The air is thick with hypothesis. Bitcoin, the flagbearer of the digital forex realm, stands on the precipice of historic transformation.

The sport seems to be altering with monetary titans like BlackRock, Constancy, and Ark Make investments submitting for SEC approval for spot Bitcoin ETFs. However is all of it sunshine and rainbows from right here?

Whereas approval might set off a wave of institutional cash, there are rising considerations that it might additionally result in the emergence of “paper Bitcoin,” doubtlessly steering the Bitcoin market away from its decentralized essence.

The Fast Upside: An Onramp for Institutional Cash

Bitcoin’s unstable previous has seen it wrestle for mainstream acceptance. Nonetheless, submitting spot Bitcoin ETFs by monetary behemoths strongly signifies a extra steady future. There’s an optimistic buzz out there, not simply due to these filings but additionally as a result of these proposals declare to deal with the SEC’s considerations about fraud and market manipulation.

If the SEC green-lights these ETFs, we’re taking a look at a possible torrent of institutional funding that would raise Bitcoin to staggering new highs.

When it comes to market influence, these developments have already set the wheel in movement, with Bitcoin surging over 20%, closing in on the $35,000 mark. With billions in inflows anticipated, there’s chatter about Bitcoin hovering to over $145,000.

The Lengthy-Time period Concern: The Rise of “Paper Bitcoin”

Nonetheless, the creation of spot Bitcoin ETFs additionally brings the danger of giving beginning to “paper Bitcoin”—a illustration of precise Bitcoin possession with out requiring bodily custody of the digital cash.

This might mark a tectonic shift in how Bitcoin is traded, managed, and understood. Like gold ETFs, typically settled in money and never bodily belongings, spot Bitcoin ETFs might make it simpler for traders to guess on Bitcoin’s value with out proudly owning the asset.

If paper Bitcoin good points floor, a spot between precise provide and demand could type, doubtlessly permitting the ETFs to manage value discovery and disrupting the decentralized ethos that Bitcoin was constructed upon. With extra folks investing in paper Bitcoin reasonably than the precise asset, there are fears that Bitcoin’s provide could possibly be manipulated to serve the pursuits of bigger monetary entities.

Nonetheless, when reviewing the newest BlackRock submitting for its spot Bitcoin utility, it doesn’t look like BlackRock might situation paper Bitcoin with out holding the underlying asset.

The prospectus states that the Belief will retailer precise Bitcoin with a custodian. The bitcoins are held in “chilly” (offline) storage and buying and selling accounts. When new shares are issued, they should be backed by a corresponding quantity of Bitcoin deposited into the Belief’s accounts.

The prospectus states

“No Shares are issued until the Bitcoin Custodian or Prime Dealer has allotted to the Belief’s account the corresponding quantity of bitcoin.”

The worth of the shares tracks the worth of the particular Bitcoin held by the Belief, based mostly on a Bitcoin pricing index. The Belief should pay bills and costs, which suggests it must promote a few of its Bitcoin holdings periodically. Nonetheless, the variety of shares stays fixed, lowering the quantity of Bitcoin backing every Share.

So, based mostly on the outline within the prospectus, it doesn’t appear possible for BlackRock to situation these shares with out holding the underlying Bitcoin belongings to again them. The Shares characterize direct possession pursuits within the Belief, which immediately owns the bitcoins.

