Because the crypto market holds its breath for the U.S. Securities and Trade Fee’s (SEC) impending determination on the primary spot Bitcoin Trade-Traded Fund (ETF), an in depth evaluation of Bitcoin’s on-chain information reveals a market in a state of cautious anticipation.

Between Jan. 4 and Jan. 8, 2024, Bitcoin’s value elevated from $44,230 to $46,944 after weeks of sideways and uneven motion. This enhance, marked by a peak on Jan. 8, signifies an optimistic however pent-up market. Such value conduct might be attributed to speculative positioning in response to the upcoming SEC determination, because the market appears to be leaning in the direction of a optimistic final result.

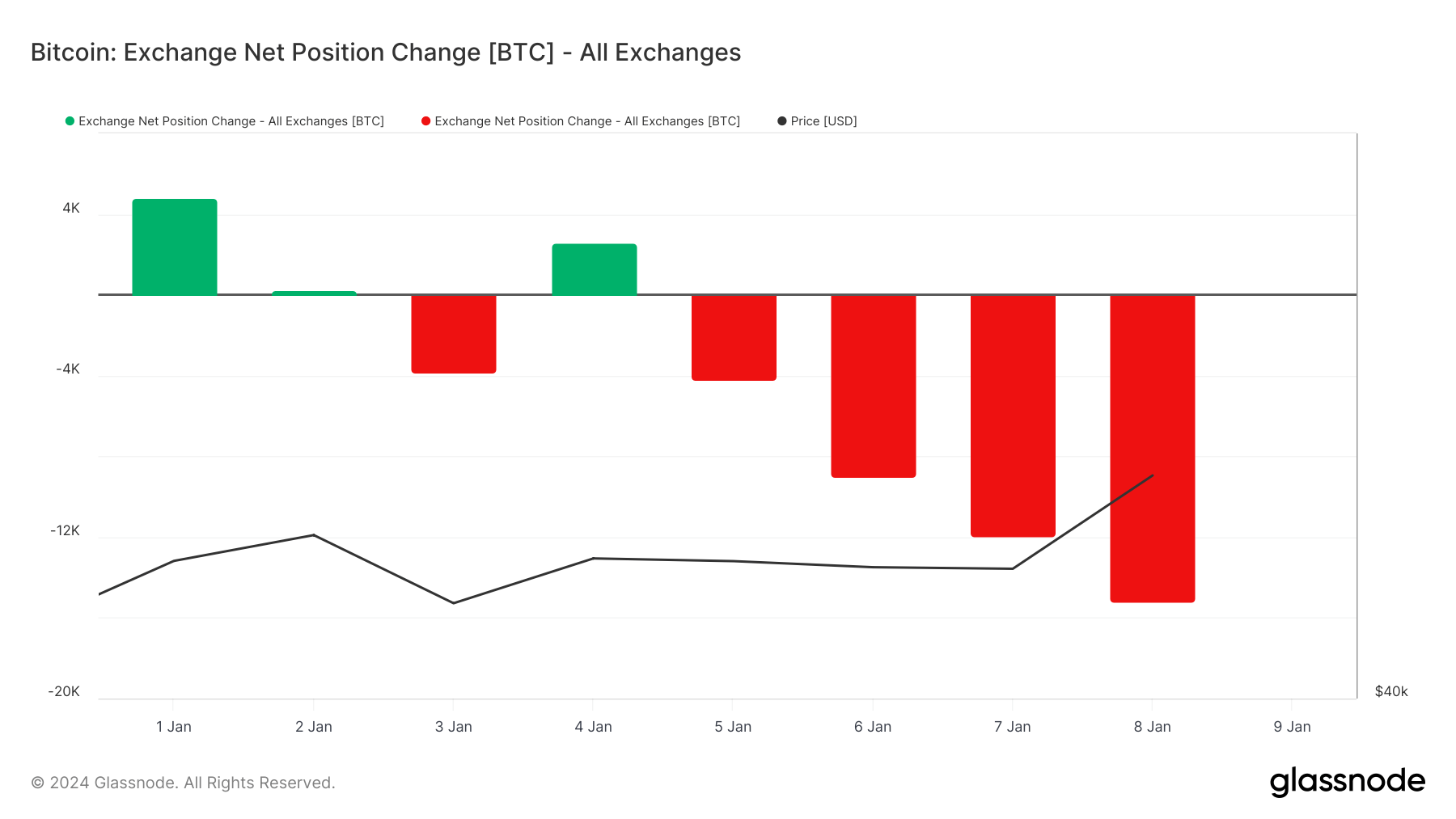

The 30-day change in Bitcoin provide held in change wallets exhibits that many of the market isn’t seeking to promote. Beginning at 2,571 BTC on Jan. 4, the stability shifted to a detrimental 15,183 BTC by Jan. 8. This constant lower in exchange-held Bitcoin suggests a rising desire amongst holders to withdraw their belongings. This conduct usually signifies a preparation for long-term holding, presumably in anticipation of a post-ETF approval surge in Bitcoin’s worth.

