On blockchain networks like Ethereum, decentralized validation underpins the complete ecosystem. But paradoxically, the highly-technical technique of developing the blocks that retailer transactions could also be quietly accruing affect within the palms of just some.

In accordance with an evaluation by Ethereum researcher Thomas Thiery, block constructing has advanced right into a high-stakes strategic enviornment. Specialised builders now make the most of proprietary algorithms, privileged partnerships, and micro-optimized arbitrage methods to maximise earnings and the chance of block rights.

By quantifying bid timing, latency optimization, order stream sources, and transaction bundles, Thiery’s work exposes the aggressive dynamics eroding Ethereum’s decentralized ethos.

The info proves that financial incentives drive builders towards consolidation, cooperation, and specialization within the relentless quest for earnings.

In accordance with Thiery, left unchecked, these developments stand to undermine Ethereum’s core worth proposition – a world laptop operated by a distributed internet of stakeholders, not an oligarchy of elites.

Thiery’s analysis illuminates the truth of block constructing right now, setting the stage for knowledgeable dialogue on potential options. The approaching sections distill important insights from his evaluation into an accessible synopsis for the crypto group.

The profitable world of block creation

Creating new blocks on blockchain networks like Ethereum is carried out by builders who compete to bundle transactions into blocks and earn earnings in two main methods:

Amassing Transaction Charges

The primary income stems from packaging transactions right into a block and accumulating the related charges. When customers submit transactions to the community, they’ll optionally specify a “fuel value,” which compensates the builder for executing their transaction. The full charges collected from all transactions in a block characterize one income stream for builders.

Optimizing this requires effectively packing in as many invaluable transactions as potential from the general public mempool queue. Builders develop algorithms and techniques to maximise the cumulative payment income from every block they assemble.

Cashing in on Arbitrage Bundles

The second, extra profitable income supply includes arbitrage alternatives that exploit market inefficiencies. Specialised “searchers” establish arbitrages like value discrepancies between exchanges, then bundle the transactions required to capitalize on the chance.

These unique bundles, usually involving a centralized change, are transmitted on to the builder reasonably than the general public mempool. Builders can gather a portion of the worthwhile unfold by together with arbitrage bundles in a block.

Some builders type unique partnerships with searchers to achieve entry to those non-public bundles, which research point out present roughly 80% of complete builder income. The commonest and worthwhile arbitrage recognized includes exchanges between centralized and decentralized platforms.

Methods for Block Constructing Supremacy

By leveraging technical experience and strategic partnerships, blockchain builders make use of advanced methods to optimize earnings from block development.

Understanding the incentives and aggressive dynamics gives insights into centralization dangers and informs mechanisms to enhance system decentralization.

In accordance with Thiery’s examination of block development dynamics, builders make the most of numerous approaches to maximise their earnings and chance of profitable block rights. Thiery’s work elucidates builder conduct and its implications by analyzing bid timing, effectivity optimizations, order stream sources, and worthwhile arbitrage methods.

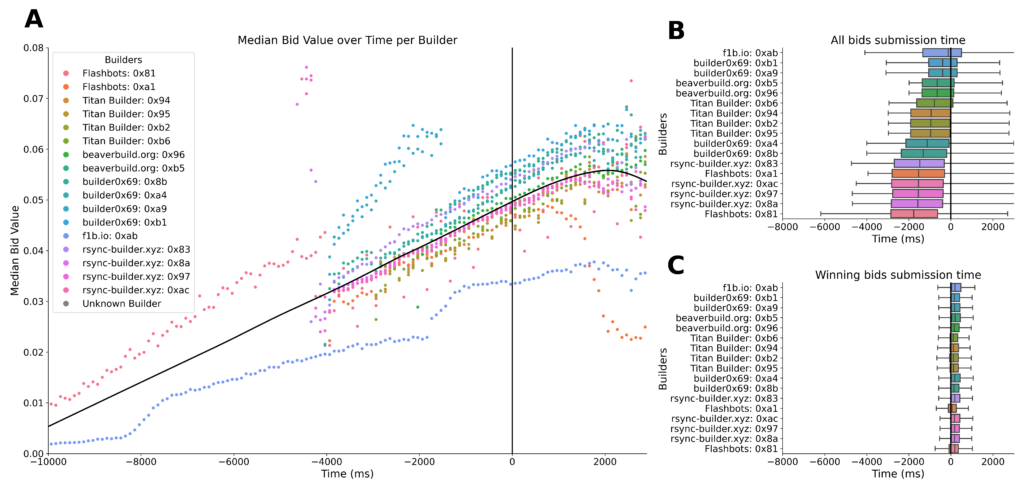

Builders enhance their bids as Ethereum’s 12-second slot progresses to include extra transactions and extractable worth. Nevertheless, most profitable bids happen towards the tip of the slot, in line with consensus protocols.

Builders optimize latency and effectivity in a different way – some entities submit bids steadily to beat rivals, whereas others concentrate on seamless block meeting. Occasional bid cancellations additionally seem to function a tactic for concealing or adjusting worth.

Quantifying Centralization Danger

Unique transaction bundles from searcher companions account for round 80% of builder income, outweighing public mempool transactions. Particularly, Thiery wrote,

“Unique transactions characterize 30% of the transaction depend, however account for 80% of the entire worth paid to builders. This helps the speculation that almost all of invaluable transactions producing MEV are packaged into bundles and transferred solely from searchers to builders.”

This highlights the significance of strategic partnerships and vertical integration achieve proprietary order stream.

Arbitrages between centralized and decentralized exchanges proved essentially the most worthwhile among the many transaction varieties analyzed. One specialised builder gained over 60% of those transactions, exemplifying the maximization and centralization dangers of over-optimization.

Thiery concludes that quantifying the methods and behaviors of builders can inform the development of profiles that consider and deal with centralization tendencies.

The info proves that incentives lead builders towards consolidation, cooperation, and specialization – limiting decentralization. Mechanisms that encourage variety of strategies and suppliers might counteract these forces.

General, the developments recognized by Thiery spotlight that prospering on this high-stakes setting necessitates exploiting latency, partnerships, exclusivity, and focus – with implications for international community construction. Understanding these points can enlighten options.

Builders’ Behavioral Profiles (BBPs)

By peering backstage of Ethereum’s block-building ecosystem, Thiery’s work sounds an alarm for the group.

Financial forces and incentives usher this area towards higher centralization, cooperation, and consolidation amongst worthwhile entities. Left unaddressed, the drift contradicts the guiding imaginative and prescient of a decentralized world laptop.

But hope stays – armed with data-driven insights into builder conduct, Ethereum builders and researchers can illuminate the best way ahead. Thiery posits a Builders’ Behavioral Profiles (BBPs) mannequin with many metrics. These encapsulate bid timing, developments in latency, bid withdrawal, entry to order stream, and MEV methods and lengthen to features like on-chain and CEX-DEX arbitrages, sandwiches, and liquidation.

Thiery additionally expressed his hope that the group will amplify the utility of BBPs by integrating new metrics and traits to make clear the operate of builders of their interactions with searchers, relays, and validators. In accordance with him, it is a essential transfer in the direction of growing sturdy mechanisms that curb tendencies in the direction of centralization and foster an equitable and proficient provide community.

The Ethereum group is but to reply to the analysis.