Bankrupt crypto lender Celsius will unstake 206,300 Ethereum, price round $470 million, as a part of efforts to facilitate the distribution of property to collectors, based on a Jan. 4 assertion on social media platform X (previously Twitter).

Celsius mentioned the deliberate “vital” unstaking occasion will happen within the subsequent few days and additional revealed that its staked Ethereum holdings supplied the failed firm a “beneficial staking rewards revenue” to offset sure prices incurred all through its restructuring course of.

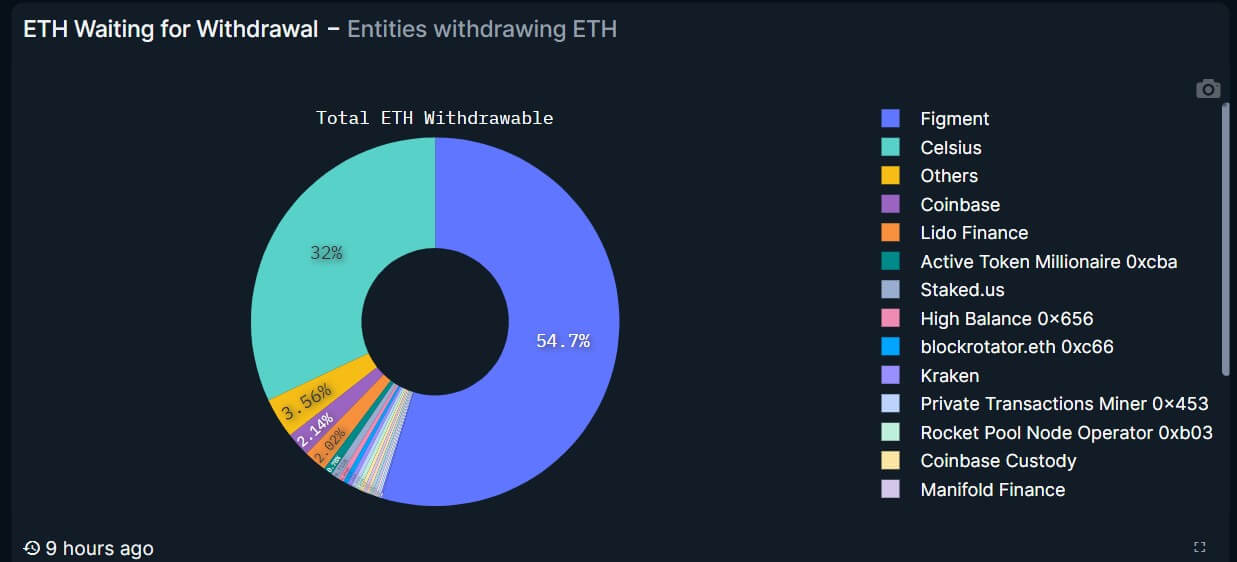

Following the information, Nansen’s Ethereum Shanghai (Shapella) Improve dashboard reveals that the lender desires to withdraw 206,300 ETH, or 32% of all ETH awaiting withdrawal, valued at almost $470 million.

The dashboard additional reveals that the agency is among the many high 10 companies which have withdrawn their staked ETH since withdrawals had been enabled final yr. Celsius has withdrawn a complete of 40,249 ETH as of press time.

Moreover, Celsius’s resolution has led to a notable surge within the Ethereum validator exit queue. In line with information from beaconcha.in, the queue has spiked to over 16,000 at this time, a report excessive, and the ready time has prolonged to roughly six days.

In the meantime, the latest announcement signifies progress in Celsius’s restructuring journey and the approaching return of consumers’ property. The court docket has already accredited a restructuring plan that would allow collectors to get well as much as 79% of their holdings.

However, criticisms have emerged because of the absence of a disclosed efficient distribution date, with clients expressing weariness over continuous preparation updates.

What does this imply for ETH value?

Crypto neighborhood members are involved that Celsius’s transfer may improve the promoting strain on the second-largest digital asset by market capitalization.

Final December, crypto-news reported that the bankrupt lender offered $250 million of digital property, together with Ethereum, in 30 days. On the time, observers urged that the agency was promoting to capitalize MiningCo, a Bitcoin mining firm that collectors of the failed agency would personal.

Nonetheless, Celsius mentioned, “Eligible collectors will obtain in-kind distributions of BTC and ETH as outlined within the accredited Plan.”