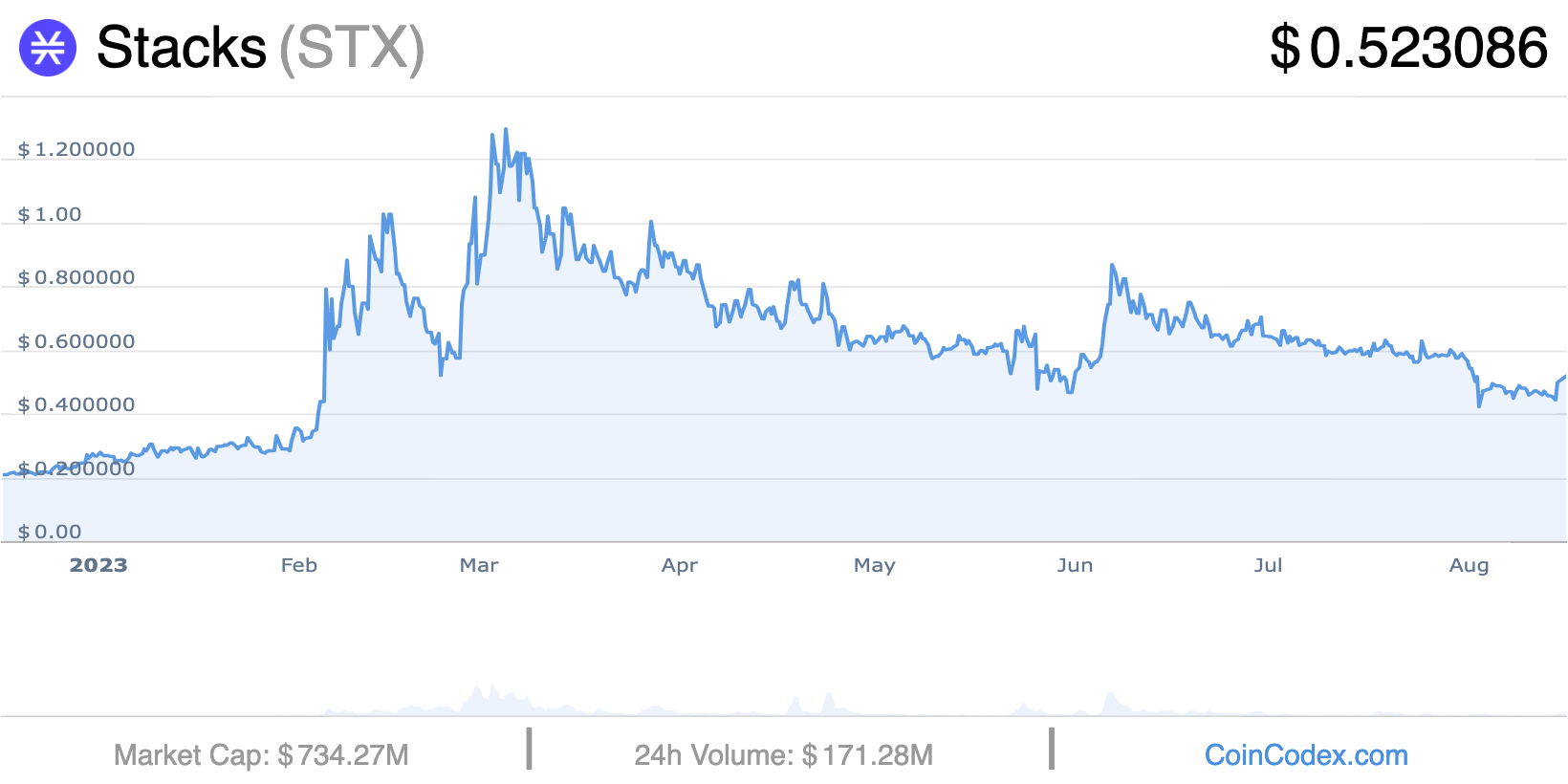

- STX outperformed different belongings within the prime 50 apart from BCH following the Grayscale announcement.

- STX hit an overbought level however nonetheless has a greater efficiency than BTC.

- If the MFI reaches 80, then STX could plunge, and the goal might be between $0.44 and $0.47.

After Grayscale’s partial win over the U.S. SEC, with regard to the Bitcoin (BTC) ETF software, the value of Stacks (STX) surged. In line with CoinMarketCap, STX carried out significantly better than different cash within the prime 50, apart from Bitcoin Money (BCH).

At press time, STX’s worth is $0.52— an 8.28% hike within the final seven days. Though Stacks enjoys a surge in value when Bitcoin has a constructive outlook, it additionally has its personal fundamentals backing it.

STX and BTC: One in all a Sort

For the unfamiliar, Stacks is Bitcoin Layer Two (L2) for good contracts. As an L2, Stacks permits settlement and sooner transactions on the Bitcoin blockchain utilizing the Proof-of-Switch consensus mechanism.

Proof of Switch regulates the interplay between two actors in Stacks, particularly the miners and stackers. For miners, on the Stack community, their perform is to lock Bitcoin in a wise contract to take part in validating Stacks transactions and, in flip, get rewarded in STX.

Then again, Stackers maintain STX tokens and quickly lock their tokens within the community in alternate for the BTC locked by miners as rewards

This yr, STX has not had solely the backing of Bitcoin. Nevertheless, the introduction of Bitcoin Ordinals and its adoption additionally ensured that the token gained extra traction. On a 12 months-To-Date (YTD) foundation, STX has elevated by 143% in opposition to the U.S. Greenback (USD), and it’s additionally up 47.68% in opposition to BTC.

Stacking for the Future

On the time of writing, STX’s volatility was at a really excessive degree, the Bollinger Bands (BB) indicated. Additionally, after the value hike in the course of the week, STX hit the higher band of the BB, which suggests it was overbought.

Because of this, the value dropped from $0.54 to $0.52. With the growing volatility, it’s doubtless that STX trades in a wider vary within the brief time period. If promoting strain overtakes demand, STX could fall between $0.44 and $0.47.

Nevertheless, if shopping for momentum outweighs sell-offs, the value could attain as excessive as $0.56. In line with indications from the Cash Stream Index (MFI), STX presently has shopping for momentum at 77.31.

Sometimes, an MFI studying above 80 is taken into account overbought. However when the MFI is 20 or under, it’s thought of oversold. To keep away from a major plunge, STX could have to keep away from touching the overbought degree threshold.

Though STX could not rally anytime quickly, it has the tendency to observe in Bitcoin’s route each time BTC’s value will increase. In the long run, STX could probably beat its All-Time Excessive (ATH) if Bitcoin does the identical.

Disclaimer: The views, opinions, and knowledge shared on this value prediction are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be chargeable for direct or oblique injury or loss