the blockchain community.

Apparently, the same development was noticed in Ethereum digital machine (EVM)-compatible chains like Avalanche, Polygon, and Arbitrum, with customers spending greater than $10 million as transaction charges on these property over the weekend, per a Dune analytics dashboard by Hildobby.