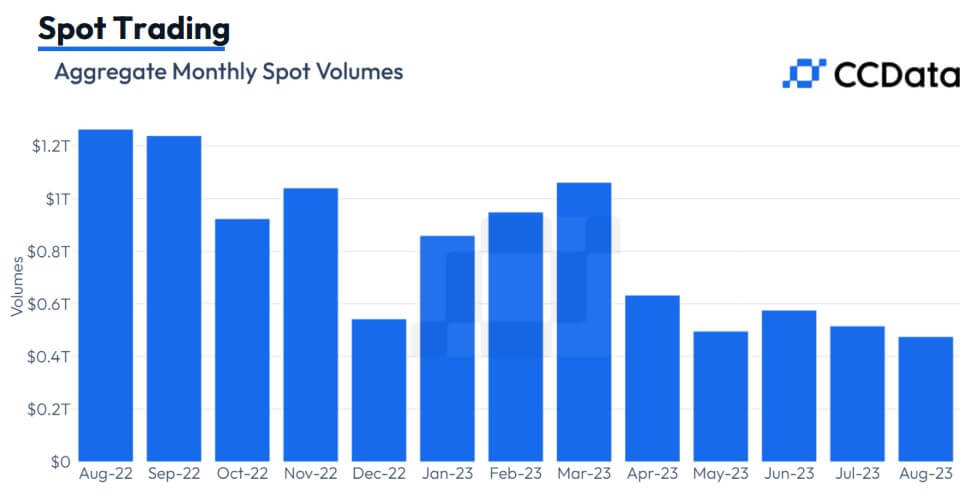

Spot and derivatives buying and selling actions on centralized cryptocurrency exchanges declined for the second consecutive month by 11.5% to $2.09 trillion, setting a brand new low for the present yr, in keeping with CCData.

The crypto information aggregator reported that spot buying and selling actions fell 7.78% to $475 billion in August, the bottom quantity recorded since March 2019. CCData acknowledged that day by day volumes on centralized exchanges additionally hit a low of $5.90 billion on August 26, the weakest since Feb. 7, 2019.

Per CCData, the decreased crypto buying and selling exercise was regardless of Grayscale’s latest success towards the U.S. Securities and Trade Fee (SEC). In keeping with the agency, the authorized victory did not spur a significant accumulation of crypto property. The agency wrote:

“The buying and selling volumes on centralised exchanges have remained low since April this yr and are actually akin to the stagnant buying and selling exercise within the bear market of 2019.”

Binance market share falls

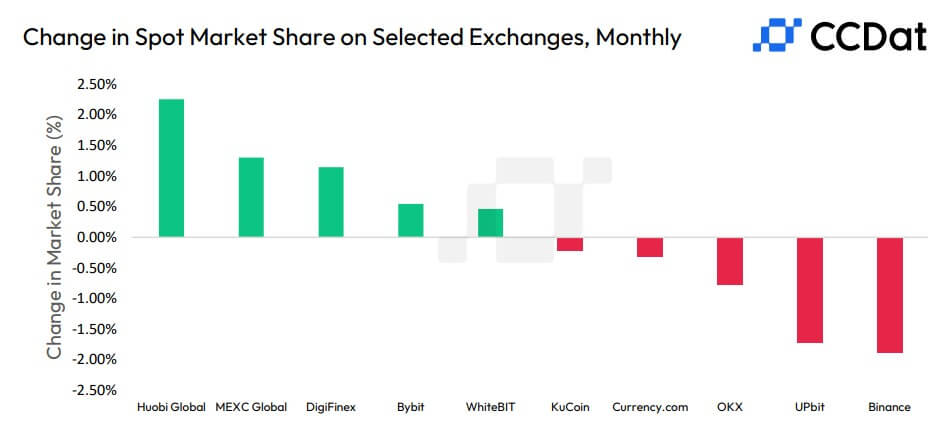

Whereas Binance continues to steer in spot buying and selling quantity with $183 billion, it’s noteworthy that the trade’s market share has declined constantly for six consecutive months, now resting at 38.5%—its lowest level previously yr.

Binance’s latest setbacks could be primarily attributed to regulatory and authorized points, which have prompted important adjustments throughout the firm’s prime management. A number of high-ranking executives have departed, ostensibly for private causes; nevertheless, there may be widespread hypothesis that their departures are linked to mounting regulatory pressures.

An instance of how these points have affected Binance is how its buying and selling quantity inside Russia plummeted by over 80%, in keeping with Kaiko information. Though Binance has publicly acknowledged its dedication to adhering to imposed sanctions on the nation, latest media stories have raised questions in regards to the trade’s continued use of sanctioned monetary establishments to facilitate peer-to-peer transactions.

Huobi quantity climbs

In August, the Huobi Trade skilled a considerable enhance in its spot buying and selling quantity. Notably, its spot buying and selling quantity surged by a powerful 46.5%, reaching $28.9 billion. This surge catapulted Huobi into the place of the second-largest platform within the business and noticed its spot market share soar to six.3%, its highest level since October 2021.

This surge in Huobi’s buying and selling exercise has drawn important consideration, notably in gentle of its associations with Justin Solar, the founding father of Tron’s community, and ongoing inquiries relating to its stablecoin reserves.

The submit Crypto buying and selling sinks to 2019 ranges as Binance sees market dip and Huobi volumes surge appeared first on crypto-news.