The Liquidity Paradox

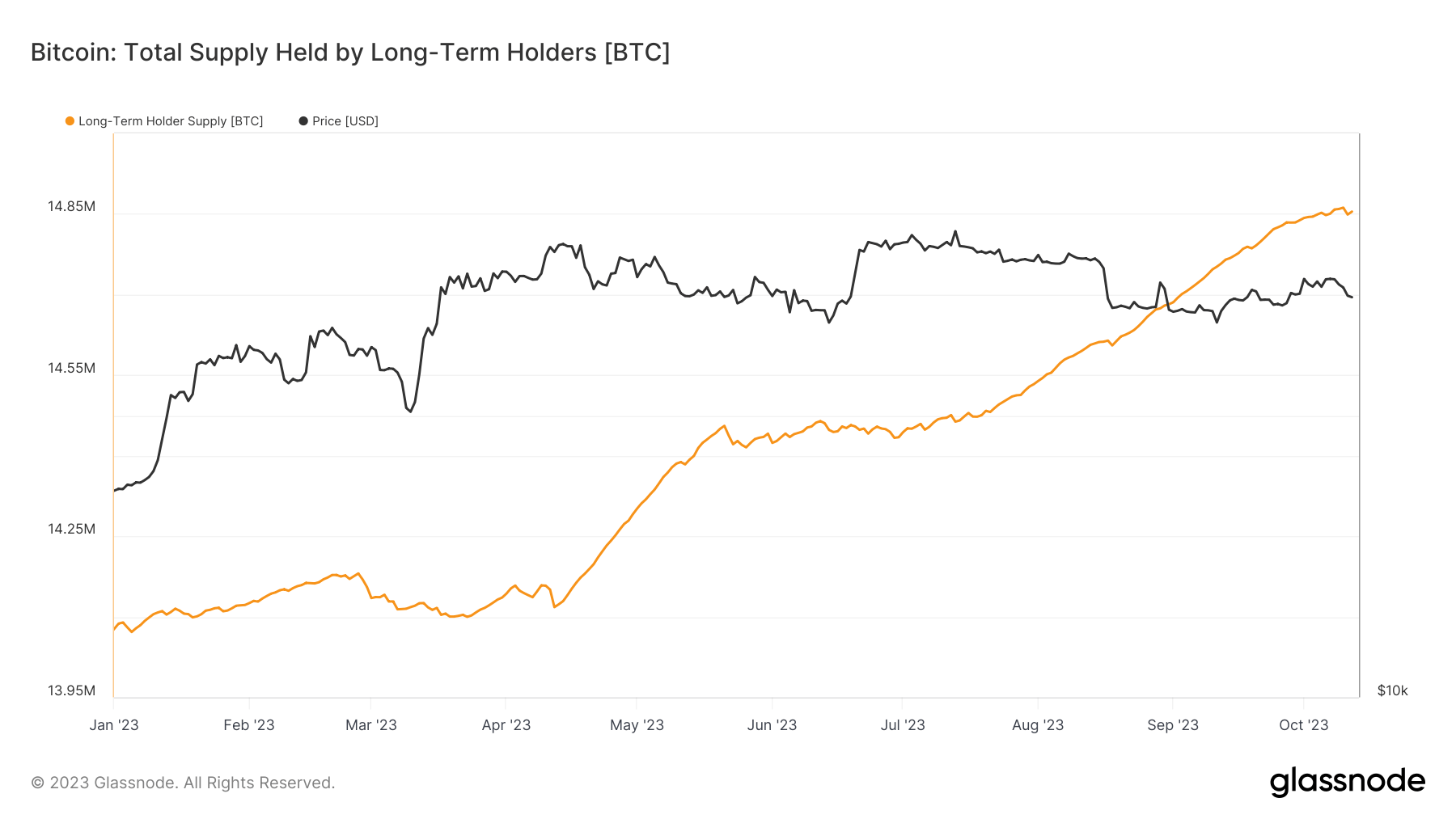

Furthermore, whereas Bitcoin ETFs may promise elevated liquidity, let’s not overlook that over 76% of current Bitcoin is held by long-term holders in accounts that haven’t transacted in over 155 days.

