- WLD surges 9.57% in 24 hours, hitting $9.24 amid Private Custody launch.

- Worldcoin’s pivot to consumer information management boosts market cap by 56.31%.

- Kenya’s ban prompts Worldcoin’s privacy-focused strategic shift.

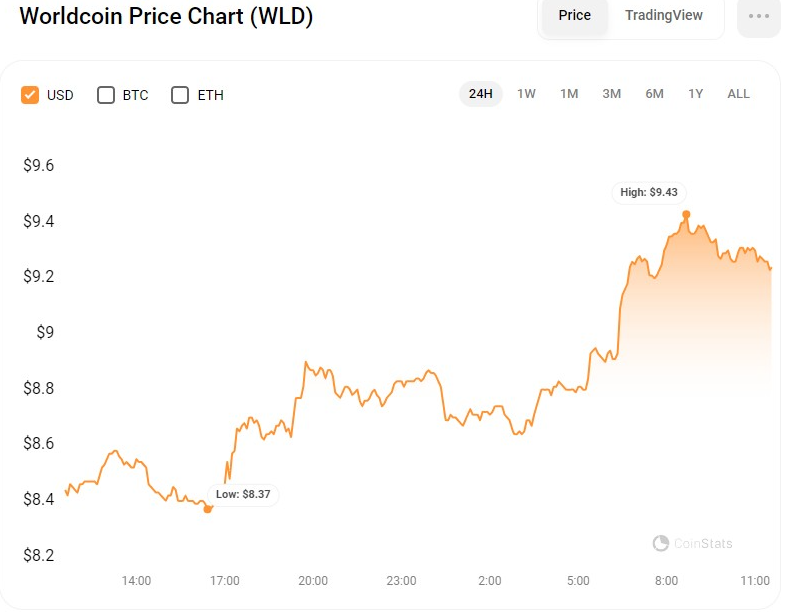

With the launch of its Private Custody function, Worldcoin (WLD) has seen a notable improve in worth, surging to a seven-day excessive within the final 24 hours. Throughout the rally, WLD’s value swayed between an intra-day excessive and low of $8.35 and $9.45, respectively. At press time, the bullish momentum was nonetheless in command of the market, with WLD exchanging arms at $9.24, a 9.57% surge from the intra-day low.

This growth comes amidst rising privateness issues and regulatory scrutiny in numerous international locations, together with a notable ban in Kenya. The brand new function represents a strategic pivot for the cryptocurrency venture, specializing in enhancing consumer management over private information and addressing the privateness points which have shadowed its operations.

Worldcoin’s Shift to Private Custody

Worldcoin’s introduction of Private Custody marks a major transition in its method to consumer information administration. The function permits customers to retain their private information, together with pictures and metadata used for World ID iris code technology, on their gadgets.

This transfer is in response to the rising demand for privateness and safety within the digital age, the place information breaches and unauthorized entry have change into prevalent issues. By empowering customers with full management over their information, Worldcoin goals to foster a safer and trust-based relationship with its consumer base.

The implementation of Private Custody additionally permits superior options like Face Authentication. This function enhances the safety framework of Worldcoin by permitting customers to confirm their identities by way of a neighborhood, on-device course of. This growth shouldn’t be solely a step ahead in securing consumer information but in addition in constructing a user-centric know-how ecosystem that prioritizes particular person privateness and autonomy.

Addressing Privateness Issues

Worldcoin’s resolution to stop storing private information on its servers comes within the wake of assorted privateness issues and regulatory challenges throughout the globe. Notably, the venture confronted a setback in Kenya, the place the federal government imposed a ban on Worldcoin operations on account of security and information privateness points. The ban highlighted the essential want for tasks like Worldcoin to undertake extra stringent information safety measures and guarantee compliance with native laws.

In response to those challenges, Worldcoin has taken a proactive method by implementing Private Custody and discontinuing non-obligatory Knowledge Custody at orb visits. This transfer is geared toward reinforcing the venture’s dedication to privateness and safety, guaranteeing that customers’ private data stays of their management.

WLD/USD Technical Evaluation

On the WLDUSD 24-hour value chart, the Vortex Indicator, which displays pattern course, is indicating a powerful bullish rally, with the uptrend line (blue) trying to interrupt above the downtrend line (crimson). This factors to a possible constructive turnaround within the close to future as shopping for strain rises and sellers lose management. This sample exhibits that the constructive momentum within the WLD market is gaining traction and will persist within the quick run.

The Stochastic RSI has moved from the oversold stage to 34.91, supporting the idea of a bullish reversal as momentum turns in direction of the buying aspect. This sample can be in step with the elevated quantity noticed in latest buying and selling classes, displaying extra investor curiosity and engagement in driving the worth upward.

Moreover, WLD’s buying and selling quantity and market capitalization have elevated by 10% and 56.31%, to $1,468,358,030 and $434,080,770, respectively, throughout the rise.

The Relative Volatility Index (RVI), which measures a safety’s volatility, has additionally elevated, suggesting that costs would transfer greater. With the RVI rising above its sign line and a ranking of 57.68, an upward breakthrough is perhaps approaching. This may draw extra merchants wanting to revenue from the rising pattern, driving costs additional greater within the quick time period.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be accountable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.