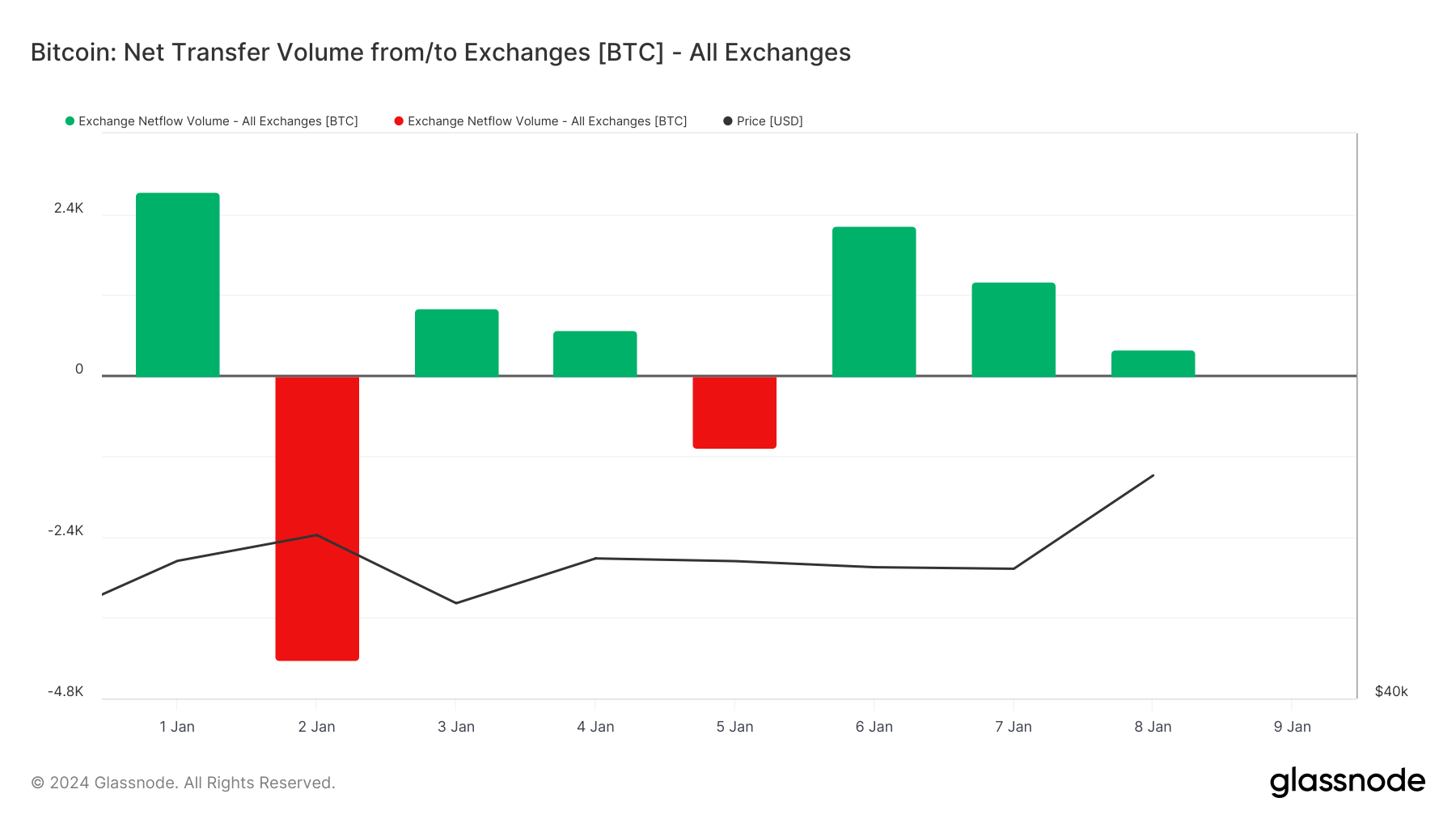

The whole quantity of BTC transferred to and from change addresses between Jan. 4 and Jan. 8 signifies consolidation. The excessive quantity noticed on Jan. 4 (52,116 BTC to exchanges and 51,432 BTC from exchanges) tapered off mid-week, solely to spike once more on Jan. 8 (53,196 BTC to exchanges and 52,798 BTC from exchanges). Such a sample is attribute of buyers repositioning their portfolios in anticipation of serious market actions.