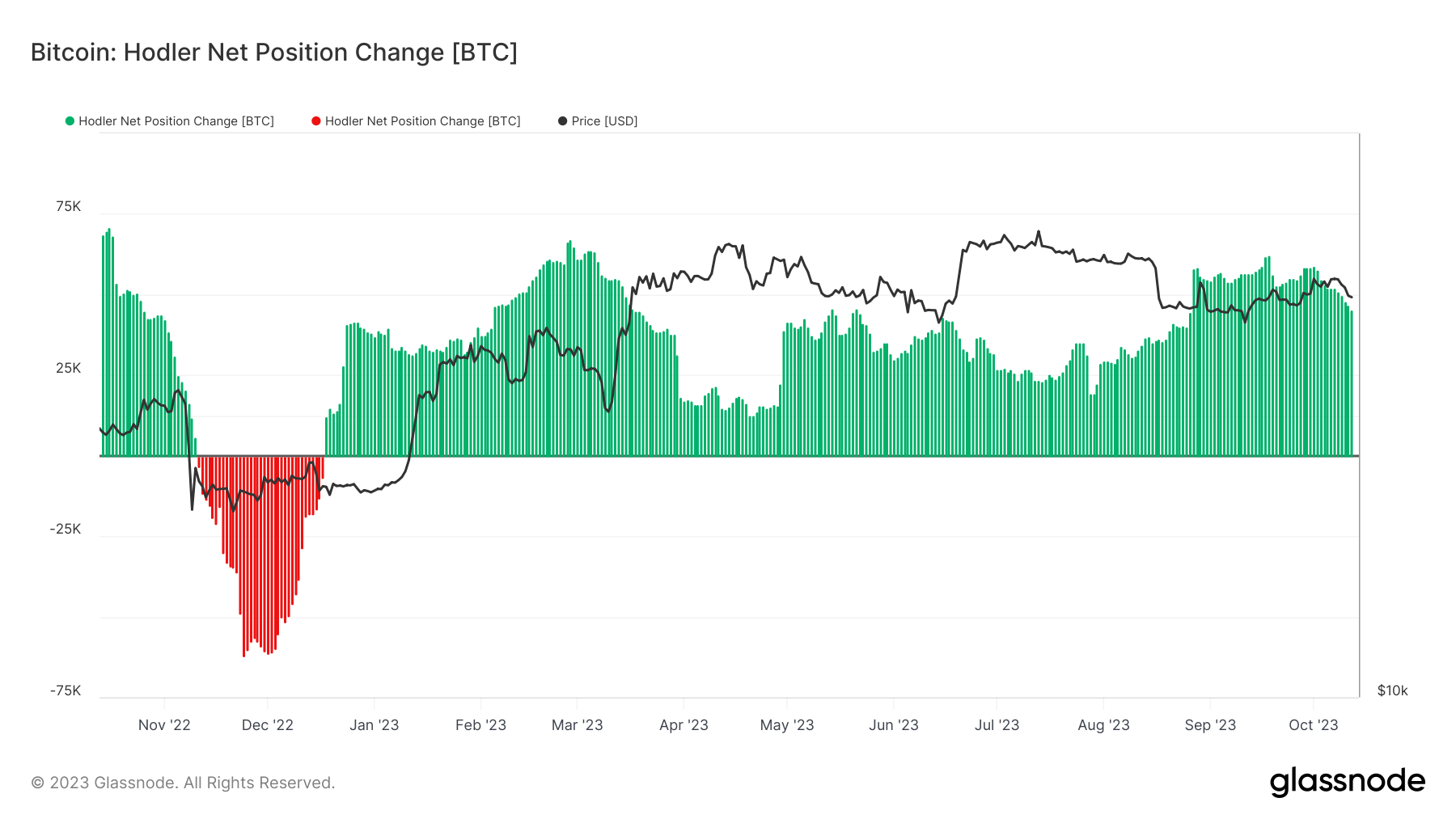

The prevalence of “hodling” suggests a sure resilience but additionally factors to current liquidity challenges. An inflow of paper Bitcoin might exaggerate these liquidity points, making the market even much less accessible for brand spanking new entrants and current holders who may wish to promote.

This huge reserve of inactive Bitcoin underscores not simply the long-term confidence of those holders but additionally a sensible liquidity problem already out there.

The phenomenon of “hodling” represents each energy and vulnerability. On the one hand, it indicators agency investor conviction in Bitcoin’s future, doubtlessly stabilizing costs and serving as a buffer towards market volatility.

However, it signifies that a good portion of Bitcoin’s provide is off the marketplace for all intents and functions. This creates a good provide atmosphere, making it tougher for brand spanking new traders to enter and current holders to exit with out inflicting important value fluctuations.

Introduce “paper Bitcoin” into this equation, and the liquidity dynamics could possibly be much more complicated. If a big section of market participation shifts in the direction of buying and selling paper Bitcoin through ETFs, we’d discover ourselves in a paradoxical state of affairs.

Whereas these ETFs might provide the attract of enhanced liquidity on the floor, they may concurrently exacerbate the prevailing liquidity challenges within the precise Bitcoin market.

Why?

