Bitcoin’s fourth halving launched a long-term and a short-term shift in miner income composition because it decreased the quantity of BTC rewarded to miners for every mined block by 50% — immediately impacting miner incentives and, by extension, the broader Bitcoin economic system.

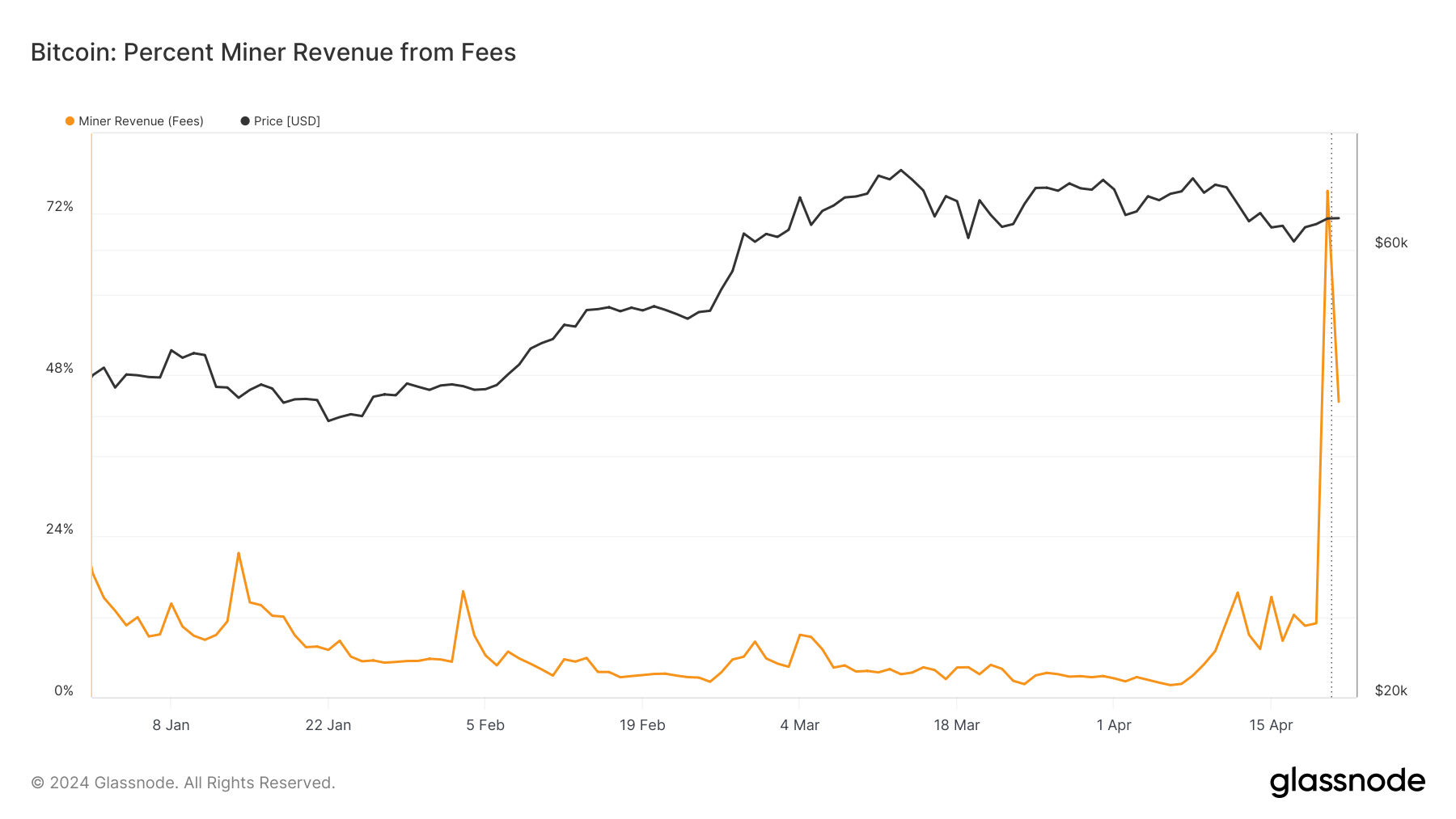

On April 19, simply earlier than the halving, transaction charges constituted 11% of whole miner income, a determine that has been comparatively secure all year long. Nevertheless, the halving occasion on April 20 triggered a considerable change, with transaction charges skyrocketing to over 75% of miner income.

The surge in charges will be attributed to a mixture of things. Firstly, a big a part of the market may need raced to settle their transactions earlier than the halving, which has pushed up transaction charges.

Secondly, there appeared to be a rising demand for transactions, and customers needed to be included within the halving block itself. Most of this demand could possibly be attributed to Ordinals, as inscriptions on the coveted block 840,000 could possibly be price extra on the secondary market.