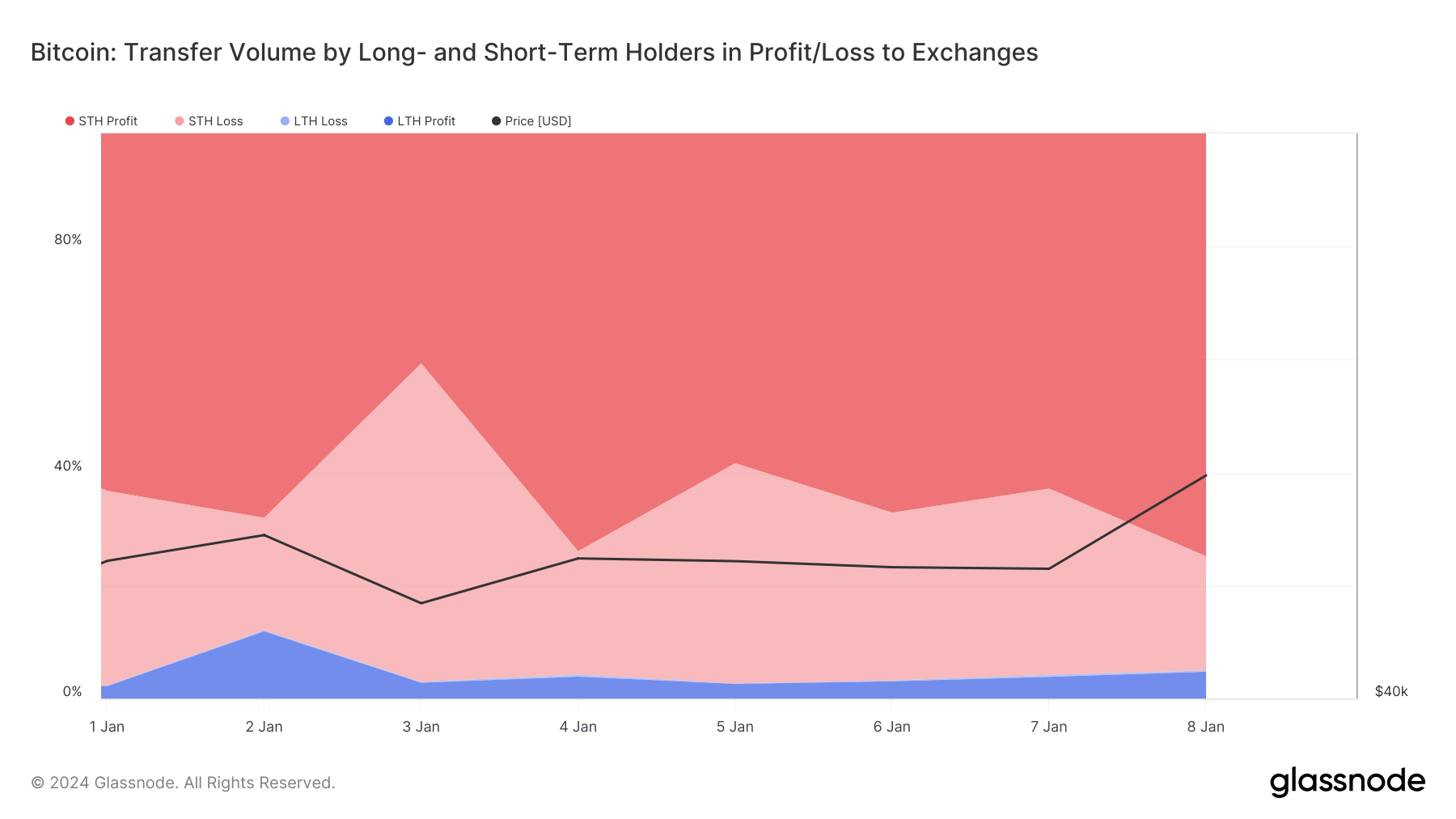

The motion of cash by short-term (STH) and long-term holders (LTH) exhibits the place the promoting stress might come from. On Jan. 8, 74.82% of all cash moved to exchanges got here from short-term holders, possible capitalizing on the latest value enhance to understand good points. This conduct suggests a preparatory stance for anticipated short-term volatility or a value correction post-ETF determination. In stark distinction, long-term holders in revenue made up solely 4.73% of the entire change inflows. This means long-term holders’ perception within the cryptocurrency’s resilience no matter short-term regulatory outcomes.

The lowering Bitcoin balances on exchanges and the buying and selling behaviors of short-term and long-term holders replicate a market at a crossroads. Whereas the final sentiment leans in the direction of a bullish outlook, the readiness for potential short-term fluctuations is clear.

If the ETF is authorized and Bitcoin’s value will increase, the already lowering provide of Bitcoin on exchanges might result in a provide squeeze. This shortage, coupled with heightened demand, has the potential to drive costs even increased.

The put up Trade flows present quick time period patrons making ready for volatility whereas long run hodl appeared first on crypto-news.