- Based on Swiss funding adviser 21e6 Capital, 97 of 700 international crypto funds closed in 2023.

- Bitcoin outperformed crypto funds as a part of a major January achieve, adopted by a March surge.

- Directional funds struggled with unsure markets, operational hurdles, and FTX collapse restoration.

The crypto winter, whereas nonetheless in restoration, has hit the business laborious, which is mirrored in Swiss funding adviser 21e6 Capital AG’s newest report. Based on the weblog, Of the over 700 cryptocurrency funds current globally, 97 have shut down throughout the present yr.

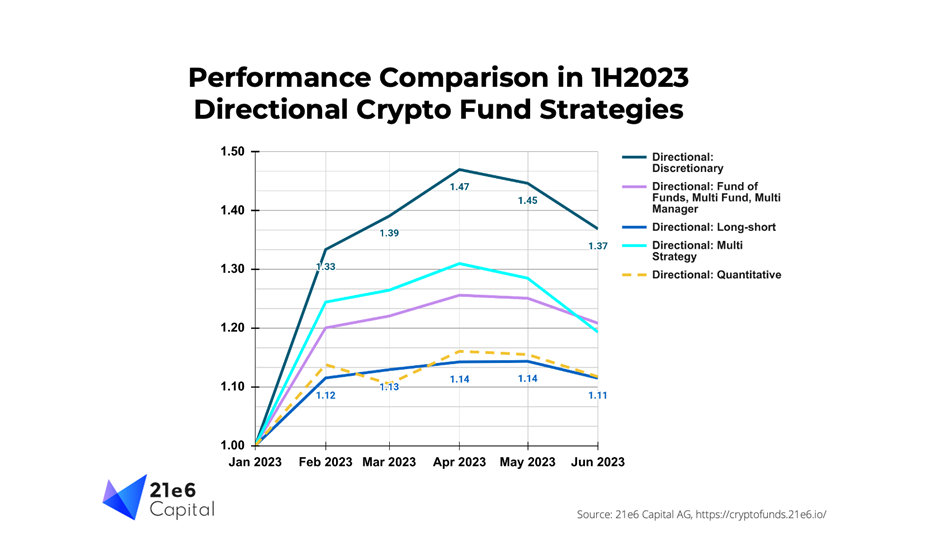

Based on information from bitcoinmonthlyreturn.com, Bitcoin noticed a powerful achieve of round 40%, practically twice the efficiency of crypto funds, in January. Whereas funds confirmed roughly comparable outcomes to Bitcoin in February (0% change), they did not capitalize on the upward motion in March, with Bitcoin surging by 23%, whereas directional crypto funds solely managed a 4% improve.

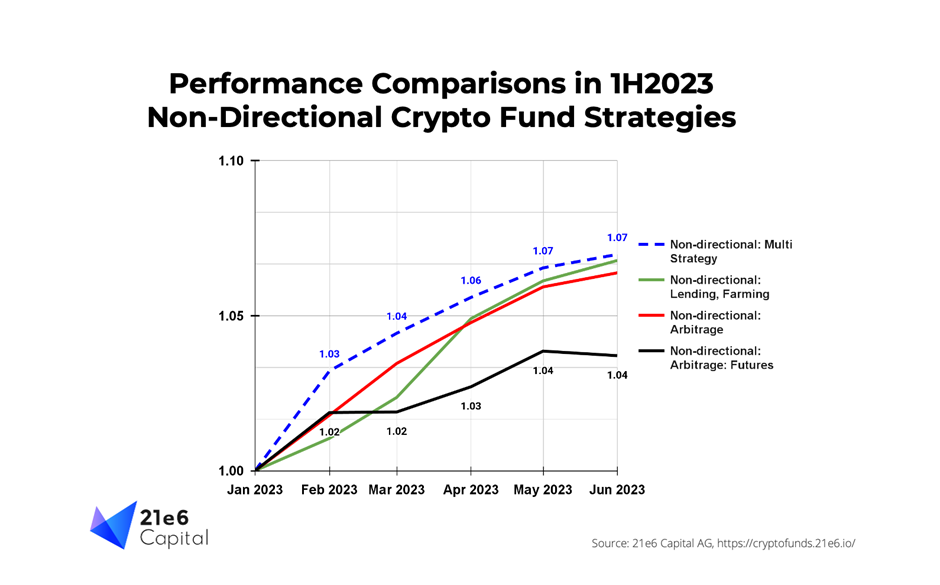

21e6 Capital acknowledged that this development occurred as a result of prevailing constructive trajectory of the crypto market till the top of June, with regulatory uncertainties impacting varied funds’ operational tempo whereas discretionary crypto funds remained comparatively unaffected.

The corporate famous directional crypto funds underperformed Bitcoin in 2023 as a result of they have been in “defensive mode after the devastating occasions of 2022, most notably FTX.” In reality, plenty of funds 21e6 Capital communicated with disclosed an elevated allocation to money holdings.

In the meantime, the funding adviser attributed the underperformance of quantitative funds to unstable momentum in “uneven” markets led to inaccurate indicators for buying and selling algorithms employed by systematic crypto quant funds.

Moreover, a difficult panorama, marked by regulatory uncertainty, the search for safe exchanges, and the lack of banking partnerships on the yr’s outset, posed vital obstacles for these funds.

The report provides {that a} simple buy-and-hold method with Bitcoin would have surpassed the efficiency of all of the fund assortments. By the midpoint of the yr, Bitcoin had accrued roughly 80% in worth. Knowledgeable crypto dealer Alex Kruger when requested whether it is higher to commerce Bitcoin or maintain it, he answered,

Each – buying and selling dominates psychological area attributable to its increased frequency.

Lastly, the report underscored a slight enchancment in investor sentiment through the first half of 2023, hinting at the potential for sure funds rising their investments within the crypto sector.

Nonetheless, the report did point out that the prevailing information regarding capital inflows and outflows point out {that a} full rebound in sentiment has but to be achieved.

At current, BTC is buying and selling at roughly $29,000, and it’s going through challenges in sustaining a place above the $30,000 threshold, which has solely been transiently surpassed a number of instances in 2023. Nonetheless, the present costs signify a outstanding 75% improve within the asset’s worth because the starting of the yr, as per information from CoinGecko.