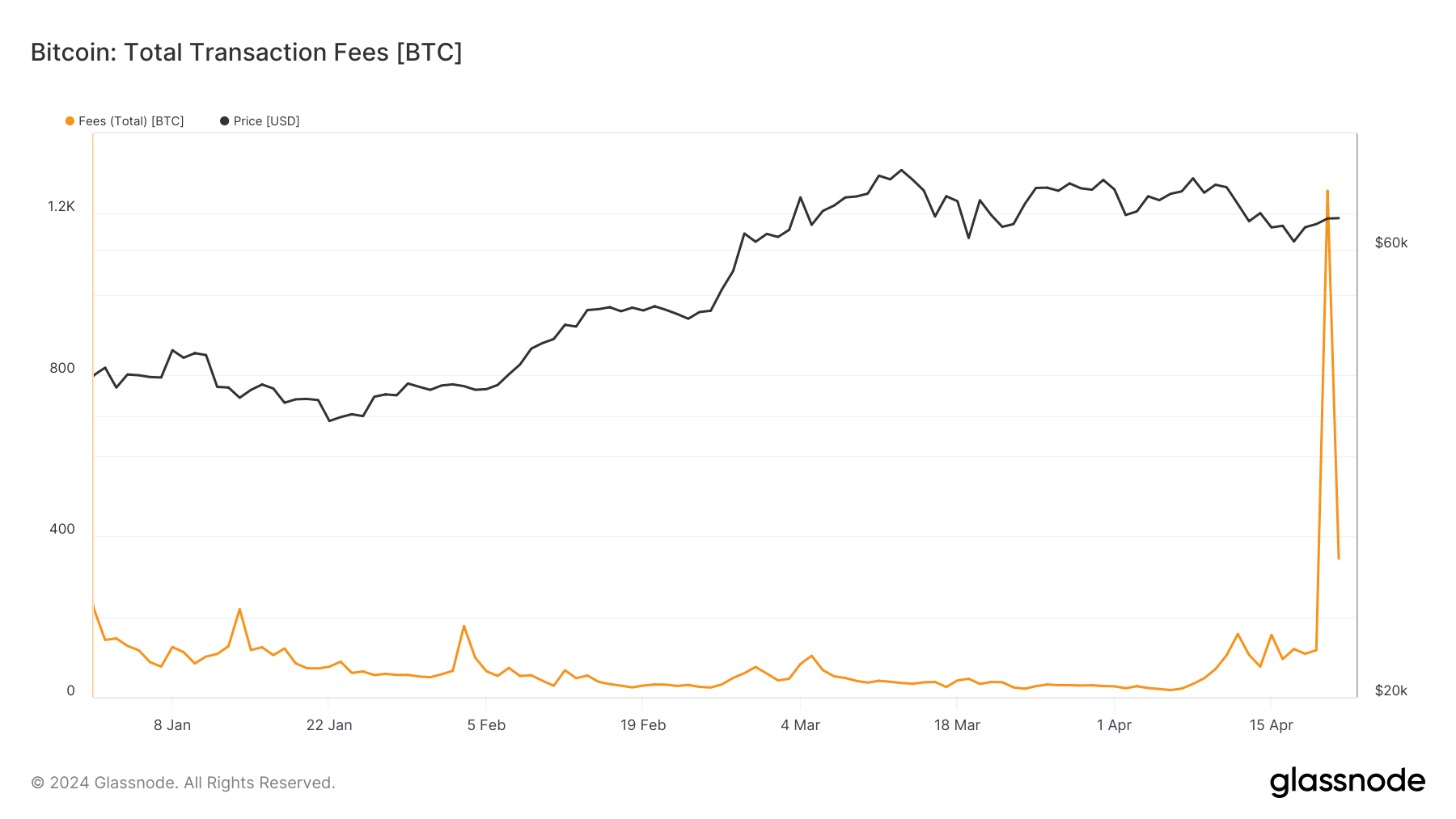

This demand for restricted block area drove transaction charges to historic highs, which paid 1,257 BTC to miners on the day of the halving. On April 19, the day earlier than the halving, the whole charges paid to miners have been 116 BTC, exhibiting simply how dramatic the escalation in transaction price was.

The following drop to 344 BTC in charges on April 21, whereas nonetheless considerably larger than pre-halving ranges, exhibits the market normalized and commenced to regulate to the brand new mining economics.

