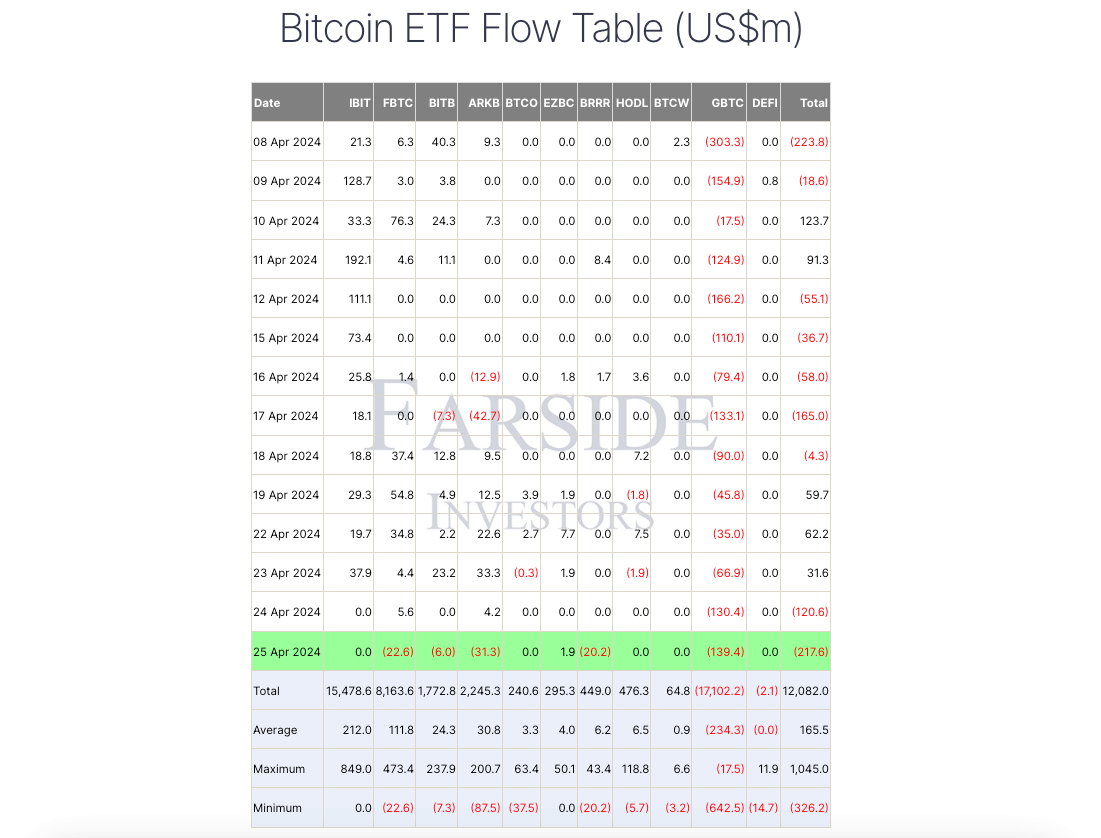

Investor curiosity in spot Bitcoin exchange-traded funds (ETFs) seems to be waning, with outflows totaling $218 million prior to now day.

Based on information from Farside Buyers, BlackRock’s IBIT Bitcoin ETF skilled its second consecutive day of zero flows, whereas Constancy’s FBTC noticed its first each day web outflow, totaling $23 million.

Different US Bitcoin funds skilled notable each day outflows. Grayscale GBTC fund continued its outflow pattern, shedding $139.37 million, whereas $31.34 million exited Ark Make investments and 21Shares’ ARKB fund. Moreover, Valkyrie’s fund skilled $20.16 million in outflows, and Bitwise noticed a destructive circulate of $6 million.

In distinction, Franklin Templeton’s EZBC emerged as the one fund with each day web inflows, attracting $1.87 million.

Regardless of these important outflows, web inflows into the ETFs have surpassed $12 billion since their launch in January.

Why are Bitcoin ETFs seeing outflows?

Earlier within the week, James Butterfill, CoinShares’ Head of Analysis, defined that these outflows sign waning curiosity amongst ETP/ETF traders, fueled by speculations about potential delays in fee cuts by the Federal Reserve.

In the meantime, some market consultants famous that the slowdown was vital for the market to take a breather. Bloomberg Senior ETF analyst Eric Balchunas reported that Constancy’s FBTC and BlackRock’s IBIT had damaged information for the best web property inside the first 72 days of launch.

He stated:

“The league of own-ness of IBIT, FBTC et al exhibits how overheated all of it was, a breather was overdue to be trustworthy.”

Constancy FBTC and BlackRock IBIT are notably noteworthy as they’re market leaders, collectively managing over $27 billion in property.

Nonetheless, there’s anticipation surrounding Morgan Stanley’s reported plan to permit its 15,000 brokers to advocate spot Bitcoin ETFs to shoppers, which may probably reignite curiosity available in the market.