As a result of paper Bitcoin doesn’t instantly necessitate the acquisition of actual Bitcoin, doubtlessly inflicting a disconnect between provide and demand metrics. This might create a bifurcated market—liquid on paper however more and more illiquid in actuality—posing challenges for each new entrants looking for to purchase and current holders seeking to promote.

Might BlackRock situation ‘paper’ Bitcoin with out holding the underlying asset?

Within the BlackRock prospectus, I couldn’t establish specifics on the timing lag between share purchases and Bitcoin acquisitions. Nonetheless, it does counsel that Bitcoin is acquired earlier than shares are issued:

“The Belief points and redeems Shares solely in blocks known as “Baskets.”

Solely “Approved Individuals” could buy or redeem Baskets. To create a Basket, an Approved Participant deposits the corresponding Bitcoin with the Belief in change for shares.

This suggests BlackRock would wish to have custody of enough Bitcoin earlier than issuing new shares to an Approved Participant. The prospectus doesn’t seem to explain a mechanism for issuing shares earlier than buying Bitcoin.

Nonetheless, the prospectus doesn’t present all operational particulars. So, whereas it suggests shares are solely issued after getting Bitcoin, it’s doable there could possibly be some quick lag in follow.

Thus, whereas Bitcoin ETFs maintain the promise of elevated liquidity, the prevailing development of “hodling” and the potential inflow of paper Bitcoin create a nuanced panorama. It might result in a market that seems liquid however is fraught with underlying challenges, making it each compelling and treacherous for traders.

Classes from the Gold ETF surge

Once we think about the way forward for Bitcoin ETFs, the trajectory of gold ETFs gives an illuminating case examine. Launched in 2003, gold ETFs revolutionized how traders might entry this conventional retailer of worth. They ushered in a plethora of benefits, corresponding to price effectivity, elevated transparency, and enhanced liquidity, successfully democratizing gold funding.

Let’s have a look at the numbers to grasp the influence higher. The common each day buying and selling quantity for gold in 2023 stands at $139 billion, making it some of the liquid belongings globally, partially due to the liquidity and accessibility provided by gold ETFs.

Furthermore, gold costs displayed resilience, falling solely 3.7% in Q3 2022 however remaining up by 11% over the earlier 12 months. These dynamics counsel that ETFs can appeal to important funding even when the underlying asset faces market headwinds.

So what might this imply for Bitcoin? If Bitcoin ETFs are accredited and handle to duplicate even a fraction of gold ETFs’ success, we might witness an influx of institutional and retail funding on a scale not seen earlier than within the crypto market. On condition that gold ETFs have enabled each day buying and selling volumes within the a whole bunch of billions and Bitcoin at the moment trades round $23 billion per day, Bitcoin ETFs might equally turn into a catalyst for large quantity and capital influx.

Nonetheless, the important thing distinction right here lies out there cap and current liquidity. Gold has been traded for hundreds of years and has a market cap within the trillions, whereas Bitcoin, with its $669.7 billion market cap, continues to be in its adolescent stage. But, this additionally signifies extra room for exponential progress.

Thus, the transformative impact of gold ETFs on their underlying asset presents a tantalizing preview of what could possibly be in retailer for Bitcoin. Whereas one should train warning given the inherent variations and dangers between the 2 belongings, the profitable path paved by gold ETFs means that Bitcoin could possibly be on the cusp of a brand new period of funding, liquidity, and valuation.

The Halving X-Issue

Including a layer of complexity is Bitcoin’s impending halving occasion. With the availability of recent Bitcoin set to lower, an ETF-induced demand surge might ship costs skyrocketing. But when that demand is principally for paper Bitcoin, then the implications for the precise, bodily Bitcoin market could possibly be unprecedented and unpredictable.

Whereas the potential approval of spot Bitcoin ETFs opens the door for transformative institutional funding, it additionally raises professional considerations.

The rise of “paper Bitcoin” might shift management of the Bitcoin market away from particular person, decentralized actors to extra centralized monetary entities.

As we stand at this important juncture, one factor is bound: the selections made at present could have a far-reaching influence on the Bitcoin panorama of tomorrow.

Due to this fact, whereas we could revel within the short-term good points, we should be cautious of the long-term implications. In any case, within the quest for legitimacy and acceptance, Bitcoin should not lose its soul.