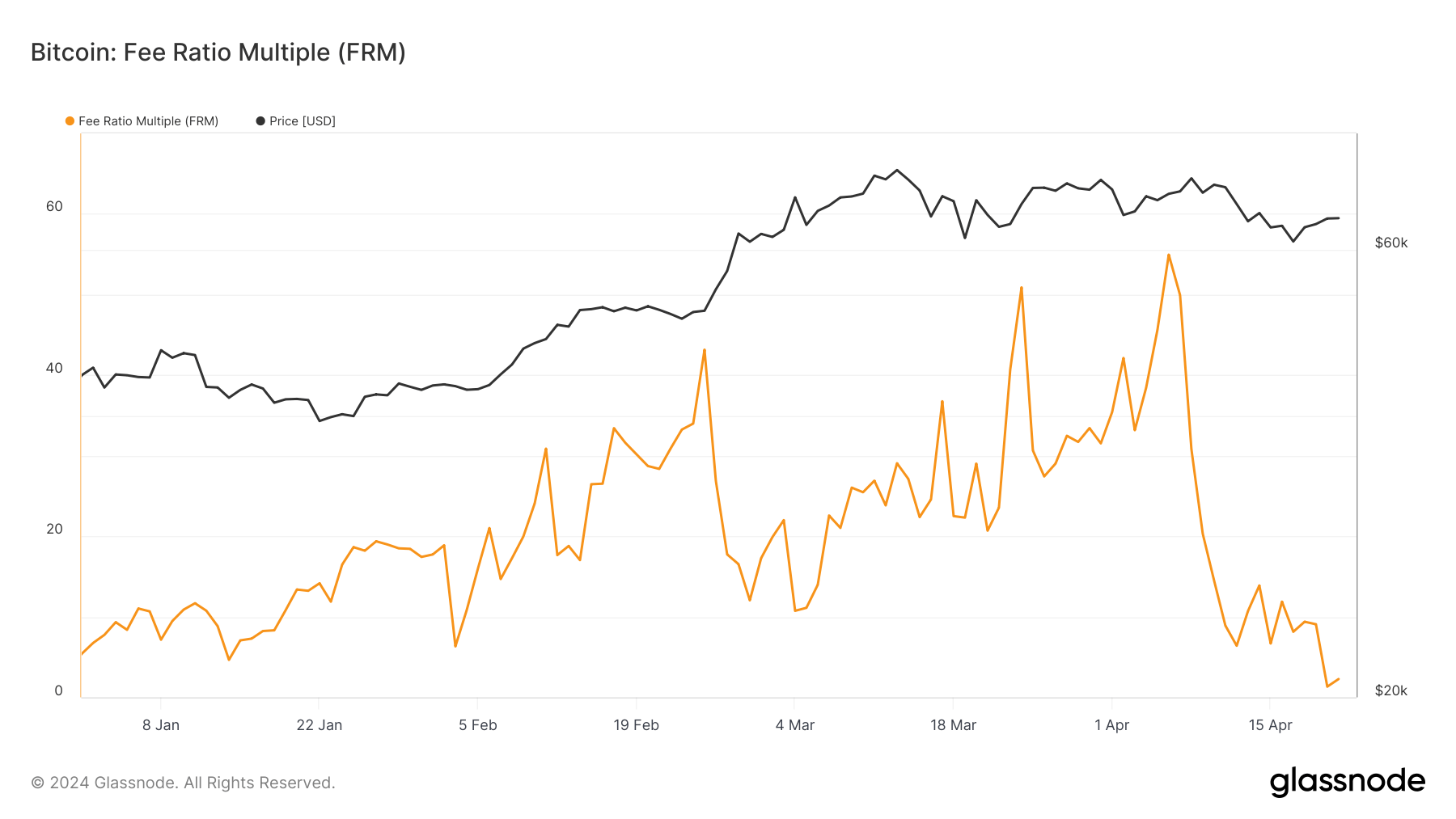

The Payment Ratio A number of (FRM) clearly exhibits the impression of those heightened charges. The metric is used to judge the financial safety of a blockchain, notably because it transitions from block reward-based miner compensation to 1 predominated by transaction charges. The FRM is calculated by dividing the whole miner income, consisting of block rewards and transaction charges, with the transaction charges.

This metric helps assess how a lot of the mining earnings is derived from transaction charges reasonably than block rewards, providing insights into the blockchain’s sustainability as soon as block rewards are now not a big issue.

On April 19, the day earlier than the halving, the FRM stood at 9.01. It signifies that the whole miner income was roughly 9 instances the quantity earned from transaction charges alone, with the vast majority of miner earnings nonetheless closely reliant on block rewards.

Because the block reward was decreased in half and the transaction charges elevated, the FRM dropped to 1.325, exhibiting simply how dramatic the shift in the direction of reliance on charges was. With the block reward decreased, transaction charges comprised a a lot bigger proportion of the whole miner income, lowering the FRM worth.

A decrease FRM worth implies that the blockchain is shifting nearer to a state the place it might theoretically maintain itself predominantly on transaction charges. That is essential for its long-term safety and viability as block rewards proceed to halve till they stop.

Nevertheless, this might negatively have an effect on a big a part of the community. As transaction charges start to represent a bigger portion of miner income, the associated fee to customers might improve, doubtlessly affecting how transactions are prioritized and impacting person habits. This might result in even larger price spikes throughout peak demand.

The submit Bitcoin transaction charges surge to make up 75% of miner income post-halving appeared first on crypto-news.